PharmX Technologies - Software Company with Wide Moat, almost Negative EV & Huge Optionality

“In business, competition is never as healthy as total domination.” - Peter Lynch

“No formula in finance tells you that the moat is 28 feet wide and 16 feet deep. That’s what drives the academics crazy. They can compute standard deviations and betas, but they can’t understand moats.” - Warren Buffett

Hi all,

And welcome to my first english deep-dive. I am aware that this wont be perfect and there might be few misunderstandings of what I really meant by writing and how you understand it. I will do the best job I can to make this write-up easy to read and understand. First, I will go back to explain where I left writing in Czech language as most of you probably have not read it given the language obstacles. I went A-Z all companies listed on australian market and now going one by one to find attractive investment opportunities. Until this point, I was invested only in Connexion Mobility which I discussed publicly on twitter and here on my blog and even though this company is in different industry, it is a similar business. My job is not only find good opportunities now, but rather follow these companies long-term to improve my business judgement and decision making. I passed on most of the companies and constantly going back to few, while also working full time and meanwhile working on other opportunities, so have real time constraints and just Australia will take me few years more. However I recently went back to my list and found one interesting situation that got immediately my attention which is always a good sign. I like to not make my investing difficult.

The opportunity

Few years back I thought the best investments are those that people do not know about. While I still think those, I am not longer rely on just “undiscovered” part and twitter mentioning. Actually there is only one incredibly smart person on twitter, who helped me after me raising some questions, otherwise not other mentioning apart 2 posts.

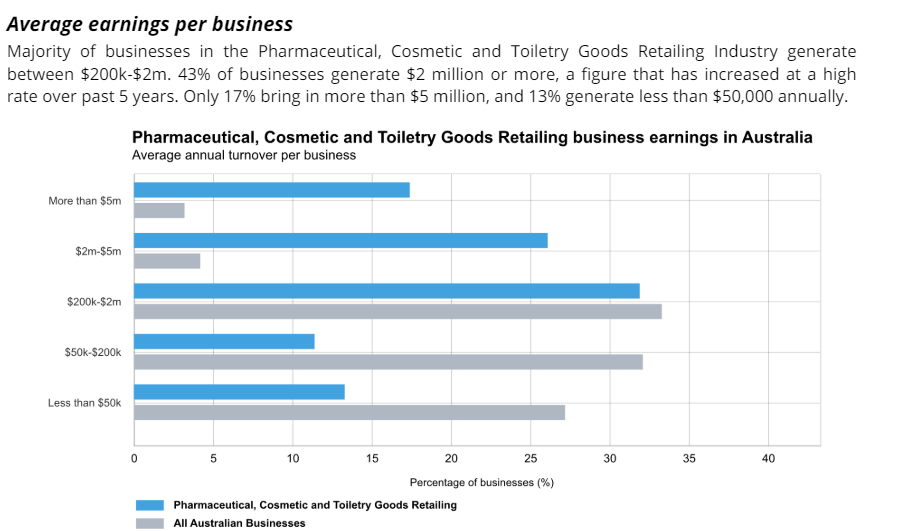

This company I came across is a little software vendor for pharmaceutical industry in Australia with multiple attractive characteristics inside, not just outside (discovery). The thesis should simply fall into cash rich, monopoly based nano-cap after huge changes with optionality of growth by adding new features. The company is called PharmX Technologies. During the last years, its profitability was undermined by increased legal costs and declining revenues of the old E-Commerce division which was divested in 2022. Before further dive, here is a quick description of the numbers, which are all in australian dollars. I bought big position at $0.030 in the last few months and all numbers are related to that price.

Share Price: $0.030

Shares Oustanding: 598.5m

Market Cap: $17.95m

Net Cash: $14m

Enterprise Value: $3.95m

ARR: $6.5m (2024)

