Advent-Awi Holdings - Is this Net-Net paying special dividends worth it?

Hi,

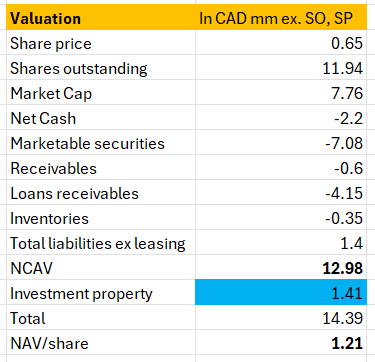

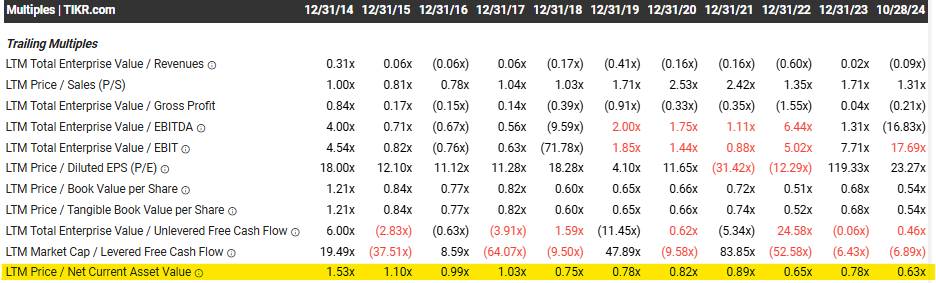

And welcome to my new article. This article was inspired by recent article of one of the greatest investors I know, Dirtcheapstocks. He provided great insights into what net-nets look like, that they are not all the same and we need to be very picky which net-nets are we buying as there are few categories of them. I know many net-nets in biotech sector that I am personally staying away from, because they usually have no revenue base and they are just burning money each quarter. Time is the enemy in those cases. Then, there are net-nets with significant contingent liability, that you cant see on the balance sheet but in theory should be paid before the company liquidates. I wrote about that one in the past. The next problem is that many companies have their NCAV consisting mainly of inventories or receivables like for example another canadian company - Findev Inc. That company is cheap, but their NCAV consists of only receivables because they provide real estate financing secured by investment properties and real estate developments, so basically are kind of a bank. There are significant risks tied to that. I like net-nets which I can buy under the net cash (cash + marketable securities), which is the case for Advent-Awi Holdings. It is just a cigar butt idea. It does not have all the qualities Dirt talked about.

