Hi,

And welcome to my new write-up. This time it is about one lesser known growth story that I have been able to find. For once, this does not come from my A-Z. What a shame. I have found this idea on twitter. But I wish I would knew this one earlier and I definitely would if I were to do A-Z France earlier. Lesson learned... I do not like many of EU businesses. You see lots of people mentioning FCF multiples of 10-13x for so called “high quality businesses”. These tend to have poor capital allocation & are really matured. Typical EU management team is very slow and likes to use “weak demand” in their presentation. Simply said, I am not interested in 99% of EU businesses, because those are all the similar stories. I want to see growth. Growth will take you from this spirale if it is profitable and lasts long enough. I always say: In ex-US markets cheap stocks are expensive, stocks with growth are interesting in general, cyclicals behave the similar way as in the US. Another reason I like to fish in Europe is that there is significantly less of venture capital and therefore companies still going public apart from the US, where companies stay private for long time and became big enteprises with alternative ways of raising capital. EU markets are also less competitive in terms of number of people looking for interesting stuff. Momentum is also lower, but that cuts both ways. Even though you see high multiples here too, it is usually nothing compared to the US. This company which I would like to present is not only potential investment idea for you, it is a case study of business transformation.

Quick overview of the thesis:

It is a recent IPO

It capitalizes on battery storage systems industry growth

New segment is growing rapidly and it is high margin, rapidly becoming majority of sales for the company. (0.1m EUR in 2022, 5.4m EUR in 2023, H1 2024 11m EUR, H2 18m EUR) and it is poised to grow much further.

Legacy business is stable, it does not grow nor declines

Management owns 58% of the business

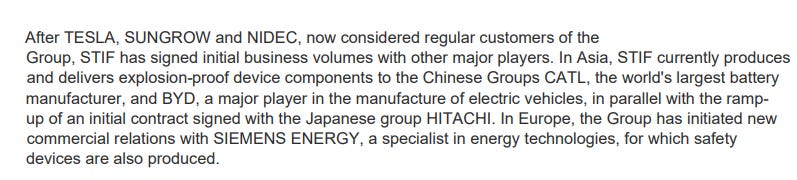

The biggest customer of the new segment is Tesla & accounts for majority of segment sales, but the company recently announced contracts with companies like BYD, Hitachi, Siemens and largest chinese storage battery manufacturer.

The company has 10% buyback in place

Share Price: 29.7 EUR

Shares Oustanding: 5.08m

Market Cap: 150.8m EUR

Net Cash: 4.41m EUR

Enterprise Value: 146.4m EUR

EBITDA: 14m EUR (My estimate based on 6.5m H1)

EV/EBITDA: 10.4x

Growth of new product: 450% YoY

About

STIF is a french industrial manufacturer of components that have two segments. The legacy business is making handling bulk products mainly elevator buckets, elevator belts. These products are marketed under various brand names. The company has a significant export presence, distributing its products to approximately 70 countries worldwide. Handling bulk products is old segment, matured, w/o competitive advantage apart from brand recognition. They sold over 1.5m elevator buckets in total. The second segment is involved in dust explosion protection equipment and battery energy storage systems (BESS). These products are used mainly for mitigating the impact of battery storage systems explosion. The BESS is the new segment the company entered in 2022 and is the core of the thesis. STIF operates two production units in France and one in China with a total surface area of 16.000 m2 usually at places close to the Group’s suppliers and customers. The Group plans to expand its production facilities soon with the opening of a plant in Texas to step up its expansion in the North American market. Having almost 200 employees, they control the supply chain from development to production and shipping.