EV/ARR: 0.61x

EBITDA Margins: 27%

PharmX Technologies

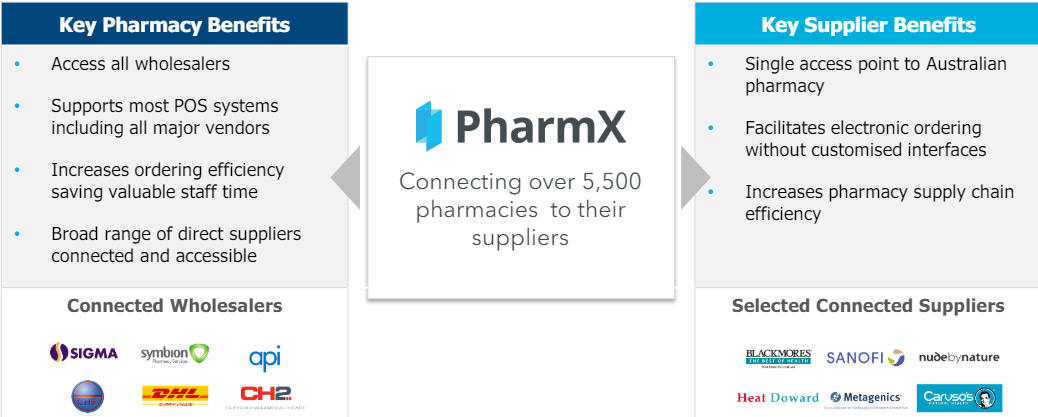

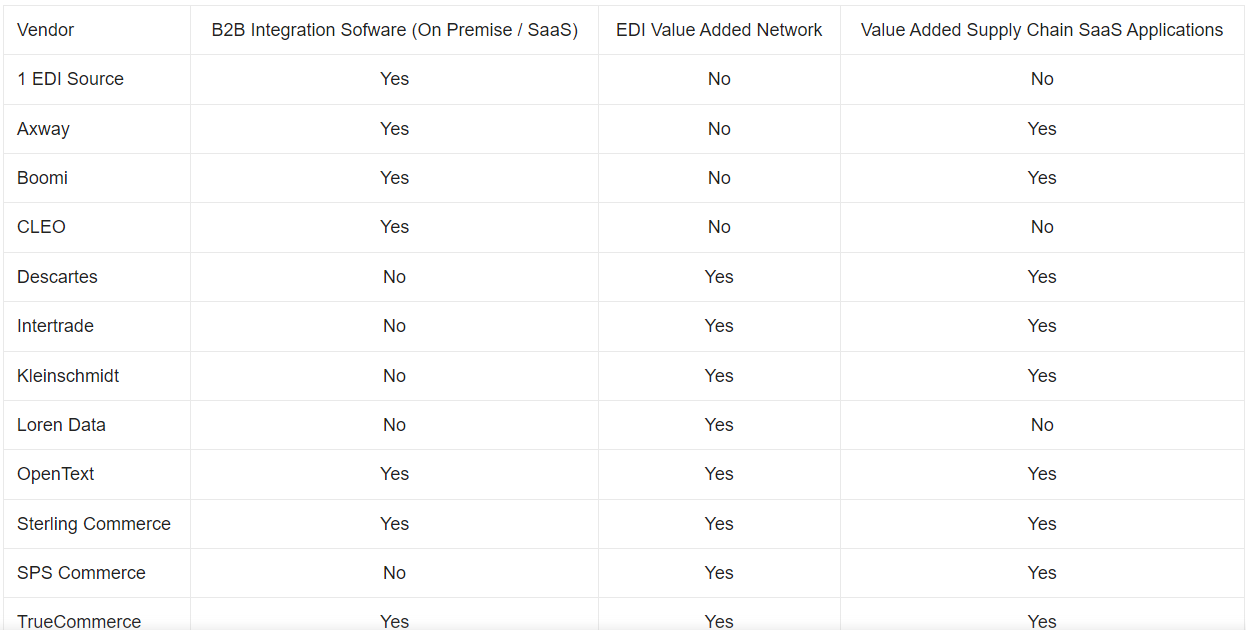

With “PharmX Connectivity”, they are a vendor of Critical EDI infrastructure (one stop shop) running on their own VAN to the pharmaceutical industry supply chain of retail, pharmaceutical and NDSS goods in Australia and partly New Zealand. With this software, they are powering 99% of pharmacies across Australia while also being active in New Zealand. It functions basically as an electronic gateway for pharmacies and suppliers to exchange orders and invoices. It provides a fast and secure way for pharmacies and suppliers to connect. When pharmacies lack some medicals, they make an order to PharmX which connects them with suppliers, who process and ships the goods & automate all the processes. Over $18b of purchases are transacted through the platform each year. When the invoice comes back, they have it in their POS system immediately. PharmX saves time and eliminates human errors such as shipping the wrong product. PharmX was developed in collaboration with major australian pharmacy POS vendors with a goal of creation e-invocing platform that all pharmacies and suppliers could use. To put it simply, they are a platform where the whole ecoystem and connection between pharmacies, wholesalers and suppliers is running. PharmX was underinvested till 2020 when Corum became 100% owner, which they wanted to resolve and they did.

Then they included the a Marketplace platform to allow greater flexibility for suppliers and pharmacies in ordering through PharmX, the enhancement and expansion of message types that can be sent through PharmX, and the introduction of payment capabilities – an extension. In April 2023, the platform added an Education and training hub, EduCentre, which provides a centralised repository for suppliers’ product information and training materials.

How it works

Each supplier uses its own ordering, invoicing and inventory management system and as such has its own requirements for the data (and data formatting) needed to process electronic orders and invoices. The benefit of the gateway is that it removes the need for each POS vendor to build custom software for each supplier so as to allow its POS system to communicate with the supplier, with the resultant need to update that software each time the supplier makes a change to its system. The gateway avoids this problem by providing a single portal to connect to POS systems. When an order is sent by a pharmacy through the POS software, the gateway converts the data into the format required by the relevant supplier. PharmX works with the suppliers to update the gateway to interface with the supplier’s systems. In return for this, PharmX charges suppliers a monthly subscription fee for each account a pharmacy holds with that supplier that is connected to the gateway. To enable a pharmacy to order from suppliers using the PharmX gateway, the pharmacy’s POS vendor needs to build support for the gateway into its POS software. Accordingly, PharmX and the various non-shareholder POS vendors enter into third party access agreements, which provide the POS vendor with access to the gateway. PharmX provides the third party POS vendors with training and technical support, and pays a monthly ‘rebate’ to the POS vendor, which is calculated by a formula reflecting the amount PharmX earns from each supplier according to purchaser order lines transmitted to that supplier from the particular POS vendor’s software. The POS vendor is required to promote the gateway to its customers and convert them to users of the gateway. Corum, Fred, Mountaintop and Simple Retail entered into shareholder access agreements with PharmX on similar terms, save that the vendor rebate mechanism is different. They have over 58.000 accounts (DHL being the largest with 4,000 pharmacy accounts in 2013, do not know now) and 73 suppliers, about 25% of suppliers come from New Zealand.On monthly basis, they process something like 2.2 million of orders. Their pricing has built in inflation indexed price rises and maintenance expenses are very low, wich makes with recurring revenues and 99% market share super attractive business.

For more interest, listen to this podcast about the value-add of the PharmX. This podcast also gives insights into opportunity for meaningfully increasing revenues by adding new supplier accounts to pharmacies. Average number now is 7.5 per pharmacy. But there might be 70-80 suppliers per total. This is the good opportunity for PharmX. I just want to briefly say that I am getting more excited the more I research the company, good sign. From reading this article, I think there is a hidden demand that could be huge optionality further for PharmX.

(Looks like hidden demand that one could identify early can provide huge returns & exciting setups - Data needs for AI training with Alarum, TikTok platform driving Sow Good’s sales, Robots needing UVC dosimeters with Intellego, Car dealerships needing to add services to make profit with Connexion’s software, DIY Community driving demand for Shelly’s products,…).

Pharmacies are becoming more & more like WallGreens is in the US, they are forced to sell more products than just medicals as government limits them by how much they can make by selling medicals, so they are on the look out for other products to sell. Obviously this will increase the number of supplier accounts as pharmacy suppliers typically focus only on medicals, so pharmacies need to seek for new suppliers of bunch of different products. The consumer wins, pharmacies need to evolve.

“Pharmacies could lose more than $150,000 each annually over the coming years under Labor reforms that reduce the cost of many prescription medicines, the government’s analysis shows. The government says allowing people to buy two months’ worth of medicine for the price of a one-month prescription will save patients up to $180 a year for each medicine.” - Profits collapsed.

“So, what’s the elixir at the heart of this drugstore’s success? Part of it is not acting like a drugstore at all. Instead, Chemist Warehouse looks like a discounter and behaves more like a “health supermarket”, with 67% of sales “front of house” (vitamins, shampoo, toothpaste etc.).”

And the opportunity is not only in the pharmacies.

“We also recently signed an agreement with Go Vita to provide both retail software as well as utilising the PharmX platform. This is a significant development as it shows that Corum can be competitive outside of its core pharmacy sector. We look forward to working with Go Vita as they grow their footprint in the vitamins and healthfood space. Go Vita operates 130 health and vitamin stores across Australia and Corum has entered an agreement to be their preferred operational software provider. Go Vita is the first major non-pharmacy customer for Corum. In addition, they are a large supplier to the pharmacy market and will distribute via the PharmX platform. Pleasingly, this singular discussion yielded a multitude of commercial opportunities for our Group to pursue.”

Understanding the Value Proposition

Skip this part if you want to get back to the thesis, this is mostly for my learning purposes. The historically fragmented pharmacy sector is consolidating into major pharmacy groups whose ambitions are for significant scale and reach. They are often owned by or aligned with a major wholesaler. This is how industry works in a nutschell.

Drugs are manufactured at production sites.

They are then transferred to wholesale distributors.