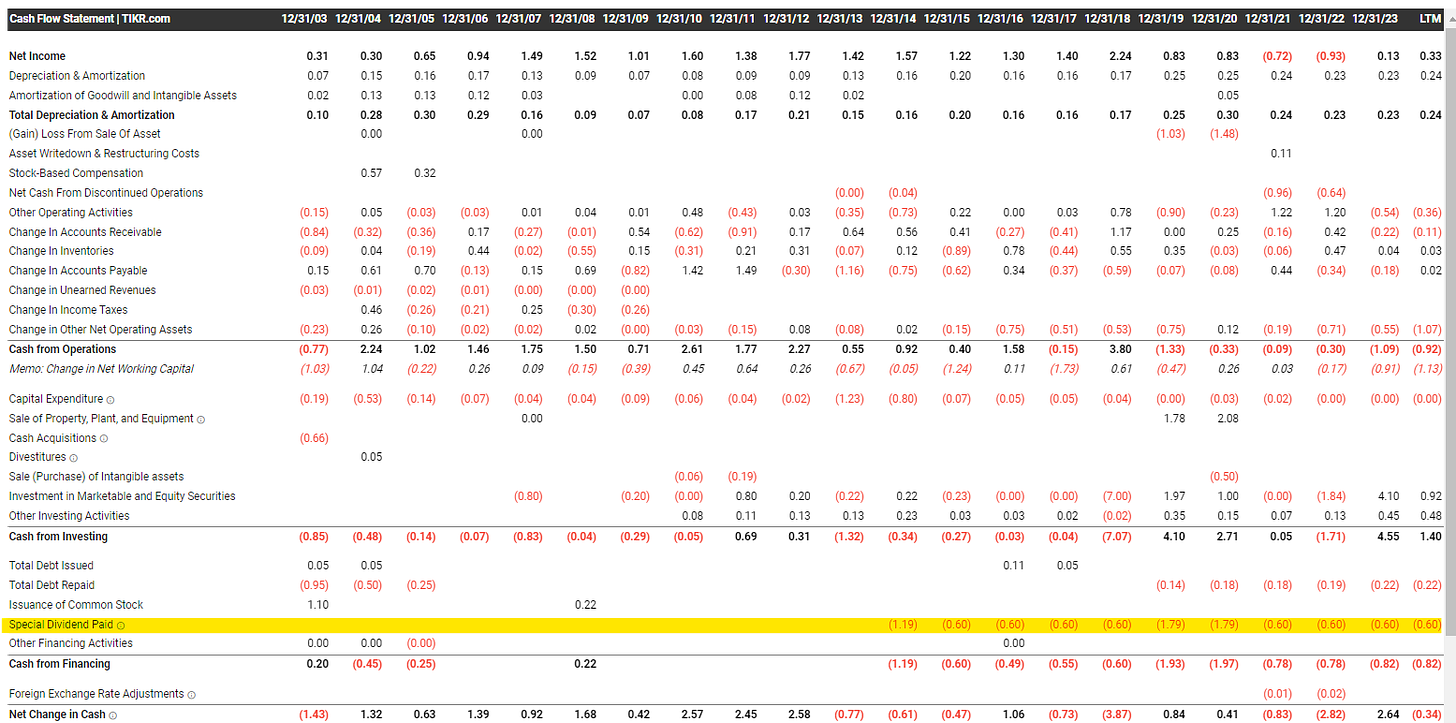

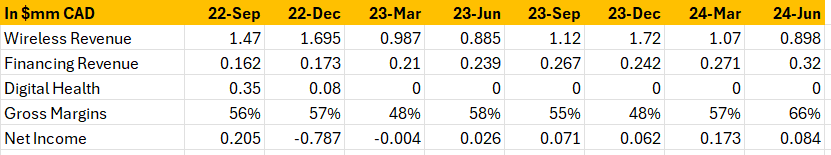

Advent-Awi has performed badly as a stock. But during the last 20 years, they reported only 4 years of losses. Their business is far from great, as it is involved in the sale of cellular and wireless products, services, and accessories in Canada through 4 stores (2 Rogers & 2 Fido). The company is in the slow un-official liquidation process. They have been around since 1984. Back in 2013, Rogers forced the company to phase out 5 stores by mid-2014. In 2017 they had 15 stores in Ontario (10 Rogers and 5 Fido), but they received notification from Rogers, that it wont be renewing its dealer agreenment which was set to expire in 2018 and the company sold its 11 stores in Ontario and paid the proceeds to shareholders through dividends. Today they have 2 segments. Wireless which is 74% of revenue and microfinancing which is 26% of revenue. In wireless, they offer products associated with Rogers Communications’s plans & services like wireless voice and data plans, high-speed internet, digital cable television, home phone services, Rogers Bank Mastercard products. These services are provided through an independent network of stores located in Ontario, Canada. They earn wireless revenue from sale of cellular phones, and from commission earned on sale of cellular plans and related products. They have only one big customer in this segment - Rogers Communications, which is 98% of the wireless revenue. The agreement with this customer expires on June 30, 2028. They focus mostly on asian ethnicites. Advent-Awi has no mentions on twitter except myself from the last few years. Over the last 9 years, they are consistently paying dividends and occasionaly special dividends too. There was not any dilution since 2009.