History

The company was founded in 1984. Initially concentrating on producing metal and plastic elevator buckets and related components for the handling of bulk materials. In 2011, they opened facility in China to be close to asian market. Harnessing the expertise acquired since 2010 in dust-explosion protection equipments mainly for industrial applications, in 2022 STIF decided to extend its range of products to the BESS protection segment. This is the timeline of their product introductions:

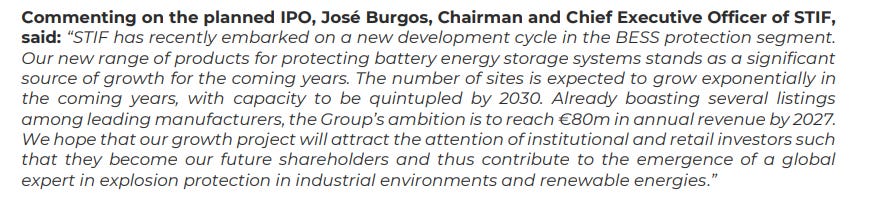

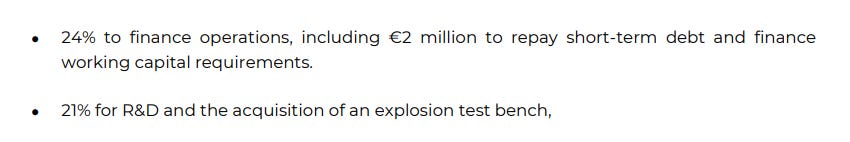

The group went public at the end of 2023 at a share price of €6.5, raising 10.35 million EUR to finance its growth in this new market segment.

Products

The company offers numerous product ranges for explosion protection like flap valves, vent pannels, hazard monitoring system, and explosion protection. If you want to have a look, here is the catalog of the products for Vigilex. Elevator buckets are bucket- or bowl-shaped containers that are attached to a belt, or lifting strap, allowing the vertical transport of bulk materials such as grains, minerals, granules or powders. These components are integrated into a larger system called a bucket elevator. STIF is mainly positioned on the food industry market in this area. For the purpose of this write-up, I will focus solely on BESS segment. Because that is where most of the potential value creation will come from. The core segment of Bulk handling, which focuses on is just stable, it does not grow but it is stable. BESS is what matters for shareholders to make money.

The explosion vents the company supplies are designed to open at a predetermined pressure during an explosion to allow the pressure and flames to be released outwards and, thus, release unburned mixtures and combustion products, valves are designed to prevent the flame from flashing back in the opposite direction and flameless venting devices, used to safely evacuate combustible gases or vapors from a system without causing a flame or ignition. Steel is their main source of material used for the construction of products such as buckets, fittings and explosion vents. The Group mainly sources from 6 different suppliers.

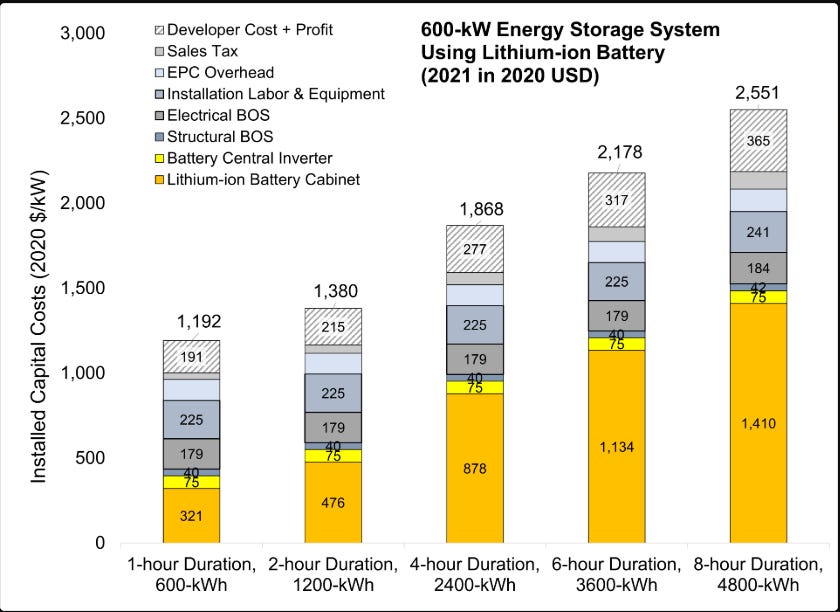

Stif has been positioning itself for two years in this niche of securing battery energy storage facilities. BESS Equipment is sensitive to explosions and requires increased security, for which the company is developing ranges of explosion-proof panels, deflectors and other protective devices. Then the products are equpped to the containers housing the lithium batteries dedicated to storing surplus renewable energy, thus they make it possible to channel potential explosions.