The pharmaceuticals are stocked at various types of pharmacies, including retail and mail-order.

Pharmacy benefit management companies negotiate prices and process drugs through quality and utilization management checks.

Finally, pharmacies dispense the drugs to patients, who take them as prescribed.

You can read more about whole value chain in this article.

When starting out, pharmaceutical companies generally rely on 3PLs providers to manage the logistics of their products, and many 3PL providers serve as a one-stop shop, providing EDI services in addition to logistics. However, companies tend to outgrow the need for 3PL services as they expand and mature. When that happens, businesses need a reliable 3PL EDI provider that understands the industry and can send data effectively and efficiently. Pharmaceutical manufacturers in are increasingly turning to 3PL providers to address various supply chain and logistics challenges.

How EDI Helps Facilitate Processes with 3PL Providers

Electronic Data Interchange (EDI) plays a crucial role when a pharmaceutical manufacturer partners with a Third-Party Logistics (3PL) provider. EDI software is a tool that converts business data and information to trading partners in a standardized, structured, and paperless format that is compliant with EDI standards. Data such as EDI 850 purchase order and EDI 810 invoice are in document format. Each document type has a standardized layout that displays and defines the information so it is easily understandable to all parties. EDI software was created to lessen the procedural demand around industry trading processes such as shipping and mass product purchasing, purchase order (PO) generation, etc. Historically, invoices, POs, shipping information, etc. were manually generated between trading partners, this process was very time-consuming and had very high error rates. EDI software is a secure solution that significantly shortens the purchasing process, as well as reduces the costs associated with manual entry using automation. It facilitates the exchange of such business documents in an electronic real-time format between trading partners and across a variety of platforms and programs. To be more specific, it facilitates seamless communication and data exchange between the manufacturer and the 3PL, including:

Inventory management – product quantities, transit status, and warehouse locations to maintain accurate inventory levels and optimize supply chain operations.

Purchase orders – digital order information reduces errors and speeds up the order-to-fulfillment process.

Invoicing and billing – electronic invoicing with details about services rendered, storage fees, transportation costs, and any applicable charges streamlines the payment process and reduces paperwork.

Reverse logistics – return or recall information communicated promptly to the manufacturer to resolve.

Quality control – inspection results and quality data to ensure that products meet quality standards before reaching the market.

Shipping, receiving, and tracking notifications – advanced shipping notices or shipping confirmations providing real-time updates and visibility into the status of orders.

Regulation - Since the pharmaceutical industry is subject to stringent regulatory requirements, EDI assists in complying with regulations such as Good Distribution Practices (GDP) by providing an auditable electronic trail of transactions and data exchanges, and EDI systems often have robust security measures to protect sensitive data, ensuring data confidentiality and integrity.

I think this very well describes the value proposition of good EDI software, which tend to be super sticky with high network effects on all sides as EDI workflows can accelerate the order-to-cash cycle, reduce errors and prevent chargebacks as it serves as the middle man. By all parts of the supply chain it is required to be used! The value proposition of good EDI software lies in efficiency, reliability, the speed and improvement of processes. You lose customers if they have delays in supplies and especially in such a critical industry like Pharmacy is. Have a look at this newspaper article in 2012 to understand customer value proposition.

Both the manufacturer, supplier and the 3PL can use EDI-generated data for reporting and analytics purposes. This data can be analyzed to identify trends, improve operational efficiency, and make informed decisions about supply chain optimization. Every business is defined by the customers and this data & analytics of customer’s behavior provides very good proposition for suppliers (Similar to Haypp Group). The visibility acquired through the digital transmission of this fundamental data allows collaboration between the 3PL provider and the manufacturer, enabling the manufacturer to adequately forecast demand, manage inventory and production schedules, and meet customer expectations. Also it helps to save costs, enhance compliance and enable manufacturers to focus on core competencies like research. Now this little australian company supplies this software to 99% of all pharmacies across the Australia, making this basically a monopoly. Also its Moat was tested by aggresive competitor with aggresive pricing practises, which we will get to shortly.

