Sweden A-Z - 5 Companies to follow #1

Hi all,

As I highlighted in my previous write-up I want to give you 5 stocks each month that you can follow along with me. These will be all the time from different countries/markets as I am globally focused and going through hundreds of stocks all the time. This time it is Sweden, where I follow about 210 companies on quartarely basis and went A-Z three times. My goal is to follow unknown companies alongisde of you so we can spot changes sooner and exchange knowledge. To those who will be truly interested in any of these companies, I can try to setup a call with management and ask your questions or you can join too.

Today I am highlighting 5 interesting swedish companies and one deeper dive complemented with management conversation and my notes.

KebNi AB (KEBNI)

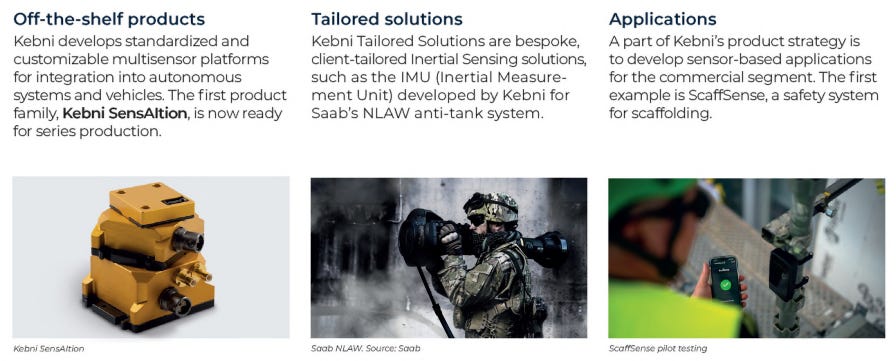

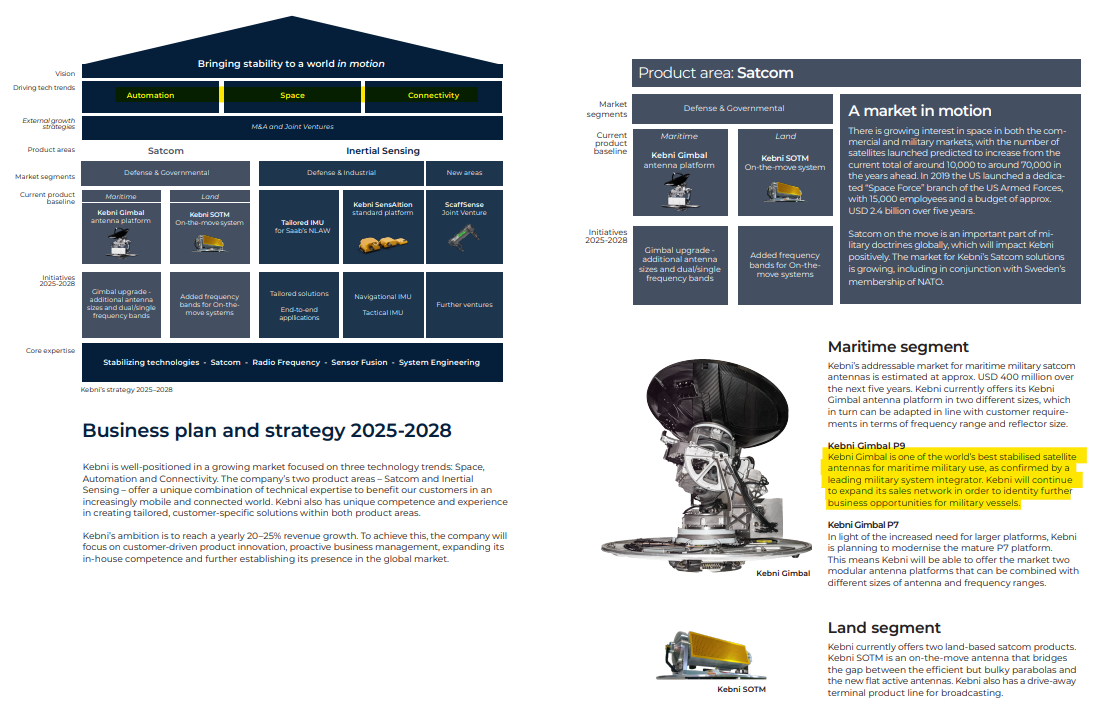

Kebni is interesting 415m SEK ($40m) company with net cash of $1.6m. The company is quite young as it was incorporated in 2013 and 2024 was its first profitable year. Kebni AB is a technology company focused on providing high-performance inertial measurement units and sensor solutions for demanding applications across various industries requiring precise motion sensing, control, stabilization, and navigation. They have a new