The BESS segment has currently 3 products and it is very impressive what they have been able to achieve with it.

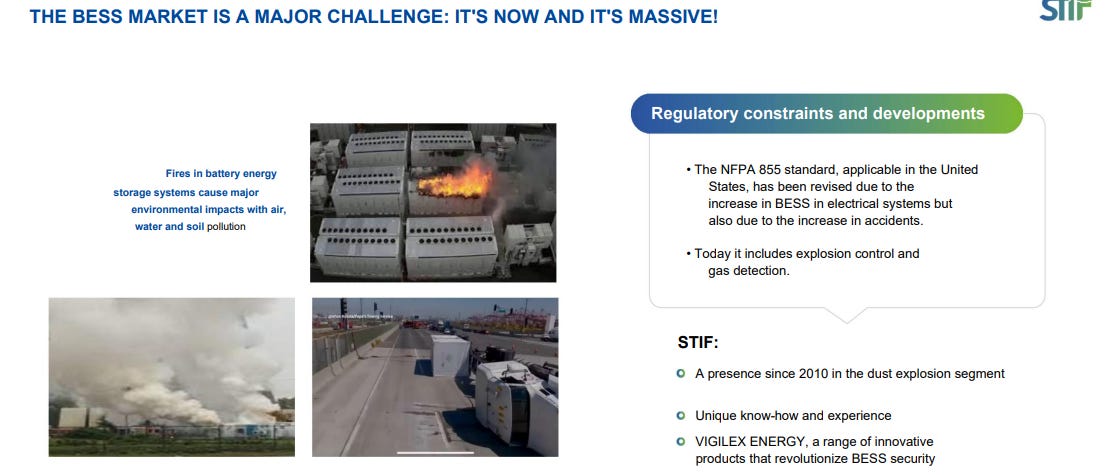

Bess Technology

Battery Energy Storage Systems (BESS) represent a significant component supporting the shift towards a more sustainable and green energy future for the planet. BESS is a technology that uses rechargeable batteries to store intermittent electricity generated by solar or wind farms and releases it as and when required. BESS units can be employed in a variety of situations, ranging from temporary, standby and off-grid applications to larger, fixed installations. BESS plays a key role in the storage of electricity produced by renewable energies such as solar and wind power. BESS also enables better management of electricity networks, particularly in the context of integrating renewable energies, stabilizing the network and managing demand. It can store surplus electricity produced during periods of low demand or high renewable energy production. Later, during periods of high demand or low availability of renewable energy, the stored energy can be discharged into the grid to help meet electricity demand or to stabilize the power supply. However, along with the benefits which a BESS applications can provide, there is a need to fully assess the risk of fire and explosion when utilizing these units to support “load managed” energy applications. The leading cause of fire and explosion inside a BESS enclosures is the release and ignition of combustible vapors from an overheating battery. Every battery experiencing thermal runaway generates explosive gasses. As BESS containers are usually installed in harsh environments, the containers must be insulated to keep the batteries cool and they must be weatherproof to prevent water from damaging the electronics. Several high profile incidents have gotten the attention of the industry and regulators, prompting investigations and the development of safety standards to provide protection within this relatively new industry. There was 15 battery related fire/explosion in 2022 and also in 2023.

I recommend watching this video by fire fighter which describes also harming fire fighters during an incident and appraise the use of ventilations, because alternatives dont do any good and failed. There is not a lot fire fighters can do with the fire, which spreads and even locations need to be closed because of air pollution.

The products are supplied through about 30 distributors and also directly. I am not exactly sure of the split. STIF also sells directly to manufacturers, which makes it easier to understand their specific needs and to adapt its products accordingly. Finally, it completes its distribution strategy with white label sales for some of its products. These contracts are generally 3 years with renewals. Distributors have the option of terminating these contracts early if the company sells its products to a reseller other than the one with which it has contracted for a given geographic area and/or products.