New Venture & Another optionality

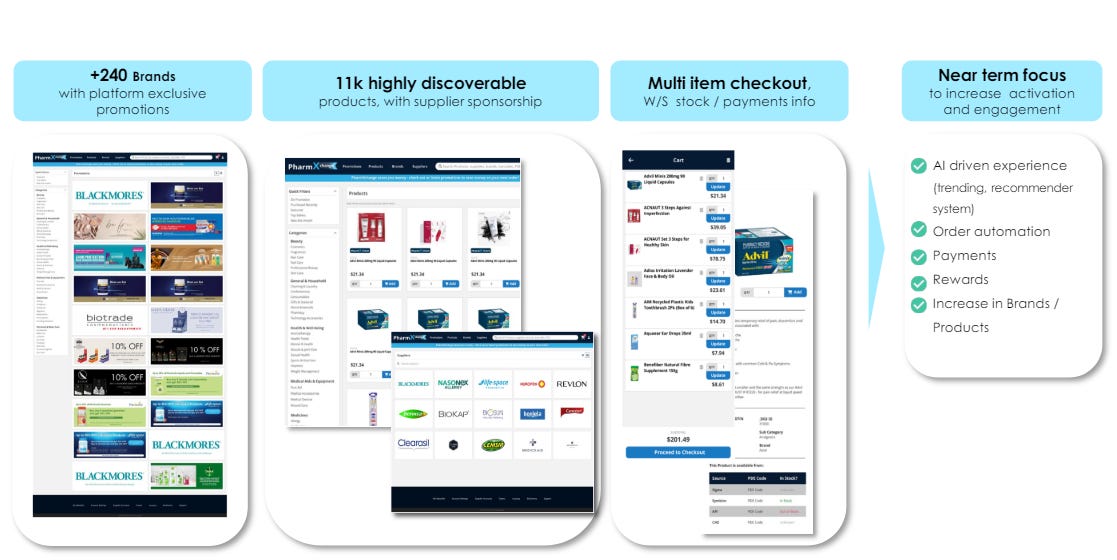

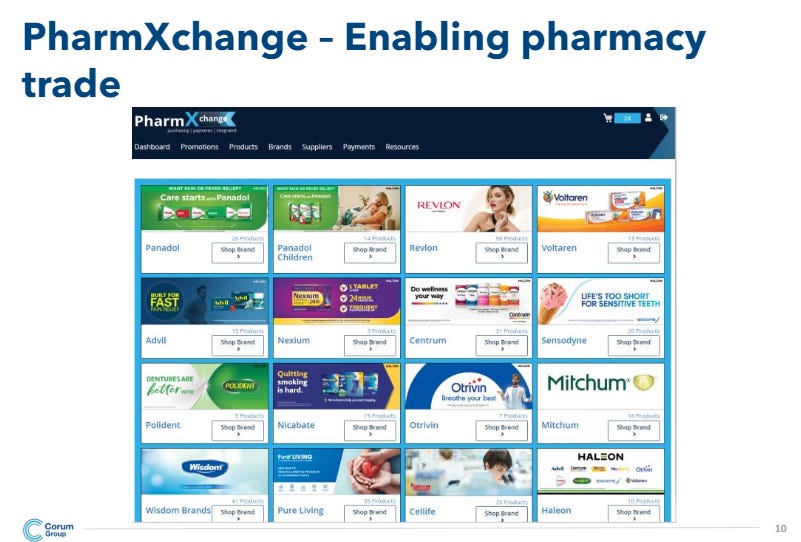

They have been able to grow number of supplier connections to pharmacy from 4.9 to 7.5 in the last three years which helped them to grow revenue a bit. The highest number currently is 21, with possible peak of 25, but they do not expect to reach it with all pharmacies. They expect small increase to average number. And given the high penetration & that management started to recognize that traditional POS vendor business is a commodity, they recently launched new platform PharmXchange and are developing a new marketplace in-house. This is the first innovation for PharmX platform after many years of litigation issues and lack of concentration from previous owner. PharmXchange is a digital sales and marketing platform for suppliers that builds on the functionality of PharmX and improves market access for suppliers and efficiency for pharmacies, also offer integrated payments. Its pilot version was launched in September 2022. As at June 2023, PharmXchange had already close to 60 suppliers signed up, covering 175 brands and over 7,500 products. Today, PharmXchange has over 240 brands on the platform covering nearly 11,000 products. 2,000 of pharmacies have already registered. Many of the leading pharmacy suppliers such as Haleon, Arrotex, Revlon, Blackmores and Reckitt Benckiser joined.

Nick England, the former CEO described it like this: “Key step in our strategy to enable trade between pharmacies and their suppliers through enhanced PharmX services...we are delighted that several key pharmacy industry suppliers have recognised the opportunity that PharmXchange represents.”

Opportunity with PharmXchange

By the words of management, they are gonna try to create Marketplace, which they want to displace all the POS systems with. They want to integrate it into all the pharmacies and eventually canibalize their own EDI, because pharmacies are becoming more retail + marijuana is potentially being legalized. The short term realistic target (management’s words) is to get GMV to $10.000 a month per pharmacy for PharmXchange, which would translate into total GMV of $660m. Current take rate is 5-10%, Which would mean $33-66m of revenue to PharmX. Longterm management thinks they can cannibalize the $18b of volume that goes in EDI, and achieve 50% of it via PharmXchange. I would take this with grain of salt, but if there is only few % of probability it can happen, the expected value is many more times current price discounted back. With getting to larger volumes, take rates should fall down to 2-3% long term but this does not deny this opportunity. If $9b would go through PharmXchange, it would mean $180-270m of revenue for PharmX. But that is still very far away if ever. When we will see the impact in financials? 3-5 years should be the transitory period. This is a key component of making this investment from a good one to a great one. If only can get to $660m of GMV, this has ten bagger potential here.

As I said Revenue is generated from percentage of transaction value, collected via monthly supplier invoice, leaving them exposed to the upside and potential take rate increase. Currently they onboarded more than 2000 pharmacies and 80 suppliers. Quite an achievement since this was founded in 2022. I believe the relationships they have after a decade of work through being vendor of EDI brings fruit. I might be wrong here, but I believe PharmXchange is where current profitability of the whole business is undermined. They invest into S&M, trying to gain traction with this “investment through P&L”. Also the sales team was expanded by 5 new people, which does not help at current P&L numbers, similar to Connexion. This carries some execution risk, which is something to watch closely. These people were hired to help increasing PharmXchange transactions and order volume.

There has also been continued development in the PharmXchange platform since launch, with improved functionality for both suppliers and pharmacies giving a better user experience. The main areas of investment in the current year were to improve automation in supplier onboarding and selfmanagement, the launch of the education and training hub, EduCentre, as well as adding more advanced pricing and promotions functionality. One thing to not forget is that they spend ton of R&D on this venture, but given it is online marketplace the maintenance costs are super low. Distribution is basically w/o any expense as the integration of PharmXchange is super easy as it does not require any additional integration which makes it easier for smaller suppliers for whom it is great and potentially the only way to access the market. For example medical cannabis supplier and distributor of pain killers joined the platform. This is a complete offering of these solutions.

And Bayer, global pharma joined recently too.

All these images should show how was launch of PharmX Change successfully received by major local or global pharmacies and suppliers. It has really become the standard and deepened more its core PharmX among the customers. I have more questions about PharmXchange, but why would all these suppliers sign up when there is a high take rate for PharmX? There must be serious value proposition in it and I think pharmacies becoming more retail is what is driving this. They got the benefits of multiple payment options, intelligent ordering and comparing products, replinishment. I would wish to talk to pharmacies directly but Australia is way out of my options to visit.

Master Data Services

While this was not a core of their operations and still is not, it is an interesting optionality. This should function as a product catalogue to enhance both platforms mentioned above, a centralised industry database with Products, Prices & Participants to unlock advanced EDI features. It should be launched this year.

“We are excited about the potential offered by the PharmXchange platform and are encouraged by its rapid take up by both pharmacies and suppliers. We believe that it provides a good growth runway in itself as well as the potential to enter new market verticals.”

The PharmXchange has been developed by PharmX following the acquisition of the intellectual property rights of a cloud hosted software platform called AlchemX, purchased from a company called Alchemy Healthcare, where Nick England is also a director. The payment for this intangible asset is through a revenue share agreement, whereby the seller receives 10% of all relevant revenue generated by the Group through the platform. Under the purchase agreement, the maximum amount payable to the seller is $1,150,000. The present value of this consideration has been recognised as an intangible asset, with the liability expected to be paid over the coming years as the platform generates revenues for the group. The biggest pharmacies immediately joined this platform as main partners. This is important note. Alchemy healthcare gets 10% of revenue now until reaching $11,500,000. Then there should be nice operating leverage. All sides are well incentivized.

History & Change

Before divestments, the company had originially two segments. Health services and E-Commerce. At Health services they developed and distributed business software for the pharmacy industry with emphasis on point-of-sale and pharmaceutical dispensing software, multi-site retail management, support services and computer hardware. At E-Commerce they operated a payment gateway primarily for the real estate and pharmacy sectors. In 2022 the company sold its Real Estate e-commerce divison for $500k, which is a bit late considering the decision not to invest into it since 2017. With E-Commerce provided its clients a simple and efficient outsourced payment processing platform. E-Commerce was money losing and declining business, milestones were not met and integration was really hard, it was operating in a very competitive & regulated market with government mandating functionality which increased development costs. One thing I observed is that this business “collided” with the PharmX platform, which is driven mainly by the need for managing costs and distribution. E-Commerce was struggling when costs in pharmacy sector increased. This rise impacted the spending and pharmacies were seeking cheaper solutions, so profitability started to decline. Dividends were cut. The only way the company remained profitable for years was due to the ability to cut expenses much faster than revenues decline. They were distributing their own-developed mobile app through RE agents. Terrible. The health business revenues have been impacted by slower than anticipated adoption of the Corum Clear Dispense platform due to feature and integration shortfalls. Impairments were made. Also tried to scale Cyber platform for pharmacies. Corum had not been successfull in a number of tender processes. The industry was oversupplied with 10 vendors and profitability got evaporated. Revenue decline accelerated greatly in 2017 by the decision to leave focus on hardware sales. What is more, their largest customer developed its own software given the pharmaceutical industry in Australia went through consolidation and they could afford it as they got bigger. Bad to worse, with extremely high management turnover the company was a strong sell. They were aware of these issues and Corum was considering at this time merger or selling the company.