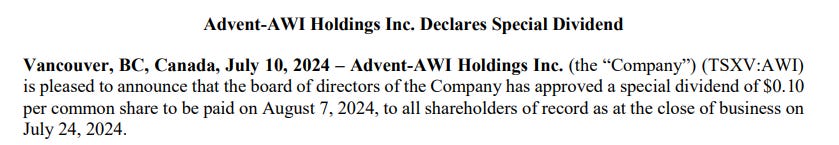

As of recently, the company paid special dividend of $0.10 per share which is 15% of the current share price.

In late 2015, the Company received approval from the TSXV (Toronto Stock Exchange Venture) to start a financial service subsidiary that would operate a consumer lending business in the Greater Vancouver Area of British Columbia. This new subsidiary, Adwell, was incorporated on January 8, 2016 and commenced operations in Q1 2016. Adwell issued 1,000,000 shares at $0.0001 per share. The Company subscribed to 70% of the shares issued, with the remaining 30% owned by two minority shareholders, Q&Y Holdings Inc. (15%) and Adwealth Capital Holdings Inc. (15%). The two minority shareholders, both with financial and lending experience, assisted in the start-up and assist in the continuing operations of the venture.

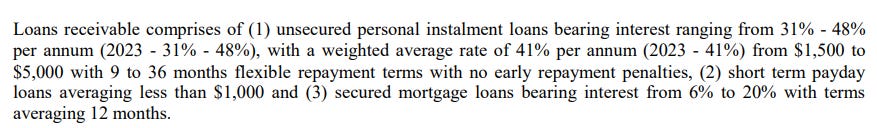

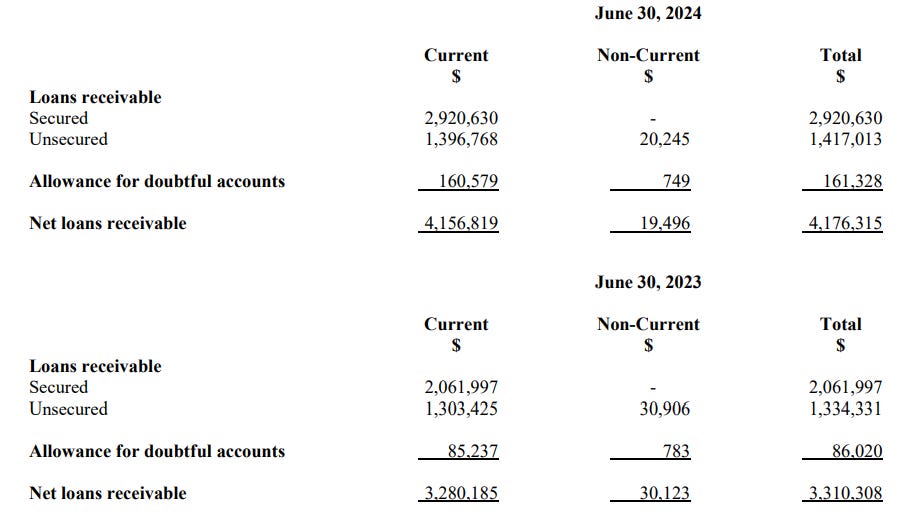

I do not like that they started the financing business. That is something I talked about. I pass on the financing business even at net-net status as these are usually unsecured loans with extremely high interest rates for a short periods. One shake in economy and this is starting to fall apart. So far, the company has not experienced meaningful charge-offs and still is net-net not considering the full status of these receivables, but it is personally very conflicting. The allowance has grown from 2.6% to 3.8%. The revenues from this segment are growing, but every financing company can grow fast by poor underwriting. That is how problems are being created.

