Please, always do your due dilligence and do not rely on my opinions/knowledge. I do not want to move the share price either way by sharing this with 3000 subscribers. This is almost all my accumulated knowledge over the last half year. Use it wisely. And I apologize that my notes are a bit of mess! Time is my master now. I assume you read my PharmX analysis and Connexion Mobility analysis.

There was some development on the PharmX during the last few months. Most of which you can not see from reports but only through digging on the internet. While lawsuit got overturned and investors sold in hurry shares, it was never main point of the thesis, but rather a free option. I think this has resulted in negative consensus on the company which has been executing (this is very old take). The cash payback did certainly not carry positive feeling, I believe it is not a huge deal. It wont put the company into cash constraints, so I think about it as dividend payout which I never got. Again, I will try to not focus solely on numbers. Anyone can read those. I think PharmX is minimum 3-5 years story, but I will go through all the important knowledge accumulated over the last half year to bring meaningful udpate.

“Putting the puzzles together.”

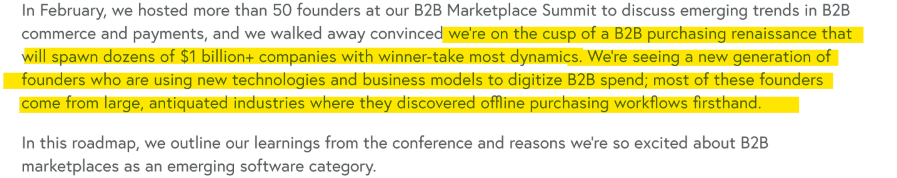

PharmX is becoming Network Ecosystem Orchestrator

Remember, the thesis here is australian pharmacies are modernizing and becoming more retail like pharmacies are in the US. And there is not a better way to play it than through monopolistic company that will enjoy this inflection point for many years to come. Basically all the money in Australian pharmaceutical industry flows through their EDI solution. There is a site I track the flows. Given their monopolistic position, there are ways to capture even slight increase through modernizing for themselves only. But not only pharmacies are modernizing, but also PharmX. Why is PharmX Network Ecosystem Orchestrator? easy description: “Ultimately, they connect the industry and streamline order management.”

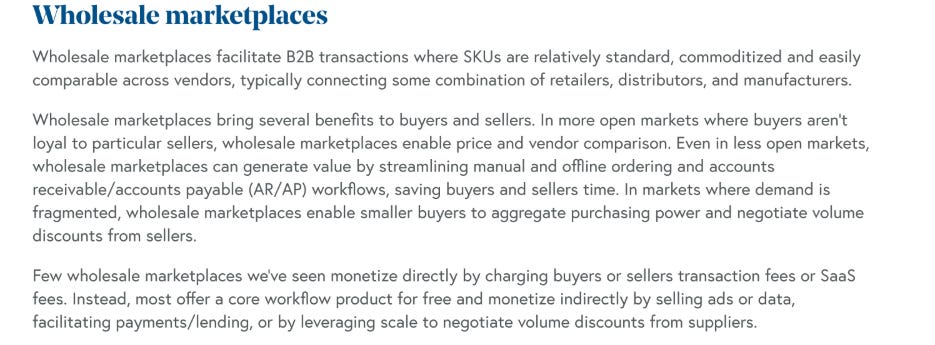

Why marketplace?

This is great piece on marketplaces.

Another good reason for marketplace are the promotions and no need to travel across the Australia to offer products. Pharmacies can just see the most demanding products through their POS and start to order them. That saves lots of costs for the suppliers. Today they spend a significant portion of their time managing clients on the marketplace, making pharmacists more aware of new suppliers. They are constantly adding suppliers to all platforms, which brings new products (beyond prescriptions) and allows them to capture orders from new customers. Their marketing team is increasingly digitizing these functions through EDMs, social media, and a new supplier directory.

“In both cases, high-friction B2B marketplaces can typically charge relatively substantial direct transaction fees, though they can also monetize via indirect business models like payments/lending, ads, and data sales.”

Momentum is picking up for PharmXchange

Lets start with question - “Why pharmacies do need marketplace anyway?”

Initially POSs were developed for regulatory purposes, not for retail. These do not have any information, deals, no educational stuff, no comps products, anything new that could increase sales of pharmacies. New POSs are retail oriented, move pharmacies from old POS to new marketplace POS. With that, there is significant opportunity in offering marketing on the platform. A while back they recruited marketing person to develop this with experience (begins with helping on media buying, centralized promotion, etc. There is room for monetization here too. To put it another way, there is $20b flowing through EDI, that could be more efficient for all sides. Given the monopolistic position, PharmX is in prime position to innovate and to capture as much of these flows as possible for take rate based model, even though the take rate will come down with volumes. Today it is 4-7% on average and will drop down to 1-2% as they grow to grab the full opportunity and not invite any competition when scale is reached. This will take some time though as purchasing patterns, trends and pharmacies adopting takes time.

“We should have been built on a percentage-based model.” CEO of PharmX.

New prescription for growth with new partnerships

MCO Beauty and its GMV beauty for PharmX

The business is projected to reach $250 million in sales this year, which is roughly 5 per cent of Australia's $5 billion beauty industry, and it was recently partially acquired by Australian pharmaceutical giant Arrotex. Denis Bastas is the CEO of Arrotex and also on the board of PharmX. MCO Beauty are now on the marketplace and it should be huge deal. They probably have negotiated lower take rate, but it should be meaingful anyway. Pharmacies will definitely want to stock these SKUs. This is a good article of how MCO Beauty became successful by offering discounted cosmetics.

What does it mean for PharmX?

MCO Beauty were originally founded by one of the supermarket chains here, Woolworths. Woolworths still have first right to certain product range and first right to some stock. Even though MCO Beauty are exploding, they don't have full control over their supply chain just yet.

That's going to change in the next couple of weeks, actually. What that has meant for us is that we've actually had quite a slow rollout into pharmacy. We were only at a couple of hundred stores with pharmacy.

But the explosion has been enormous. In less than nine weeks of having MCO Beauty with a handful of stores, about $15 million worth in order flowed alone just for MCO Beauty. As we start to expand that into the national market, as we start to expand the range, we see that going to absolutely explode.

That's a great story for us. We have another couple of brands in the pipeline at the moment that we're negotiating with to get them on the platform, which we think will have probably not quite the same effect, but a fairly similar impact. Very youth-orientated, high-trending products, highly sought-after products, and we will become the sole supplier or distributor into market.”

Natio Beuaty

Recent update for Beauty: “We've seen an almost 400% increase in beauty, primarily driven by Emco. We've just launched Nude by Nature, which is doing well but is small by comparison. Emco's growth is expected to continue as they increase supply and roll out to new stores.

Vaping

Law Enforcement was very slow. Businesses operated for longer period of itme, even they should have been shutted down. That eventually happened. Requiring a prescription was a complete nightmare, that sent everybody to the black market and reduced volumes. Now prescription is not needed based on what I understand. Lots of pharmacies are reluctant to sell the vapes, but it is slowly getting better as there is lots of money for pharmacies to be made. By the words of the CEO, 50% pharmacies have it and 50% do not and they can see ordering pattern increasing more and more. Obviously from a low base. It is still early days as the selling in pharmacies was approved in October only and vapes are being sold behind the counter.

Due diligence on vaping: I would like to follow if for example australian government wont come up with changes in nicotine industry. For example if vapes will be allowed to be sold elsewhere that could be problematical. Pharmcies related I would like to follow how the adoption of selling vapes is going. Because some pharmacies were/are reluctant to sell vapes as they are not helping the consumers and it is not actually a good product for your health. They are mostly being sold behind the counter.

Got exclusives now with some big players: Phillip Morris (Vape), McoBeauty (DBH Brand). Some big players are coming exclusively to them. Built a “replenishment model” - where buyers could put their whole order through rather than just their promotional orders.

Cannabis

Not only vaping now being rolled up in pharmacies across Australia, but cannabis should soon be too. They've seen stock movement, indicating sales, and reordering has started. They now have the three market-leading suppliers, with Veve being the top one. Penetration for Cannabis is between 5-10% of pharmacies, with regional variations. They expect this to increase over time.

Data Analytics

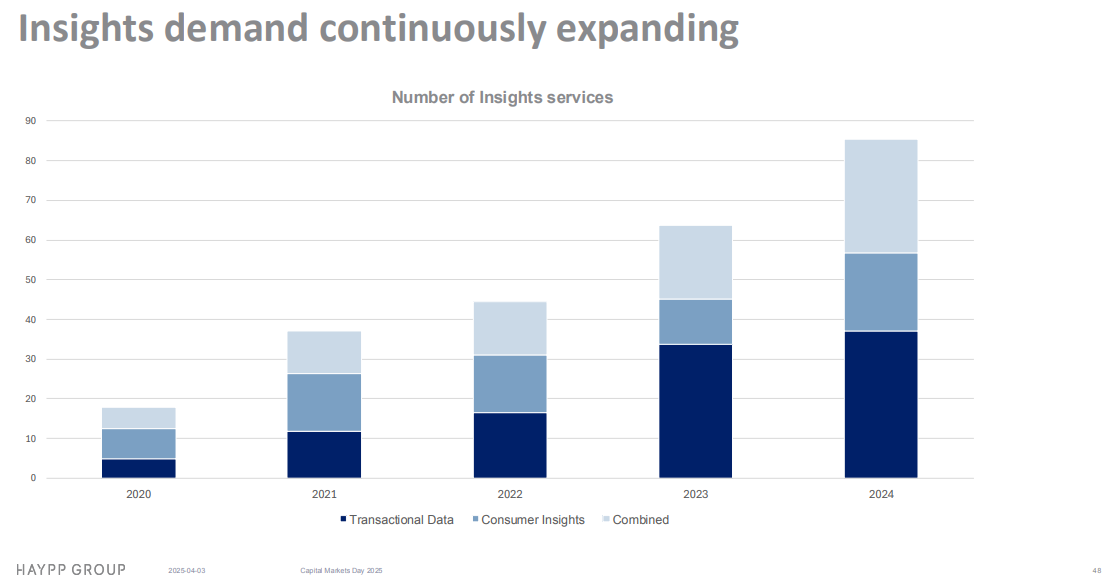

Tom thinks the Data solution is a big asset to monetize. They are the only one with 100% visibility. There is room for good monetization potential as they see all the money flows in the industry. They are working on it, but it will take 3-5 Years. You can imagine under “Data Analytics” updates and user metrics. Users doubled in less 6 months. Uplift in branding and messaging. They are currently experiencing 60% open rate on promotion rate (very high). Through this they are getting more exclusive partnerships and more supplier agreenment.

Pharmacist gets high quality product choice. They can see & compare prices and alternatives. Multi supplier checkout. 10 different suppliers. B2b complex: You have many different suppliers some are preferred some 2nd tier, 3rd tier. Same product can have 4 prices vs different wholesaler depending on your own contract term, and it will be different for different pharmacies depending on their association. Outcome is it is very hard to build a one cart for everything. With the EDI they can do that - saves a lot of time and hassle. The ability to build a cart is unique and is a differentiator.

Tom brought the idea of selling data analytics.

I believe PharmX given its extremely strong network effects and monopoly position can follow similar path to Haypp Group here.

Marketplace & bottlenecks

They needed to make it easier for small - mid sized suppliers to onboard. “We were a bit slow to recognize that in the beginning. So we started thinking about how to do it easier. We thought having an online portal to connect through will be a good way.”

They soft launched it and it went to all the suppliers and we had good response. “We recognized that the big guys already on the EDI wanted the marketplace to replace their sales and marketing guys saving them a lot of travel time (Australia huge). If we gave them marketing functions this would replace their sales rep activities - massive savings. And so the interest from them was bigger than from the smallest guys. The big guys got it instantly. Immidietly we signed up some very large players. And we continued to try and recruit smaller suppliers.”

“The interest actually swamped us as we didn’t have enough people on the ground. We probably did not have enough sales people as we should have had. So we got off to a slow start. We were excited about the product and the response but did not have enough sales people to convert interest to orders and we weren’t delivering technically what they wanted. So we probably lost 6-9 months where we could have done a lot better.”

The marketplace is taking off now. “Huge interest”. Smaller participants are interested but they are not huge volume for us. We do sign them up. Targeted 100 new suppliers for the year ~70% done. But we are following the money. With our limited resources we need to focus on the big suppliers. We want to control costs and prove investments made work. Want to focus on what will earn the highest return on our investments.

EDI Opportunity

There are 130 suppliers to connect ~5000 pharmacies (not all active). High average have 23 connection, they think this can be the standard for all active pharmacies (especially with the effort to monetize pharmacies on retail side). Want to grow suppliers to 300. (TAM).

10% of pharmacies are tiny, rural that will never have more than several connections. Will not grow connection. Rest are in metro areas and there is no reason why they would not grow. They think, there is 10% growth just from EDI over the next 3-5 years possible.

Average 16 AUD for monthly connection (less 25% payment to POS) for gross.

Regulation: a. 50% of prescriptions (every second month) cuts deep into pharmacy’s revenue (drive to retail is very beneficial)

Accounts connection target growth 10% forward for the next years. Mature but fair opportunity to grow: broadening connections (suppliers) better job increasing suppliers they worked with. Opportunity is 6000 pharmacies, 100 suppliers, 7 connection.

Expansion into New Zealand

The collaboration with Tonic, who has 85% of the New Zealand market, is strategic for several reasons: Gateway Solution: They're taking over Tonic's gateway solution, migrating their 50 suppliers into network, which increases sign-up fees and ongoing management fees. Partnership with Chemist Warehouse allows them to grow revenue and importance with Chemist Warehouse in New Zealand, providing them access to more suppliers. Then Data management. Tonic's data management will improve their data analytics in Australia. Then they have the opportunity to run a marketplace product in partnership with Tonic. There's potential for further international opportunities with Tonic's parent company, Clan William Group. I believe this is very positive and was not initially expected as part of the thesis. I believe it highlights the opportunity PharmX is having given their strong moat. If this fails, it does not impact the thesis. This new collaboration abroad will bring in revenues next year due to the time needed to bring on new suppliers and generate revenue and so they expect to see the effects of this collaboration in FY 26 rather than FY 25. Tom also spoke about expansion into asian countries but that is not present.

Given these all opportunities they will invest more during this year and that might bring them to FCF negative teritory. They will consume some of the cash, but they will still focus on financial management to not overshoot things. I think this is the right approach as I believe they have great opportunity set in numerous areas for the next number of years. All in all, to really see if the investments are worth it, I will closely follow the top line growth, while remembering that this was a business with 50% EBIT margins when it was a private company, that was just milking it. Management still thinks this is 50% EBITDA margin business.

Question is, what makes them so confident that pharmacist can sell all this retail stuff? Evidence from pharmacists and data trends indicating: Increased Orders: More frequent and diverse orders from suppliers. SKU Diversification: Pharmacists are trying different products, indicating a shift towards retail sales.

With all this being said, PharmX shares the potential they think they can reach medium term by combining EDI + Marketplace. $50m ARR is very very meaningful. It is a bit less what I understood from conversation with the management, but this is extremely high margin revenue that they could acquire. Let’s say they could make $30m EBIT off $50m sales. At 15x EV/EBIT which I think is very modest for monopoly, this still could become a 10bagger here. They capitalise lots of intangibles and also hired a lot of new people to supplement growth, so I think P/E is not a good metric to look at as of this moment.

Further, they terminated the revenue share agreenment with Alkemy for marketplace. It would impact numbers a lot, but it is a burden that will not be an issue during this scale-up phase.

Revenues of MP?

Tom told that they will disclose segments only when they reach 10% of total revenues. They have not done that yet for matketplace so it still is very low base that I hope will exceed 10% soon. I would be suprised if it wouldnt.

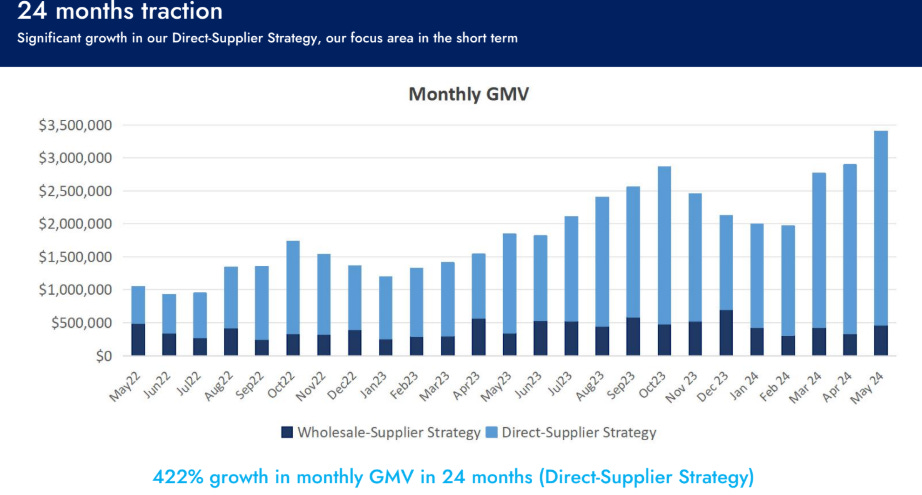

Directo - The competitor that can be “turned off anytime”

We found the company called Directo (private company), which seems like they are the closest competitor to PharmXchange as they are offering the similar marketplace to pharmacies across Australia. The recent reports show that they have around $40m of GMV growing 70% YoY confirming the demand for the marketplace that PharmX is ramping up recently. This might look like that PharmX faces stronger competitor in two-sided marketplace which are usually natural monopoly markets (the same way EDI of PharmX) and winner takes all, is not good. The network effects are the biggest competitive advantage for such marketplaces, very unlikely to be disrupted.

However Directo is running on the EDI of PharmX and can be shut down anytime or be bought out by the company. The company raised $2.2m and was founded by Gavin Upiter and Shana Louise Upiter as trustees for the Upiter Family Trust. They started with low take rate and started to charge more after the value of that was proven. I think the opposite approach is the right one.

Have a look at their metrics from half year back. $40m GMV (75% of that are direct suppliers and 25% is wholesale), growing 78% YoW. Demand is there. Projecting uplift of 10x would mean $400m of GMV. Tom told us there is a possibility to get to $8b in GMV (I am not 100% sure what is the probability of that). But they have only 55% of pharmacies onboarded. There is significant potential before maturity. PharmX can shut them down anytime. But they must not allow get them big enough. That would be an issue. Another thing is that there could be regulatory (antimonopoly) hurdle of doing so. But Directo will have all the time higher cost structure than PharmX as they pay them. $400m GMV would mean $20m (assuming 5% take rate) of high margin revenue for PharmX. Marketplaces typically have 90% GM. But with running own infra, could be 100%. What is the marginal cost? Not a lot. And then you have the data analytics and further EDI growth. These $20m could easily bring $10-12m of additional free cash flow assuming no further cash flow from Data Analytics. Now what is the timeline? I do not know that. P&L of Directo looks just terrible. PharmX has time to decide what to do with them. But one thing remains: There is serious demand for the marketplace.

The group expects to reach profitability in 2028 and only very slight. I think it is very unlikely. They have been raising more money recently.

“It is much easier than it was. Integrated payments and lending are unlocking new business models for software companies and vastly improving the user experience. B2B marketplaces with “indirect” business models like invoice factoring can offer core workflow and ordering applications for free to drive adoption. This is important. Marketplaces are take-rate based. Usually use something like 7.5% take rate and scale down with volumes, which creates extreme barrier for new entrants and therefore natural monopoly exists with strong network effects. Now, PharmX announced a company called CH2 as a new supplier that come to marketplace. CH2 has about $3b in sales. However, PharmX wont make 7.5% on this supplier given the huge volumes they can bring. Based on my understanding PharmX will make close to 1.5% on the volume, which anyway is very significant for the company.

API-driven architecture is maturing as a paradigm and enabling more communication between applications across value chains. Open architectures allow B2B marketplaces to build real-time multi-vendor product catalogs with accurate SKU and pricing information.”

“Both wholesale and high-friction marketplaces rely on infrastructure providers to facilitate payments/lending and connect various.”

Therefore my reasoning leads me to outcome where PharmX be a likely winner of this marketplace adoption, because they have the infrastructure, which is similar to Visa/Mastercard, they have the data about purchasing patterns, they are cash flow generative and are widely recognized across australian pharmacies. While Directo is growing fast and have higher GMV than PharmX, they are still money losing and running on the infrastructure of PharmX and paying them for doing so. Also, Directo is in need to raise capital.

By talking to management team, we observed that Directo’s model wont probably be ever profitable. They describes themselves as “Australia’s first truly independent online marketplace connecting pharmacy buyers and sellers”. Management thinks too. And they are trying to raise capital, which will they quickly burn. Here is where Directo stands.

The opportunity

Directo is projecting also significant increase in GMV and with that they are projecting $44m of revenue (Not GMV) in 5 years and 47% EBITDA margin clearly thinking they will dominate the marketplace. I think it is just fund raising tactic and PharmX will soon prove them wrong with all the partnerships announced and its powerful EDI network.

General thoughts about competition

The difficulty in operating multiple gateways into ordering is something almost impossible. It would be close to impossible for pharmacy to switch between the two. So it will take any competitor many years to sign up all the others, to get all the suppliers. It is too much risk for the suppliers.

When supplier go they do a detailed analysis. They often go without the knowledge of their pharmacies. And when the pharmacy finds out, they get them reinstated.

Fred once moved wholesalers accounts without them knowing. It caused issues for them and for the pharmacies and wholesaler.

“Any loss we’ve had, we worked hard to retrieve. We had 14 bn now 20.”

Would actually like to get FRED IT back to use the platform.

“We deliberately not released marketplace figures a. Because they were not impressive yet - we lost 6-9 months developing the marketplace due to lawsuit and slow start. But also because we dont want to tip off Directo / MedviewX. As we grow we will release more info.”

MedviewX (Fred IT - 100% owned by Telstra Health)

Fred IT tried to set up competition (discussed in the legal case).

Been at it for years not gained any traction.

Telstra Health is undergoing strategic review, estimate nobody will be interested in it so it will be shut down.

Fred marketed them by saying to wholesalers “look Corum changed management, who knows what will happen, EDI is the core business process in your business, you should have a backup in case this does not work”. PharmX ended up building lots more functionality, moving to cloud, did in one year more that was done in 12 years. And now everyone can see the balance sheet and be comfortable with them.

New partnerships - Supply is growing & PharmX is becoming data company

https://pharmacydaily.com.au/news/pharmx-and-ch2-position-for-growth/112945

PharmX will also support CH2’s growth strategy through bespoke analytics services and predictive demand analytics. PharmX CEO, Tom Culver, said “We’re excited to strengthen our relationship with CH2 by offering our extended service portfolio that brings even greater value to our partners—not only for CH2 but also for our pharmacy customer expanding CH2’s product range across our Marketplace strengthens our service offering and provides more accurate information on pricing and stock, which we know are highly valued by our pharmacy customers. We’re also seeing significant value in our data solutions. With our combined Gateway, Marketplace, and Analytics offerings, we are thrilled to support CH2 in strengthening customer engagement while reinforcing our position as Australia’s largest pharmacy network provider.”

"Partnering with PharmX in this expanded capacity represents a significant milestone for CH2 as we continue to grow our reach amongst Australian pharmacies. By leveraging PharmX's full service offering, this partnership not only strengthens our engagement with existing customers but also allows us to connect with new pharmacies across Australia, reinforcing CH2's commitment to providing comprehensive, innovative solutions for the healthcare community."

Then they have signed Blisterpot. Products for blisters. Then products for teeth withening, then vegan skincare products, Luxurious artisan oils and salts, one-stop shop for flawless eyebrows, Australia's leading distributor of Nicotine Vapourised Products, Phillip Morris, Pfizer Abrilada product, wholesaler of dental supplies…. Total 80000 SKUs are now being offered on Marketplace, which is basically becoming not just pharmaceutical platform, but retail platform too. There are billions of dollars that might be very soon flowing through this platform and the adoption is increasing like crazy.

Update on Management Team

Tom is a product guy. Nick England is making the calls on the capital allocation. He sounds enthusiastic about the opportunity here. He does not “swim” on the financials

We wanted to understand a bit more about his past: Douugh lessons/learning? “Were bought out. Diligence is critical. Think alot about all assumptions and challenge them. Why we do things? How? With Whome? I built goodman (what he sold), scaled it, pivoted it, sold it. Says his business under douugh the business is not beginning to do well. Stock was terrible. But proud of what he accomplished. Note: seems like he is very aware of the reputation and learned to be very careful with investments and execution.”

Nick and co holds 15%.

Nick roots are from pharmacy business side. British who followed his Australian wife. Been global business development at wholesalers and chains.

Were following the Corum story unfold, cash burning management, bad execution that drove a good business belly up.

They thought the pharmacy software was interesting. Got involved when cash ran out on a raise, kicked out all prior management and chairman. Took control to discover the situation was worse than they thought, started cleaning up the business, firing people, selling the software.

The dispute between the PharmaX founders was their cue - the founders were getting dividends not per ownership but per traffic to the EDI. The 2 smaller parties were upset. They helped to buy out the big players and took out the smaller ones.

Capital Allocation

“I dont believe in ‘lazy balance sheets.” Money we got we distributed, and had we won the appeal, we would have distributed the cash. We don’t need much to build our own business organically its very asset light. We looked at some acquisitions but didn’t find anything we cant build alone and prices were outrageous. I am a shareholder myself - we don’t want to do stupid things with our money. If we’d do an acquisition I will want it to be efficient. - Nick England - I like this a lot. It seems to me that shareholders will be treated well and be aligned with owner-like operator.

Verdict

This is almost all I know at the moment. Of course I will keep the best levers for myself at this point. I really do not want to have many traders coming to the stock. I value buying on the way up and I hope I can do that for the next 5 years. I love companies that have their destiny in their hands. PharmX can build, grow and monetize basically without interuption. It is very rare to find micro-cap company like this one seems to be. Time will tell, but PharmX has become my biggest position and I would like to be buying more, even though the thesis now relies on execution. If they can execute with the marketplace I believe current price of around 5x EV/SALES is not expensive at all. Remember, they had over 50% EBIT margins when milking this network.

Connexion Mobility

Up until now, I was only updating Connexion on my twitter, but I decided to change that I write down everything here on my blog. Connexion reported a really good quarter with growth accelerating from their marketplace (non-CTP product). By my understanding, most of this is related to Ridehail as they recently finally launched the platform and collaboration with Uber and Toll management system. On this topic, check my article.

Revenue grew 6% QoQ (SaaS 5%), accelerating from 1% last quarter. Connexion is spending a lot through S&M and R&D, which is being expensed. Growth is therefore important to follow if this spending is worth. Here is their commentary of things they are currently focusing on. I am closely following the development of the two most interesting products that could drive growth in the recent future - Tollaid and Ridehail. To get the conversion, the company will increase its spend to improve products as well as market them to dealers. It is just another venture where Connexion can grow its intrinsic value alongside buying back ton of shares.

I am happy not to talk much about the stock. They are buying back shares like crazy and I hope that will continue going forward. These buybacks can be extremely meaningful in the future alongside further growth. During the H1, the company spent $985k on buybacks. They bought back 7.7% of shares last year, most of them occuring in the second half (about 52m of shares just last quarter, which is 6% of SO based on July 1st). They still have around 19m of Performance Rights oustanding, but these are old programs. During this half of 2024, no new rights were granted. No loan granted shares for employees either. The buybacks from now on should really mean an impact.

The Connexion made around $1m of EBIT during the quarter. That does not include the growth spend of $600k. It is really a growth spend. They dont need to market themselves to independent dealership and offer them new products. They dont need to spend developing and integrating products to sustain revenues. Traditional accounting does not work here well. That is $1.6*4 = $6.4m of EBIT annualized. Market Cap is $14.3m and EV is $9.7m.

On the diversification side, Connexion is grew 96% AMRR QoQ with Isuzu. That is growing from super low base and I am not sure if it will become anything meaningful, but it is good to see and hopefully it will continue. Otherwise market is probably waiting for contract extension with GM. Contract is running out in 2026, but I think it is 99% chance they will get the extension after deepening and even funding the venture from GM, which they will not get any revenue from. The asymetry here remains. I am working on write-up of another software swedish company, that had high customer concentration (50% of sales) and recently announced new customer comparable to the biggest one. Share price immediately doubled, therefore they become both 33% of sales. If Connexion has only one customer, the asymetry of getting the second one is even bigger. The swedish company was trading at 20x P/E. Normalized P/E of Connexion is between 3-4x. If they get new customer, what prevents them getting to 15x? And if not, 10% annual growth + 10% buyback a year will do its thing, as it wouldnt be long when Connexion trades at 1x normalized P/E. I am happy & patient investor cheering for Aaryn and what he is doing here. And when I have new funds, I buy more shares.

The Case Study of the swedish Company

If anyone is interested of what can happen, I highly suggest studying Avtech Sweden AB, which is small vertical software company focused on software provided to aircrafts for emission efficiency. The company had 50% of sales in 1 customer and they announced a deal as big as the 50% customer was. The risk decreased and the share price rocketed from 4 SEK to 8 SEK. But. The company was trading at 20x P/E before. Connexion is much cheaper. If they can get one new OEM, it is asymetrical.

Tarrifs?

One of the most recent spoken word is Tarrif. The revenues are partly based on number of cars in CTP. This could mean a risk if production of the cars would go down and SaaS revenue would get impacted. On the other hand I do not expect to be worse than the Covid was. And the company survived that. I believe they will scoup shares on any weakness at this price.

The presentation is not an investment recommendation. It is for educational purposes only.

Thank you for your criticism, feedback or discussion,

Jacob

This post is free for everyone, but if you value my work and would like to buy me a coffee, you can do it here:

Why do you think CXZ is struggling to acquire more OEM?