Explosion Protection

In terms of explosion protection options fall into two categories – Passive and Active Protection. NFPA 855 does provide a third alternative of using Gas Detection with Emergency Ventilation under certain circumstances where this is approved by the Authority Having Jurisdiction (AHJ) based on large scale testing. Passive explosion protection is typically the most cost effective option in terms of installation and maintenance. Passive Protection devices take the form of explosion relief vent panels which safely divert the deflagration to a safe place (atmosphere) and in doing so prevent the rapidly developing explosion pressure from causing container rupture, structural damage, and possible injuries to personnel. Vent sizing is based on a number of different factors, including explosivity characteristics of the vapors that may be off-gassed from the specific type of batteries, container strength (including door latches and hinges), opening pressure of the vent panels, and free area atop the storage unit for vent panels to reside. A qualified professional should be used when determining the size and quantity of vent panels to be used for BESS units and various designs, sizes and profiles are available to suit all installations and locations, including “flameless venting” devices if the explosion cannot be safely vented to atmosphere. Although Passive Protection (explosion venting) is the most common protection method, Active Explosion Protection Systems are available which incorporate detection, control and monitoring, and suppression to instantaneously quench the incipient explosion before it reaches a dangerous state. Active systems may be integrated into the overall BESS control system to provide alarms and safety shutdown in the event of an explosion.

Under normal operating conditions, the venting opening on the technological equipment is covered by the explosion venting panel. When the operating pressure level increases inside the device, the venting panel opens, and thus the pressure and flame are released from the protected space. The technology is exposed to a lower pressure than its pressure resistance and hence won't be destroyed.

Regulations

Given its risk, regulatory agencies & insurance companies through out the world require BESS to have explosion protection products installed. The production of explosion protection equipment is subject to stringent safety regulations. They were implemented to protect workers and assets. BESS manufacturers would need to ensure compliance with regulations like NFPA 855 & EN 14797, which could require additional certifications and expertise in safety standards that are specific to explosion protection like ATEX certification, which companies need to have if they want to sell explosion protection products in the EU. In order for its devices to be ATEX certified, the Group must be ISO9001 certified, which must be renewed annually, and is carried out as part of an audit conducted by INERIS. These regulations are different in the US and the EU. NFPA 855, the Standard for the Installation of Stationary Energy Storage Systems, calls for explosion control in the form of either explosion prevention in accordance with NFPA 69 or deflagration venting in accordance with NFPA 68. The NFPA 855 was formalized and published in 2020 so it is quite new. Having multiple levels of explosion control inherently makes the installation safe, therefore some jurisdictions require both preventative measures as well as the installation of explosion vents. Insurance companies are also reviewing the risk within these applications and underwriters may also require multiple levels of protection even if local regulations have not yet been developed. Dust explosions also have a considerable financial cost for the companies, estimated at $1m per explosion.

Moat?

The most important question is: “Could the manufacturers do it themselves?” While I am not 100% sure and it might be possible they could do it themselves, Tesla recently revaluated the contract on the upward by 30%. And Tesla is also opening a new plant for BESS in China. And they are consistently winning a new customers. In May, the company won the first chinese contract worth of €5m by Sungrow, which is manufactured directly at the Suzhou plant. So if it is possible why do not they do it? I am not sure. But customers probably do not mind too much. This is super small % of the overal BESS costs. And the interesting point is that even chinese BESS manufacturer do not make it themselves.

Competition

#1 RSBP

Altough it seems like an interesting niche, there is competition to be found. One such company is RSBP from Czech Republic. They seem to have many different verticals but also a BESS systems products. They seem to be a really small company without significant contracts. Their main target markets are Czech Republic, Slovakia and Poland. They are attending global conferences, but so far I have not found anything particularly big. The company has been working in fire and explosion protection since 1992, but their specific focus on BESS appears to be a more recent development aligned with the growing deployment of battery energy storage technologies. By some sources, they entered in 2020-2022 into this market.