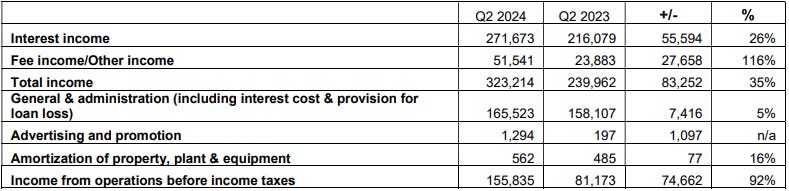

When starting it up, the Company has committed to investing up to $4,375,000 in Adwell (they call it venture), of which $375,000 is for ongoing operations and the remaining $4,000,000, in the form of a line of credit, is for advances to customers. At the time of last quarter the Company had invested $3,850,000 in Adwell, of which $350,000 was funding for the ongoing operations of Adwell, while $3,500,000 was funding for Adwell’s advances to customers. This gives me hope, that their “investment” into this business somewhat peaked and they wont grow it any further from here, but I am not 100% sure. Somewhat pleasing is that they are rather growing their secured loans instead of unsecured. The secured loans are secured by a real property. This product particularly targets homeowners who have a stable working income and need shorter term financing. These loans generate higher fee income because of their larger amounts. Then they have pay-day loans - this is a loan product offered for customers who have a regular income but cannot find guarantor to qualify for Adwell’s lower interest personal instalment loan. Pay-day loans are smaller in amount, but generate higher fees, and have become more and more popular in the BC market. Many customers of this segment work in industries most affected by the economic slowdown, including restaurants, retail shops, hotels and homes for seniors so good underwriting is a key, but it is cyclical anyway. They are talking about conservative approach. Fee income is very sensitive to new loan applications.

“Credit quality of the customer is assessed based on a number of proprietary credit models, and individual credit limits are defined in accordance with this assessment and other factors including the ability of the customer to comfortably afford the periodic loan payments. The linear approval flows lensure a high-quality loan application process. After evaluating the client's information, Adwell makes a decision on the loan terms for each applicant, these include the maximum loan principal that the applicant may borrow.”

They also started a new subsidiary in 2020 in Hong Kong Advent TeleMedicare, but they divested it 2 years later after printing some losses. This had significant impact on P&L during those two years.