“Corum is a major player in the pharmacy software system market. We used to be the largest and we want our market share back!” -2020

The company sold in H1 2023 their Pharmacy software (Corum Health, the second division) for a total consideration of $6.25m. The $4.75m was paid immediately and the rest ($1.5m) is due to be paid in September this year. There are also some earn-out payments that could be paid if revenues targets in year 1 & 2 are achieved. Pharmacy software was sold to Jonas Software, which is part of the Jonas Group which is an operating group of the Constellation Software. Being this managed by Consellation, you get the feeling that they might be able to reach their targets and therefore earn-outs should be in game. The company decided to return the capital from this sale to shareholders (this execution is important in case the litigiation wont be overturned) of $4.5m, with 91% of shareholders approving this and also change its name to PharmX Technologies. This distribution was made after the new CEO Thomas Culver was appointed in November 2023. These sales will have them focused only on much more quality business, being the EDI software vendor to pharmacies and further focus on creating other features.

Since 2022 they focus on expanding their core & good business PharmX to develop new package of products PharmXchange, where they desire to leverage their market leading position to enter new verticals. Basically expanding their cycle, not doing any stupid entrances into new markets they do not anything about. It was implemented in September, so the full year was 2023. Management talks about small contributions to the overal revenue growth.

There was a small change in the industry as well, that should prevent pharmacies against stock piling. The PBS Safety Net early supply rule means that for some PBS medicines a repeat supply of the same medicine within less than a specified interval will fall outside the Safety Net. The Pharmaceutical Benefits Advisory Committee (PBAC) has recommended that a 50-day Safety Net Rule be applied to 60-day prescription items to discourage stockpiling and reduce the quantity of unused medicines in the community. By my understanding this further creates pressure on pharmacy supply chain and PHX should benefit as this pressure pharmacies to be more effective in managing stockpiles.

I would suggest listening to this interview with Nick England, the former CEO about the past (Corum), present (PharmX), and the future (PharmXchange).

“We always do proposals to shareholders and will return the excess money to them.”

Difference between Corum Health and PharmX

I think one gets really consufed about how the previous software business was different/similar to business today. So here is my understanding. Corum Health Services and PharmX Connectivity were both part of Corum Group Limited but served different purposes within the pharmacy software and services ecosystem. Corum Health Services was primarily focused on providing software solutions for pharmacy management (dispensing, inventory, POS), while PharmX Connectivity focused on facilitating EDI to streamline transactions and communication between pharmacies and their suppliers. To better visualize that, Corum Health Services provided tools to manage the internal operations of pharmacies while PharmX provided connectivity solutions that linked pharmacies to external suppliers. Obviously Corum got into problems once pharmacies decided to develop their own software. Will this happen with EDI? Doubt it. It is a standard used by pharmacies and suppliers. Developing their own software would be very risky as it no longer adresses internal operations of pharmacies but the whole supply chain. Also all the suppliers are using the PharmX. It is a completely different expertise and segment. Here are two well describing charts I borrowed.

Testing the Wide Moat

Moat/competitivnes is being always tested. It is always as strong as how much damage did the last competitor to you that tried to gain your business/returns away. And I think PharmX competes here very favorably. Connection of major wholesalers and suppliers create strong network effects, with suppliers having acess to the whole pharmacy market. Fred IT developed its own EDI solution and offered it to pharmacies at a cheaper price, however those were reluctant to switch. Pharmacies should not switch unless forced by suppliers, who pay the bills. How did the Fred IT try to compete with PharmX? Before we get to it, lets understand competitive advantages before.

Also you may ask, whether there is possibility that customers will use more than one EDI software provider. While it is typical in global operating companies, it increases complexity of their processes as working with multiple EDI service providers can quickly make compliance a costly logistical and administrative nightmare. Australian Pharmacy is quite circumsized. A major challenge when using multiple EDI software solutions is the lack of visibility across your supply chain. You are working with a number of different business documents in a number of different formats exchanged using a number of different communications methods. In effect, you’re building inefficiency into your supply chain, therefore I dont think it is very likely. More than 50 countries worldwide have their own distinct regulations for electronic invoicing (e‑Invoicing) – from archiving to digital signatures to value added tax. This is an increasingly dizzying amount of new and changing regulation that every business faces. Also the all suppliers have sophisticated customized integrations with PharmX systems as they all wanted something slightly different over many years. This all creates high switching costs. Fred IT provided in the legal report that they would need at least 34 months to compete successfully with PharmX and that is the optimism of the counterpart. In reality they tried to undercut PharmX with any success.

Looking for sources of moat (which could be partnerships too) others may miss take for example Arrotex, who is the major supplier and user of PharmX, that participated in capital raise, when Corum was raising money for buying remaining stake in PharmX, and is basically a shareholder of the company with the former CEO & billionaire Dennis Bastas being appointed to the board. This is a long-term partnership. I bet they would not switch to Fred IT by no means.

Also using PharmX is usually based on long term contracts that wholesalers get comitted to. In 2022 the Sigma Healthcare, the largest pharmacy network company in Australia, renewed contract with PharmX for 5+3 years with Sigma saying: “PharmX is a vital part of the industry infrastructure and we look forward to working with them as they continue to enhance both the capability and functionality of the platform.”

And then other wholesalers. Symbion is national wholesaler who distributed to 3.850 customers, a signatory to the Australian Government’s Community Service Obligation, they are dedicated to ensuring medicines reach pharmacies and their patients within 24 hours, no matter where they are, using PharmX since 2008. ProPharma is the only national pharmaceutical wholesaler in New Zealand and they are using PharmX since 2007. This just confirms that the entire value chain runs on EDI software from PharmX.

First newspaper article from 2008

“2021: Since the beginning of the new financial year, we have signed agreements with a number of retail pharmacies including, TerryWhite Chemmart, Alive Pharmacy Group, Good Price Pharmacy Group, Capital Chemist and Blooms The Chemist, representing over 600 pharmacies.”