CEO since 2021. Back then, they had only one marketable product and single sales person. Today they have numerous products that are generating revenue or are on track to do so. They have two segments and in both of them are authorized and proven partner for military solutions: Inertial Sensing and Satcom. Inertial Sensing is a motion sensing technology which is found in places from smartphones to nuclear submarines. They are mostly custom designer for critical applications in defence and industrial sectors. They have only 25 employees and 3 development and production sites in Sweden.

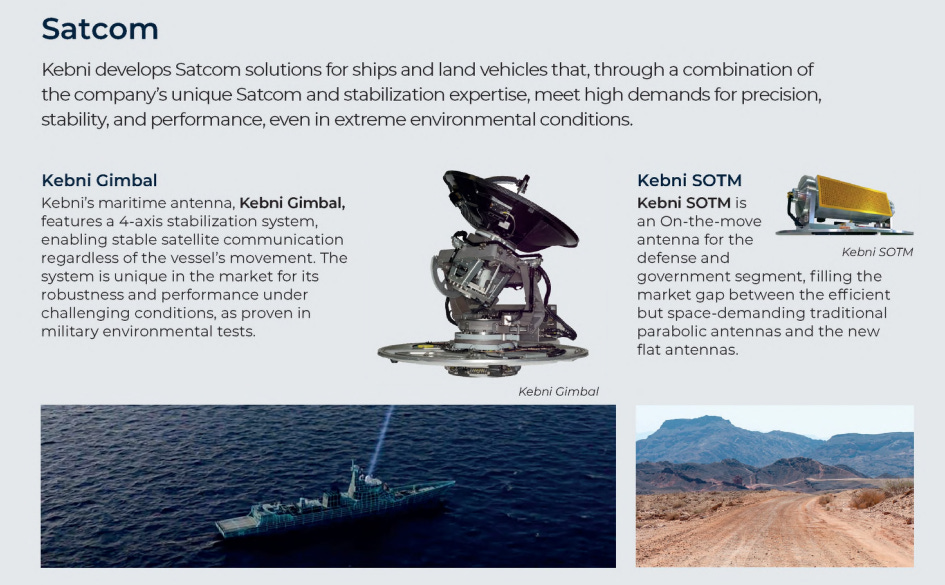

Then they have Satcom segment. I think these are quite entrenched programs with few players. But the company does not disclose economics of these two segment which is a bit shame. These solutions are for battle-like harsh environments. Satcom Antennas (VSAT terminals) are used for mission critical satellite communications crucial for defence, intelligence, humanitarian aid and emergency response missions.

They recently announced partnership with Indian company Varisis which is specialized in military-grade advanced hardware and software.

Client use cases include guided missile systems, underground navigation, predictive maintenance analysis and stabilized maritime Satcom platforms.

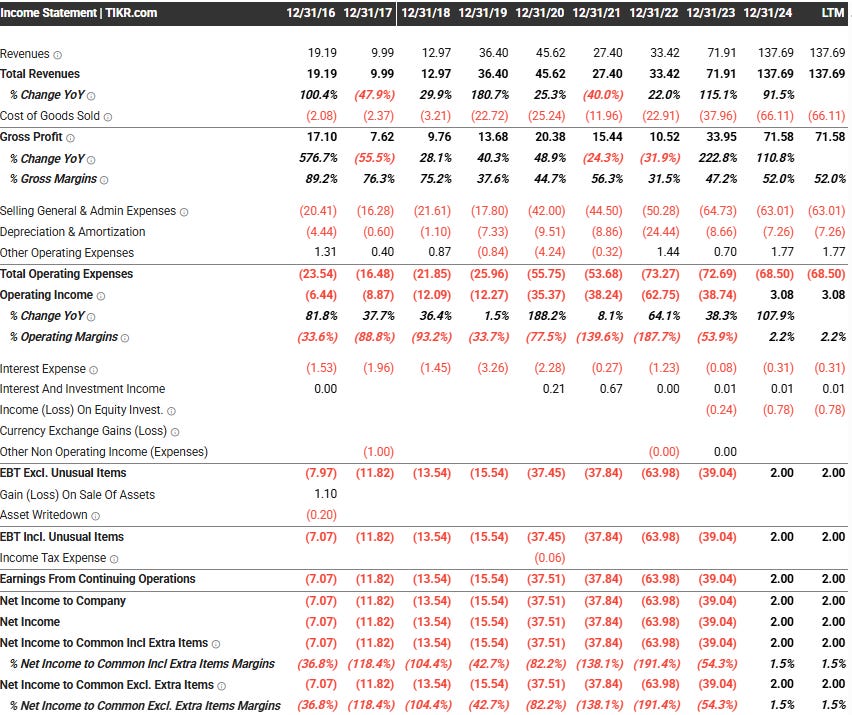

These are their long term financials in SEK.

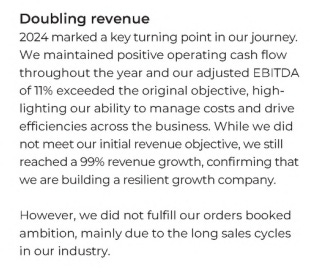

As can be seen, the company is organically growing rapidly its topline, while profits still have some path to catch up. The company is not losing money anymore, which is the first step for sustainable future. Recently they announced also scaling down of their subsidiary, which will results in 8m SEK of cost savings per year.

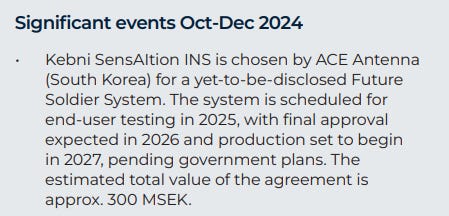

Just that would bring the valuation down to P/E of 40x, which is not extremely cheap and still relies a lot on margin expansion. However, they also announced a new deal, which will almost triple their revenues. Still there is some uncertainty as it is scheduled just for testing for this year with potential approval in 2026. And the management is very positive about it.

Cash flow for the period was 7.5m SEK, which is quite good but it benefitted a lot from collecting more receivables, so I do not think it is sustainable. The company did not dilute for the last 3 quarters straight, which is something that has not happened for a long time. I expect no further dilution given the company can finally finance itself.

If the company can sustainably grow margins with scale and reach 10-15% EBIT margins, then this could become cheap in the next few years. If further wins are announced, then this could be very cheap.

They have some interesting partnerships to start with. Syntronic is a big company with 1-5 thousands of employees. They are engineering design house specializing in the design and development of electronics, electro-mechanics, embedded and IT software. Then they have collaboration also with Saab, which is particularly interesting, because current CEO has background in defence industry, especially in Saab Dynamics where he was head of sales and marketing and a head of the ground combat business unit. Unfortunately his ownership is only few hundred thousand of shares, which is about 0.2%. In total management has ownership something about 2.5% of shares.

Further their products are currently being evaluated for a wide range of defense applications, including aerial drones, underwater and surface drones, and land vehicles. As we know, there is going to be significant demand in Europe for defence applications. It will be interesting to see if they can catch it a bit.

The risks are availibility of raw materials and lead times. As I highlighted, that potential new 300m SEK will start in 2027 and it could almost 3x the current revenues. If there are further delays, it could undermine the financials models others are preparing as . I will be following further development on 29th April, when they should release Q1 report. Their long-term ambition is to grow 20-25% growth per year.

Kebni’s addressable market for maritime military satcom antennas is estimated at approx. USD 400 million over the next five years. They have $12m sales LTM, so there is significant opportunity, but I will need time to understand whether they can compete there with established players.

Now to the others.