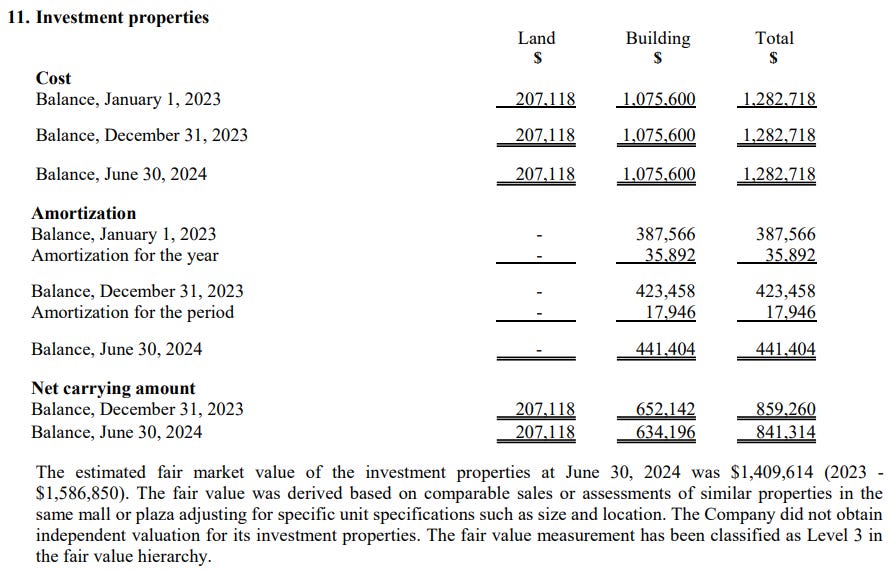

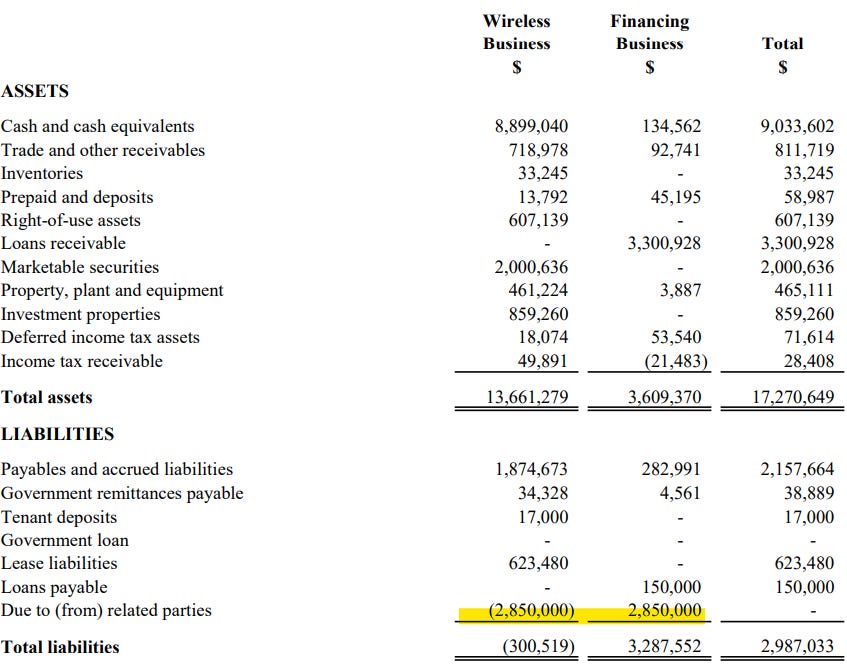

Investment properties

The company has two properties in its investment portfolio with which they generate rental income, one each in Ontario and British Columbia. Investment properties include land and buildings held to earn rental income and are recorded at cost, which does not account for any inflation. The Ontario property (Horizon Centre) has been leased since 2009. This commercial condominium unit was originally intended for use as a store for the Company’s wireless business, but later determined that the location was not suitable for selling wireless products at that time. The B.C. property (Aberdeen Square) was also originally intended for the Company’s B.C. wireless business, but since that business was sold it was converted into an investment property. This property has two units, both leased with expiry dates of December 15, 2025 and December 31, 2026. Beginning in Q2, 2023, the Company also sub-leased out part of its warehouse space at its head office, to a third party to generate additional rental income. Total rent received was $31,742 in Q2 2024. It is in intention to sell these properties, so special dividends might be continuing for some time.

Management

There is very little information on the internet about the company, but Insiders own 49% of the business. Alice Man Yee Chiu is the CEO since 2014. The company has 3 managers all of them coming from Hong Kong. Alice owns 27%. The company has stock option plan since 2011 but no shares were ever issued. I do not like that they pay themselves almost 20% of revenue. Their salaries in 2023 were $813k, which seems very excessesive. They could be consistently profitable if it was not of this. This is a yellow flag, but at least they are returning cash. On the other hand their MD&As are very insightful with lots of rhetoric questions about the current state of the wireless and financing idustry.