First Mover Advantage & Innovators Dilemma

This is from Dr Williams, who was a Professor of Law and Economics at the Melbourne Business School until 2002. Since that time, Dr Williams has been the leader of the Competition Legal Group of Frontier Economics. Dr. Hird continues with his insights. This is from a legal case which we will get to. PharmX had been challenged by competitor who was shareholder of PharmX before. What chances Fred had and how did it end? Fred could leave the whole thing behind, but they started their own EDI software MedViewX.

Fred has pursued the steps of the Dillemma

Fred has in fact taken steps to establish a rival gateway (whether to show the court or really compete, I dont know, but gateway is key part for dominance in this business), MedViewX, subsequent to its exit from PharmX in 2020, which launch took longer than anticipated. Lets start there. The reasons for the slower rollout of MedViewX to four principal factors which would not have been present in 2013. First, due to the onset of the COVID-19 pandemic, Fred had competing priorities, including the need to fast track an electronic prescription exchange infrastructure so as to enable fully digital prescriptions to be sent via SMS. Secondly, and relatedly, a lack of IT resources since 2020, due to a decline in immigration which deprived Fred of access to IT skills that would have been available back in 2013. Thirdly, Fred is now a larger company encumbered by more processes and procedures, resulting in slower and more expensive software development and fourthly and most significantly, the biggest cause of delay in competing with PharmX is due to delays resulting from the need to conclude an agreement with the Commonwealth Department of Health and Diabetes Australia for MedViewX to have capability to support the NDSS. To start competing they needed at least 2-3 wholesalers to sign.

“Calculations of major Fred devel assumed that MedViewX would obtain 100% of the Fred sites (evidently those pharmacies using Fred POS software). Mr Windhofer’s spreadsheet was prepared on the assumption that PharmX was charging $20 per month. Mr Windhofer’s email concluded: ‘Not looking too compelling a proposition for the wholesalers so far’. Based on the movement of Fred POS user sites to MedViewX, Mr Windhofer’s calculations estimated savings for the major wholesalers of $150,000 per year, which equated to 4.2% of the amount currently spent by them on the PharmX gateway.”

Complexity of getting it to work

Fast forward to today, Fred has no or very minimum of revenues while burning money on costs. Recently Telstra was sold and the new owner is cutting unprofitable divisions —> possibility of cutting the Fred’s chances completely. That would release pricing power for PharmX.

At the end of the moat, there is also reputational side when there is health involved, this makes it harder to switch. The key stakeholders in the pharmaceutical industry supply chain include raw material suppliers, drug manufacturers, regulatory agencies, wholesale distributors, pharmacies and pharmacy benefit managers, healthcare providers, and patients. Each stakeholder plays a crucial role and proper coordination between them is essential. In such a complex process, the stakes are high for pharmaceutical companies. Incorrectly distributed drugs can harm their reputation, customer satisfaction, and potential profits. To be honest I think this company has a real moat that has super low chance it will be disrupted and aggresive pricing practises of the competitor should prove that.

Litigation

Here comes the interesing part. Litigation, but not that you would probably expect. The company has already won it by decision of the court and already has been paid, but the risk of overturn remains and that is where you see the liability on the balance sheet at the line as “unearned revenue”. It is not a real liability unless they would lose after overturning this May and they would need to return it back. So this liability is there for prevention the case gets overturned.

The Battle

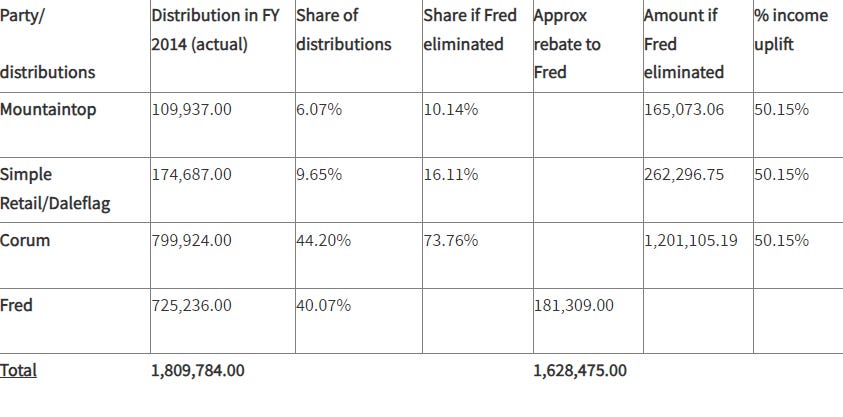

PharmX was initially co-founed by Corum and three other investors (POS Vendors, they were running their own dispensing solutions like Corum did) including Fred IT Group in 2006 in a joint venture (Corum, Fred IT, Simple Retail and Mountaintop System), building it for about a year. First mentioned in H1 2019 report, the company was due to the payment from PharmX. In around 2011, Fred approached Telstra to see whether Telstra wanted to acquire part of Fred’s business. Telstra showed an interest in buying the entirety of the Fred business and as a consequence entered into a confidentiality agreement. In 2013, Telstra revisited its proposal to acquire an interest in Fred, and on 6 August 2013, Telstra and Fred’s shareholders exchanged an executed term sheet where Telstra was to acquire a 50% shareholding in Fred. The court proceedings arose from the failure of PharmX to pay distribution to its certain investors in part from an alleged change in control of Fred IT that occured in 2013. During that time it was not reported to the investors and distributions that should have been made were not. In December 2019, the court find that Fred IT actually went through change in control that had occurred in 2013 but was not reported at that time to the other investors, as required under the investors agreement 15.5(b) clause: “should there be a change in control, it provided an opportunity for other shareholders to acquire that shareholder’s interest at a low value”. The change of control arose as a consequence of the acquisition by Telstra Corporation Ltd (‘Telstra’) of a 50% shareholding in Fred. Corum has only been drawn into the case because of its 30% stake in PharmX, with the dispute centring on Telstra's 50% ownership of FRED IT which was claimed to have impacted the PharmX trust agreement. Fred, backed by Telstra, stated that there was an announcement to the other shareholders of PharmX, however no documentation was disclosed. Then Fred wanted to do JV with Corum for 50:50 ownership but Telstra backed off that they would not want that with Corum, saying it is not the core business for Fred IT. The Court ordered the parties to enter mediation. The mediation was unsuccessful in resolving the issues in dispute as two members of the PharmX Unit Trust using their combined votes to block payments. Corum therefore elected to exercise its rights under the agreement to acquire its share of Fred IT’s investment in PharmX arising because of Fred IT’s change of control. Corum paid $770.000 additionaly for that investment and increased its stake to 43%. The opportunity to invest further came after units held by Fred IT were put up for sale after a preliminary ruling from court proceedings undertaken by Fred against PharmX. During this time the company made capital raise to fund that. During the September 2020 quarter, Corum completed its acquisition of the remaining 57% of PharmX from the other two shareholders who bought stakes of Fred IT, and now owns 100%. These two wanted to exit since 2016 due to failure to properly investigate or disclose details surrounding the Telstra purchase of Fred IT shares and given the mess, the unavailibity to rightfully distribute the profits (Corum was blocking it, because they believed Fred had no right to receive and Fred got into financial constraintss because of it). However then Fred tried the last desperate move to buy the PharmX with three wholesalers/customers of PharmX. Corum did not fall for that stating they would sell if Fred would not retain any % ownership.