#2 IEP Technologies

Very old company. Over 60 years of explosion protection experience. They are big in explosion protection business. IEP seems to have global reach. They are 1 of the 3 subsidiaries of HOERBIGER Safety Solutions group. Hoerbiger is a big company with about $1.4b of revenues in total. It is estimated, that they made about $67m of revenues in 2023 for IEP Technologies, which does not solely focus on BESS. Therefore total revenue could be quite close to STIF for BESS products. Found some older articles. Good insights into what is happening.

The product of all competitors seem to be very similar. They all have vents that open at the moment of explosion. The installation probably is also not differentiated value add. The inspections are held by operators of BESS who conducts peridocial observations. Everybody can do that. I guess the main drivers for customer acquisition is reputational side and volume needs. STIF has created one which can be seen by expanding orders. Why switch suppliers? Manufacturers want field tested product, which know it works well. The goal is still the same. To protect people and the investment inside. That said, I believe the customers combine multiple suppliers because the lack of scale of each one. Could this be at least barrier to entry for new entrants? Who knows at this point. Important is to expand and scale the numbers, so you can meet the demand. The shareholders who saw new segment taking off probably did not think much about the moat. They saw new product taking off. And it is still happening.

That being said, I do not believe there is MOAT and there is a risk that new competition emerges and current great margins and ROIC is solely based on industry supply imbalance. And also it is new and young industry that emerged from renewable needs. Who knows what will happen. There is interesting note from annual report:

“The company filed 4 patents for products related to explosion protection, which constitute significant innovations. It also holds 3 patents on fittings and its Vigiflam product, however, for other products (buckets, other fittings, Vigilex panels, etc.), the Group has decided not to protect them through patents, considering that these products do not benefit from such significant innovations.” Vigiflam is their flameless venting but optimized for conveyors – bucket, belt, chain, and screw conveyors – due to its compact and efficient design, making it suitable for protecting such equipment in industrial settings. So no patents protect BESS offerings. Anyhow, even the patented products are not protected outside France. So I doubt, it would be very useful. If competitors wanted to reproduce the Group's BESS products, they would be faced with investment needs in tooling and production equipment, which is not a moat.

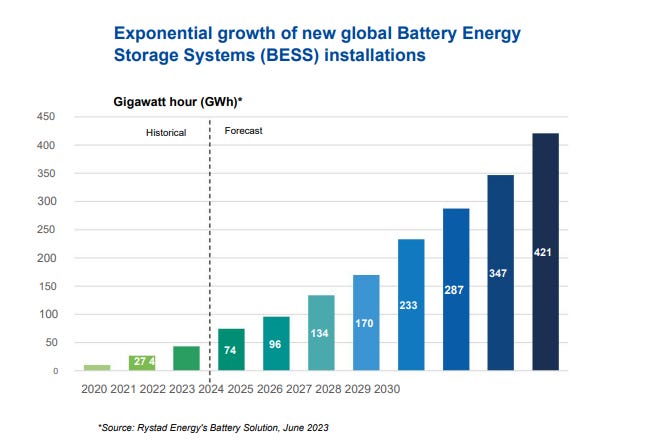

On the BESS demand growth, Global energy storage installations is projected to grow 76% in 2025, reaching 69 GW. Market is valued at $13 billion in 2023, is expected to reach $43.9 billion by the end of 2030, with an average annual growth rate of 28.9% over the 2023-2030 forecast period.

Tesla BESS information

Tesla is manufacturing their Megapacks products which are equiped with explosion protection by STIF. Tesla ventured into this business of megapacks in 2019. Right now, Tesla is ramping up production at its new Megapack factory in Shanghai (the first outside of states), aiming for an initial capacity of 10,000 Megapacks per year, translating to 40 GWh of energy storage capacity. By my understanding this new factory will enable to double current rate of the production of their BESS products. And these will need explosion protection. I think there is a high chance that players like STIF will get some of the business.

Tesla reported $2.4b of sales for energy storage (which includes Megapacks) in Q3 growing 52% YoY. Compare this to minimal cost of STIF’s explosion protection products. The gross margin on this business is about 30% for Tesla. If Tesla would look for different supplier, how much would they save? 0.2-0.3% on that margin? They need supplier who can manufacture at scale and is expanding manufacturing line. Also I believe they solely focus to grow it as fast as they can, so the relationship might be like: “Hey, can you supply us all you manufacture so we can keep up with huge demand?” One thing to watch is that Tesla is trying constantly reduce the prices. At maturity state, they might be focused to lower costs with suppliers too. I am not sure how much Explosion protection products by STIF cost, but one megapack costs $1.25-1.85m without installation. Apart from Tesla, Siemens is already using their dual vents.

Management/owners

Manuel Burgos, founder of STIF, is active in the investment and innovation part of the Group while José Burgos, his son, leads the development strategy, namely the commercial deployment in France and around the world.

José BURGOS, the current CEO of STIF, joined his father and founder of the eponymous Group, Manuel BURGOS, in 1998. Trained at a business school specializing in finance, he developed his appetite for business development in close contact with his father, and built up the Group's network of international partners, first in Asia and more recently in North America. He is also behind the Group's new strategic direction, decided in 2022 to address the Battery Energy Storage Systems market. Together they own 59% of shares.

I like that management has launched free share allocation plan for its employees. That is impressive. I usually come across loan funded plans. But this is basically giving part of the business to employees for free. Great way to make their work aligned with the goals of the company. Employees basically get €12.300 each on the 2nd February. I am totally okay with that. They deserve that after such growth. Also I like to be on side with owner-thinking managers who own a big stake in the company. They focus on very small details like photovoltaics to save costs for the plants and favor proximity with the customers.

Management is overly conservative

They were targetting €60m sales for 2025. But on 22nd January they released revenue of €61m for 2024 already. That being said, I think given the announcement of huge customers, the target for 2027 is too low and will be beaten. As can be seen, the company predicted that they will have BESS as 50% of sales in 2027. It is happening already.

Owners are selling some shares to increase the free float. Even with selling 10% stake, they will own 59% of all shares.

Financials

Revenues and adoption of the product is accelerating in recent years. The growth rate is super impressive and considering getting the huge customers just 1 year after releasing the product too! Other revenues account for shipping costs. BESS changed the game for them and it is another classic case study of new product changing the trajectory of the business and the investment.

The company pre-announced only sales so for 2024.

BESS products are higher margin than legacy business. One thing potentially worrying is that BESS has good economics because competition still did not catch up. If that would be the case then it is all about how growth can offset the marginal price decrease, which would pressure margins. It will be trade off. But so far, no signs of it.

In R&D team there is about 8 people. The group expects to be constantly investing into developing their products further. Some of the marketing is tied to traveling to trade fairs and marketing of new products, which is their focus now.

Balance Sheet

On the asset side, the company has The 10.000 m2 production facility in France and 6.000m2 in China. These are highly automatic and they want to expand the facility in China. Currently the company is building another facility in Texas to be close to the customers there, with which they want to apply the same growth model they once did with China. I believe this will provide significant growth in the coming years. Also I believe, that having a plant in the US might save good chunk on costs given that 49% of sales are to the US by the company shipped from France. Otherwise more than 50% of assets are current consisting mostly of cash and inventories. The company has net cash of about €4m and is using cash flow to expand its lines. One thing I would love to get answer on is what is the current manufacturing capacity for BESS. I think that is very important, but I am not sure at this point.

€190.000 receivables will probably be impaired. Those were sales to a distributor who sells the products in Ukraine.

The company also received €6m funding by Bpifrance, the public investment bank acting on behalf of the French government. It comprises a €3 million revolving credit facility that can be activated in whole or in part at any time over a 3-year period, and a €3 million loan amortizable over 8 years

Valuation

I like to do simple valuations. I think the shares at the current price are attractive if they will continue to grow. The BESS segment grew 450% YoY from low base, so obviously the growth must slow down. Current valuation is about 10x EV/EBITDA, which seems quite cheap riding this BESS trend. If this would be an US company, we would probably see much higher valuation, but that is just mental masturbation. On the other hand, I understand that this could be also something that excites investors, so if growth continues, multiple can expand further. If expansion into the US will be successful and the recently announced customers will start to put orders similar to Tesla, I think we might be just at the beginning of the huge growth curve and therefore I think valuation is very modest. + The market should grow very fast for a long period of time (remember, it is quite young as a whole, so these things are tough to value). On the other hand, if this product proves to be commodity and new players will enter based on attractive return on capital and they will be able to acquire customers of the company, there is also big downside too.