Financials

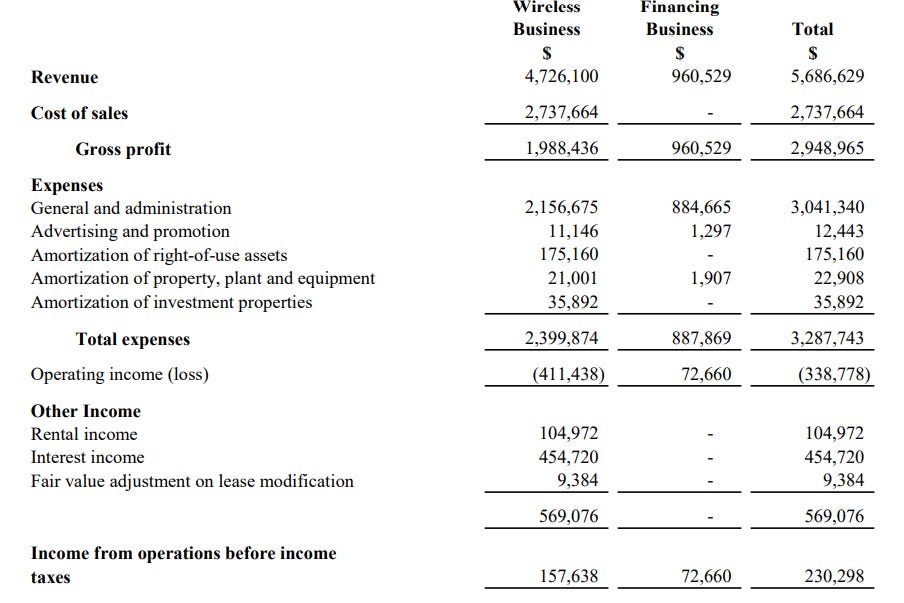

Their inventories consist mostly of finished products - Cellular phones, which they should be able to liquidate at cost, or slight discount. The receivables are mostly from their largest customer - Rogers Communications, which makes 100% of receivables very probable to be collected. At June 30, 2024, 23% of trade receivables were outstanding for between 30 and 90 days and the remaining 77% were outstanding less than 30 days, with no major credit deliquences. They put $7m into marketable securities which are guaranteed and mature between July 22, 2024 and February 24, 2025, earning interest between 5.20% to 5.80% per annum. As Dirt said, “no capital allocation is good capital allocation for such a company”. Revenues from wireless are quite stable during the last few years after not extending the agreenment (2018). Revenues from financing are growing slowly each year.

They have some loans payable which they state that are non-interest bearing loans due to minority shareholders of Adwell Financial Services Inc. These loans do not need to be repaid as long as a shareholder retains their interest. They are giving money to Financing business from the wirelesss one, which is reported as a liability but it is not a real liability.

In 2023, Am-Call’s phone hardware sales increased by 8%, as the number of phones sold stayed the same from 2,243 in 2022 to 2,244 in 2023, but price has increased. The increase in hardware revenue is caused by the increase in the price of smartphones which is getting higher and higher now. Consequently, a change in the number of phones sold would have a higher impact on the Company’s revenue. On the Fido side, the high percentage of BYOD (Bring Your Own Device) activations does not generate additional revenue. Although this does not necessarily mean less profitability, it does depress hardware sales and hence overall wireless revenue.

Some commentary on the business/industry by the company

“In the past few years, the Company has been increasingly focusing on nonwireless products such as Rogers TV/internet and Rogers Bank (Mastercard) in order to mitigate the impact of the decrease in wireless transaction volume. This 8 product is usually sold in stores as an add-on product when customers perform their wireless transactions. It is a highly competitive product and sign-up incentives are crucial in attracting new customers. This strategy proved to be successful in 2023 as both cable/internet revenue and Rogers Bank (Mastercard) revenue increased by 58% and 1,292% respectively. This revenue source successfully reduced the negative impact on the Company’s overall 2023 result. Going forward, Rogers Bank (Mastercard) will remain the focus of Rogers and thus the Company. Internet and TV will also stay center stage as staying connected via internet and TV-entertainment have proved to be very important revenue streams. With the phasing out of legacy TV and the introduction of Internet TV and concepts such as Rogers’ Ignite TV, which offers seamless integration with apps such as Netflix and YouTube, sales of this sector is expected to remain strong in the foreseeable future. On the new technology front, the arrival of 5G will change the telecommunication landscape of Canada. 5G networks offer faster download, lower latency and better connectivity/performance on more devices including smart cars, home appliances and remote medical devices as part of what is now called the internet of things (IoT). Major Canadian carriers are all developing their own 5G networks.”

Subscriber base attached to the four locations (two Rogers and two Fido) of the Company wireless business and is constantly decreasing, because of the phone prices. The Company’s subscriber base is mostly consumer customers who are more price-sensitive and are therefore more likely to churn. The company needs to stop this bleeding because the Company receives residual income on each subscriber every month = steady source of income. The Company’s Wireless business has been doing less brand advertising on its own as carriers are now more inclined to centralize branding within their own marketing departments. In addition to receiving co-op subsidy from Rogers on advertising and promotion activities, the Company may also receive marketing funds support from Rogers throughout the year, thus further reducing its overall advertising and promotion costs. However, the availability of these funds depends on Rogers’ budget availability and promotion timing, and therefore are not repeatable nor guaranteed.