The total consideration for this transaction was $7.9m in cash. Fred counterparted the claim that if it would leave the PharmX stake in 2013, it would have made a rival EDI MedViewX solution and competed PharmX profits away by developing it with new features and doing it at 6 months as it would have been much easier in 2013 than in 2005, and also that it is unlikely that others would acquired the interest from Fred because it would not put them in better bargaining position in respect to selling PharmX. However it is extremely probable that Mountaintop and Simple Retail would have taken steps to acquire Fred’s interest had Fred given notice of change of control immediately after 30 September 2013, given they would acquire the Fred interest at just 4x profits.

And to the bargaining of selling stakes would have considered that their capacity to negotiate an exit on favourable terms would have been enhanced by only having to deal with Corum, not Corum and Fred. They both gave that evidence and it is consistent with commercial rationality. The fact that this is exactly what did happen in 2020 after Fred exited, is entirely consistent with that view being a reasonable one and hence likely to have been their state of mind in 2013.

Judgement has ruled that PharmX must distribute dividends from 2017 and 2018, despite two holders in the PharmX Unit Trust using their combined votes to block payments. Judgement handed down in 2023 by the Victorian Supreme Court ordering Fred IT to pay PharmX $5.1m plus interest and costs (an additional $3m). Therefore I think that overturning is unlikely as Fred IT really went through the change of ownership and agreed on paying the sums to Corum, even though. The only way to overturn this would be to persuade judge that they gave notice of the change at the time the change of control went through immediately. However it did not happen until December 2019.

“In April, judgement was handed down in the Victorian Supreme Court proceedings related to Corum Systems Pty Ltd and PharmX Pty Ltd and in May final orders were made. As a result, Fred It Group Pty Ltd was ordered to pay Corum the judgement sum of $5,133,701 plus interest of $1,469,785 (False distributions to Fred after triggering change of control + overpayment claims). Fred IT also agreed to pay $1,525,000 of costs. The judgement is subject to appeal and Fred IT has filed an appeal that is expected to be heard in May 2024.

The final judgement is subject to appeal set to be heard at the end of May 2024. So I do not know if that is the end of litigation timeline, but it tells me a thing. My opportunity cost here is measured by time. I will probably know which way this investment goes in 3 weeks time. If the litigation gets overturned, the worst case that happens is that PharmX will have to pay back the “liability” or to be more precise, the cash they received, back to Fred IT.

If one wants to read the whole document, here it is.

What to in case of not overturning the appeal

In case of not overturning the litigation, I expect further capital returns to shareholders. The company would be left with $12.4 + $1.5m of cash, which they basically dont need in full amount. They will retain some for further new features development, but majority could be paid out. We can play out with probabilities of how much, but I will fire a shot and give it at least 50% of todays market cap of $9.2m. The company would be left with market cap of $9.2m and further cash on hand of $4.8m, meaning EV of $4.6m for more than $6.4m of ARR and $600k run rating Net Income, which seems depressed by ramp-up costs of PharmXchange. Obviously you may say that market always discounts the cash and you might be right in most of the cases. But I think a real confidence gives the recent distribution of most of its profits from the previous sale. And I already discounted that with predicting that they will distribute of 65% of the cash they have if the litigation is not overturned.

Management

Going back to all the possible filings of the company, one can notice that it has a history of board changes. In the 2015, new company got the new CEO and CFO, just to lose the CEO few months later. Corporate governance was poor, trading halts occured. In 2016 the new CEO was appointed and then again in 2017. In 2020, the largest shareholders and board member retired, and pharmacist Nick England became the interim CEO after the board asked him to do that, which he was until recently looking for successor, for a more tech minded guy, and now he is non-executive chairman. Now the CEO is Tom Culver, who has experience from other companies like Goodments Pty Ltd and Oko Platforms Ltd. He was also COO from 2021 to 2023 in Douugh Ltd, autralian listed company, which was quite tragic, down 96% over 5 years. He is the founder of Goodments, “ethical investment app”, one of several new investing platforms targeting young investors. So I can not evaluate his past in positive way, but he was the CEO when the distribution to shareholders here was made. Nick England has done stellar job and he still have high influence, but decisions of Tom are being watched closely by me.

Over the long-term the company seems to have a shareholder friendly behaviour as they added significant shareholders to the board in the past. Lots of former performance rights lapsed and had never been issued with these frequent board changes. Also they have been quite reflexive and focused on the customer needs.

“In particular, the Board recognised at the beginning of 2015 that our loyal pharmacy customers, who enjoy many of the particular features of the Corum software, were not being provided with adequate service levels and the software upgrades were proceeding too slowly. Correcting those deficiencies became the Board’s primary mission.”

The board got refreshed in 2021 or after acquiring the PharmX, so there was just a little time to evaluate their capital allocation decisions, but signs are encouraging. Apart of long-term history of the company distributing profits via dividends, they distributed the profits after making business simpler and divesting non-core assets. Also they know they need to invest more as the PharmX was underinvested. So even though I dont like much frequent board changes and it is certainly a red flag, the situation of the company was poor back then and now it seems to be much more stable.

Mangement team owns 15.3% of the business, which is great to see in such a small company, but nothing extraordinary compared to other australian nano-caps, where I find lots of large ownerships even in poor businesses. It tells us nothing, as high ownerships can make us to be biased towards investing. Recently Nick England acquired more shares for a total of $127k or about 0.7% of the business. It was over 1% at a price he acquired those at - 0.016$. They certainly benefit the cash distribution they made. Their total Compensation was $1.35m in 2023. Ownership is only 2x higher than this, which is a bit low. I like to see more economic interest compared to the compensation. Also this remuneration is quite high compared to the revenue base, but operating leverage should do its work if they can succeed in scaling the business. Here is not disclosed current CEO who joined late 2023. During the last 10 years there werent any sales of shares by directors and most of their direct buys happened at much higher price, than the company currently trades at.

During July 2023, the Group signed a new office rental lease for the Sydney office. This is for a reduced space and at a lower cost than the current office lease which ends in August 2023. It is really good sign to see management being focused on cost base even if it means they will have smaller office. Management should treat every dollar like a gold, and this definitely gives me a bit of confidence. You can see that they have lots of directors, odd for such a small company. They dont expect to grow the number (actually want to trim a bit), they want to grow only sales people.

Financials

I would wish to make a spread-sheet of potential earnings power, but it is just not possible. One-off items like litigation costs undermined the profitability of the recent years with most in legal costs as well as declining revenues of Corum health and disappointing losses of E-Commerce. On top of that they invested lots of into R&D (they capitalize unfortunately compared to Connexion), which increased the amortisation and w/o any significant economic benefits yet to be shown in financials, it further decreased the accounting profits with further amortisating of acquired intangibles and accelerated amortisation of older products which are being replaced by newer ones. PharmX grew 14% YoY from 2022 to 2023. Even though it is definitely tough to grow the legcay PharmX, which has access to 99% of the pharmacies, I think current valuation if the litigation is not overturned makes no sense. You are looking at 0.60x EV/ARR for FY24, where revenues have grown 14% from FY22 to FY23 and recently grew 5% HoH. Anything over 10% is absolutely stellar, however I dont think there is any growth needed at these prices to make this investment work. It is just a further optionality from here. And this growth has been achieved by adding just one new supplier to the main platform, with rest coming from new feature PharmXchange. Unfortunately the company does not provide numbers for PharmXchange yet. What we know? Half of the R&D for the year 2023 was devoted to continuing operations - That means $2.1m. I think this almost whole goes to PharmX Change and Data Services. Lets assume 80%, which is $1.7m. Anyway, these developments are usually being amortized over 3 year period, which should lead to $700k amortization per year. But only $400k goes to legacy PharmX, therefore amortization/real expense is about $133k per year for this core business through P&L. This is the H1 2024 numbers. For core EDI it is probably even less.

Currently, investments eat up the whole EBITDA of over $2m, but adjusted numbers would leave the core PharmX Connectivity business with $845k of EBIT this half year, or close to $1.7m annually, even w/o considering new 5 sales people devoted to grow PharmX Change which increase SG&A. I get to similar numbers by using EBITDA and deducting estimated maintenance R&D of $400-500k. I bet that 12x EBIT for leading & sticky software, with inflation adjusting closules, is not much = about 15x P/E, or value close to $20.5m to additional $14.5m in cash, leaves just this at a $35m valuation, and that might be very conservative. One can play with numbers here. But one needs to not forget the strategic value of having market-leading software and synergies the acquiring company would get by eliminating public fees and salaries/overheads. This is super small and sub-scale company, so these expenses eat up lots of the ARR. Also when Corum bought the PharmX in 2020, they had 45% EBIT margins. There should be space to incrase them again. Anyway, I dont see many reasons for this company being public and it may end up eventually be sold. This is my estimate of potential savings before even considering eliminating number of non-executives.

Have a look at profits from PharmX from the past, which can be found in the legal document. Currently it is impossible to get all the financials into Excel since 2021 was the first full year of the company inside Corum. But this is its distributable profits since 2011 till 2016. Of course there are now more overhead costs and etc., but PharmX is growing long term and I dont see any reason they are not making at least $2m of profits in its core business today even though they did $3m and had over 60% Net Margins in years prior being a small public company, which can be found in the legal report. Reduction is what Fred IT believes they could gain off them if making their rival EDI.

Given the stickinnes of the software, but the lack of growth opportunities/maturity (number of pharmacies does not grow, or super low growth, because it is controlled) of the core PharmX, I think the right acquisition multiple for software comany is 3-5x ARR (similar but larger company transactions were close to 6x ARR), which would translate into 19.5-27.5m of equity value (Corum acquired the remaining 57% for $7.9m, but very underinvested and has grown since then, Assets acquired were over $18m). Net Cash position is (potentially) $14m, so that would translate into equity value of 33.5-41.5m vs 18m today. There are some large EDI providers with much broader operations in the world, not many direct public peers, specializing on Pharmacy directly, as the industy is very consolidated globally. But economics are similar. I think PharmX Connectivity has close to 100% upside while minimum downside risk with huge cash buffer and good further upside optionality with PharmXchange and potential new ventures into veterinary or healthcare food gateways. The point is that the business has ton of operating leverage and could grow without any incremental costs. At worse, they will grow with inflation + adding new connections, but given the successfull launch of PharmXchange, they have real possibility to grow much faster than that and we pay nothing for that optionality.

Also we know that PharmX was evaluated by 3rd party in 2012 and its value for about $10m. Add the growth and the same EBITDA numbers in 2024 and you get much bigger business and much higher valuations.

In mid-2015, there were discussions between the PharmX directors about potentially selling PharmX. Deloitte once again was retained to undertake an analysis, referring to the project as Project Accord 2. Deloitte assessed PharmX’s indicative enterprise value in the range of $12.5 million to 14.5 million, based on an implied multiple of 6.1-7.1x PharmX’s budgeted EBITDA for the 2016 financial year.

Risks

Last year they invested $2.1m into the new software development + maintenance. I may assume wrongly that most of it comes to PharmX Change. Also this platform may not bear fruit and could be subject to impairments and investors could see them being unable to grow from its core business. Also one needs to not forget that in the past they burnt lots of money to grow the other segments they had and experienced impairments. Also they may venture with these new featuers into teritory led by other players. I dont have broad understanding of it at this point. In the past they tried to develop new features for pharmacies (different software) and most of the time it failed to bear any fruit due to regulatory scrutiny and pharmacies being reluctant.

This is not fast growing business currently. This means that if my thesis around pay-out fails, I can’t expect much of the multiple expansion. I have not done well with other low growth investments so one needs to really ask their opportunity cost if the growth won’t materialize. However, I see the asset value on the balance sheet which is a core of the thesis and will be the main force of value creation.

The company can use the cash (main asset) for a stupid acquisition. Current CEO, Tom Culver has not especially great track record. But given the Nick England esentially still has the impact to control things, I bet it is highly unlikely. He was on a look-out for acquisitions few years back but prices were high. Now they are low, but obstacle to fund them is much bigger. Nick is aware of the risk with acquisitions and preffers to invest mainly organically or return the cash back.

While this is not one of the higher growth companies I typically like, I think odds are pretty good, that this is a short-term opportunity that could lead to long-term investment. It has wide moat for such a small company and If the already won-litigation will proof to not be overturned, I have a critical software company with history of capital returns for almost negative EV, while still have growth optionality on. Simply put, I think currently market is valuing this company on an outcome that has not happened yet and I think it is unlikely it will happen. For that reason I decided to take at $0.03 10% position in my portfolio. I think it is cheap little software company others may want to look into. What I learnt now may cause my position will get much bigger in the future, or how it is many times, it may be destined to be sold.

Additionals & Some links

How will the AI impact the EDI

PharmX attended Australian Pharmacy Conference, Fred IT did not

Value Added Networks and history of EDI industry

The presentation is not an investment recommendation. It is for educational purposes only.

Thank you for your criticism, feedback or discussion,

Jacob

This post is free for everyone, but if you value my work and would like to support me, you can do it here:

Great write up Jakub

Long write-up, I need to read it thoroughly first because I understand the space very well. Funny enough I work for a competitor in this space and in this geographic location ( I m in Singapore though but we do Business in ANZ). So I will ask around to get some insights about PharmX.