Interestingly, the company has a target of €80m revenues and 15% EBITDA margins for 2027. Just this year they already exceeded the EBITDA target, with revenue getting closer to target.

The company has also 10% buyback in place. Something you like to see with such strong growth and not demanding multiple. But so far they have not bought back any significant amount of stock. Not sure if they will buyback any significant amount back given they want to increase float. And small note in the annual tells, that the maximum price should not be excess of €24/share. The company also pays out a small dividend.

Risks

Slowdown in BESS expansion. I am not sure how would that happened, but perhaps we get away from “green” transition or lithium prices spike up a lot?

Margins are a risk. I think they can not expand much further and I would need management assistance to figuring out BESS unit economics and how sustainable it is. If we get new players entering in, margins might decline. So far this is not hapenning.

Even though the group has diversified supplier base, the risk of commodity prices rising is there. In the annual report they stated, they have been able to pass the rising costs onto customers without experiencing major problems. Regarding supplier risk, the company has maintained business relationships for over 15 years with its two main suppliers and has over 10.

The company has big customer concentration. For example Tesla in BESS segment is about 50% of sales by my understanding. However I believe this risk is becoming less relevant with company announcing new customers. The company mentioned that some customers have pricing leverage over their business. Encouraging is retention of customers by the company, even though it does not account for BESS segment, it is appealing to see satisfaction of the first two customers which have been with the STIF for 7 years and 35 years.

Regulations could be harmful or beneficial. In a harmful way, it could make the company to change its product or other adjustments in manufacturing process, etc. That said, the compliance is neccesarry for the business to operate. If they dont get renewed licence of ISO 9001, it could be harmful for the EU sales. “The Group has a perfect command of the ISO9001 certification process and has never been the subject of a finding of non-compliance preventing the renewal of this certification.”

Key person risk. Management has been with the company since the beginning. They built the business. I am not sure if I would love to see them leaving. But I think the business is simple enough to run even by different operators.

Review

I think this is interesting growth story at reasonable valuation. Obviously I am aware that many things can happen that would kill the thesis. And that is okay, if I size it correctly. I have smaller position acquired at €29 per share. The main thing I will be monitoring is the growth with the new customers and of course Tesla. I think the road will be lumpy as it is with timing of contracts. I am lacking lots of information and have not spoken with management team here, which I would like to fix, but I did not get the answer for example if they are also equipping the older BESS base or not. French shareholders have also an advantage over me because they understand the interviews with management. I do not and subtitles are not provided. And I do not want to learn that language, haha!

I have new write-ups coming. Lots of people asked for follow-up on PharmX and I promised that, but hesitated to share. The blog is getting bigger, and I do not want to move the share price for any of my stock by writing it up. It prevents lots of hateful comments if thesis do not develop well. But I promised and I will publish it soon.

Write-ups coming soon:

One swedish bad-co good-co setup with inflecting earnings, potentially at 5x earnings

Updates on my stocks from Down Under

Australian company with positive earnings, new leadership and negative EV, which you do not see, because assets are “hidden”

The presentation is not an investment recommendation. It is for educational purposes only.

Thank you for your criticism, feedback or discussion,

Jacob

This post is free for everyone, but if you value my work and would like to buy me a coffee, you can do it here:

Thanks for détailed review.

Note that an amendment raised thé buyback maximum price to 100 euros.

A question, do you know if their 3 years contract policy applies to BESS business ? To Tesla ?

Thanks for the write-up.

As that this technology was developed with a small R&D with little funding are you concerned that if this industry gets bigger they would make it themselves ?