On the wireless side of the business, the general trend in annual retail sales in Canada is that Q1 is normally the lowest, sales then gradually increase in Q2 and Q3, and finally peak in Q4. They experienced growth in Q1 but Q2 was impacted by high interest rates and general consumer spending in Canada, or at least they say it. Financing revenue has steadily increased in the last four quarters beginning in the second half of last year, as Adwell cautiously increased its advances to customers. In response to the potential increase in credit risk posed by the rising economic environment, Adwell continues to monitor the quality of its loan portfolio closely.

I think, the agreenment with Rogers will expire (and wont be renewed) in 2028 and they will be left with micro-financing business, which will they potentially sell if they cant grow it from this subscale business. They still have good ownership and could make them lots of money by liquidating. Till then, the company will probably continuing to pay 8% dividend and occasionaly special dividends too.

Risks

Sensitive on Rogers

The company is very sensitive to economy development through their largest customer Rogers (financing also). Rise in interest rates really impacted the business. That + intense competition Rogers face can impact the results of Awi. Rogers compete with other wireless network carriers do not have exclusivity to new phone models and all major carriers now have the same products in their lineup. The Canadian telecommunications market is highly competitive, with carriers fighting hard to retain customers and to attract customers from competitors, especially towards the end of each quarter. But they also benefit the increase in advertising by Rogers. It is all trade-off. This + increase in hardware prices can make customers hold their devices much longer w/o upgrading. Launch of new phones used to be a highly anticipated event among phone followers, and for retaining early adopters, who are usually the most loyal customers, is key. The Canadian government also mandated that Canadian carriers sell hardware unlocked and also to unlock customers’ phones upon request; both of these mandates further encourage customers to shop around when their existing contracts expire, instead of automatically rolling over their contracts and upgrading to new hardware with their existing carrier. This is welcome news for consumers as Canadian carriers need now to be more aggressive in their pricing in order to retain existing customers and attract new ones. This was evident in Canadian Carriers new plans as they now include much bigger data allowances. Combining the results of both Rogers and Fido brands, total new voice and data activations were down by 13% and 16% respectively, while customer upgrades went down by 3%. This all impact Awi. In order to entice customers into new phones, devices are now mostly financed by the carrier over 24 months at no interest. This will help generate more hardware revenue.

Capital allocation (doing something similarly stupid as in 2020 with Hong Kong division) and mismanaging the growth of financing business.

Investment property has not been evaluated by third party, but it relies on their assesments of similar transactions at that place.

Review

There is not much to say about it. I do not like the business and it is likely the business wont be around in 5-10 years. It is just cheap net-net that pays dividends and occasionaly special dividends, but it seems like it always has been. At this price it trades at its lowest end of NCAV in last 10 years, but it could be even lower after selling the investment property (at about 0.54x NCAV). Selling the investment properties could make people a bit more excited again given the deep net-net status and potential dividends that could be paid.

Anyway. It is idea I wanted to share to get better insight into net-net investing style. I know a few net-nets and just picked this one to monitorate how will it end up. This is not an “investment” for me, but solely a cheap trade, which I would get rid-off if I get 50% return. I allocated very tiny and not meaningful % of the portfolio to it. Is it worth it to spend the time with company like this one? Time will tell. But if it does not work I know the time is better to use elsewhere. I am aware that net-nets work better in a basket if not truly special and I do not think this is the case here, so please careful. Therefore I will share few more in the future write-ups as my global net-net list is growing and growing. I am at situation now where I am following closely 150 canadian companies and will share all I can find. Those might be more thoroughful investment ideas based on business quality straight away or just watchlist ideas that I wanted to do more work on anyway. If I would do it for myself, why not also sharing even if 99% people wont like it? You will also see whether something like this works or not. Let our pattern recognition rise. Next write-up soon. Cheers.

The presentation is not an investment recommendation. It is for educational purposes only.

Thank you for your criticism, feedback or discussion,

Jacob

This post is free for everyone, but if you value my work and would like to support me, you can do it here: