Hello,

And welcome to my new article. This time it is another australian company from my A-Z database. It is my 4th write-up from the down under. Australia is quality and not so well followed place, so spotting changes early can be very valuable as liquidity is coming later in many examples, mainly in not so fast growing companies. It is great as you have lots of time to look closer and follow for longer time. This company is not future high ROIC business that has extremely long growth runway but rather bet on the change that is happening in financials, execution and potential future re-rating. It is a time exercise. The company is a staffing agency, which is another reason to not spend a great amount of time. I studied and research staffing companies in the past to come up with a decision that I don’t like them as businesses if not extremely well managed and cheaply valued. The staffing industry is full of problems from low barriers to entry, fragmented market, lack of supply of employees at points of market cycle, to management teams pursuing value-destructive M&A as growth is usually only possible through acquisitions to get to scale. TSR Inc. which worked nicely was a good story of activism, focusing on higher margin staffing markets therefore scaling down markets with better economics resulted in margin expansion and also had a good cash hoard on the balance sheet that was protecting the downside against market melt down, which was eventually happening in the US. With this write-up, my goal is to take a look at exactly all of these attributes that led to the successful investment of TSR, but also to a poor investment like Gee Group, which was the exact opposite of TSR except hoard of cash.

IMPORTANT:

I wrote this few months back before my world turned upside down. I went through tough times recently and did not have any energy to finish this write-up. My average buying price is 80 cents. It is more of the case study now, given the valuation gap has closed, but there might be another chance and still looks interesting. I apologize for that.

Summary of the investment thesis

The company has new capital allocator who cares about shareholders.

He participated in cash raising with his own money.

He got the company from losses and the company is now profitable, which should improve further.

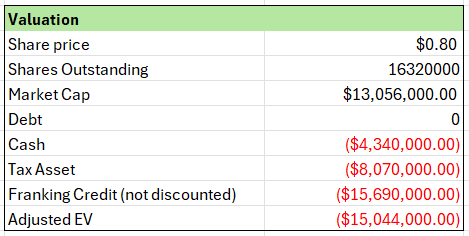

The company has deep hidden assets, which makes this a profitable company with negative Enterprise Value. You need to dig in to find the hidden assets, screens won’t find them.

The company is owned by entrenched group of shareholders. Australians own 99% of shares, making this super illiquid stock.

The company is trading at 8.7x EV/FCF w/o considering hidden assets.

Just announced a dividend for the first time in 13 years.

Ignite is australian recruitment agency with four decades of experience operating across public and private sectors in Australia, even empowering government and federal agencies and a customers like Kellog’s and KPMG. Their focus in on government contracts. They have a national footprint of 2 offices and their focus spans across various industries, including IT and digital, government, business support, engineering, information management, and professional services recruitment. They also provide sought-after on-demand IT services, in which they serviced for example IBM in the past. They offer temporary but also permanent contracts and their laongest contract is 24 years and ongoing. They have over 7.500 IT consultants and over 870.000 candidate records. They started operating in 1984 and made few mergers before going public in 1997. During 2000s they did exactly the roll-up strategy, buying other players in Australia. They have some interesting partnerships to start with.

There are over 950 government recruitment suppliers in Australia and Ignite is around 6th largest. In 2021 they supplied contractors to 30 government departments and they were in TOP 5 for 9 largest departments.

History

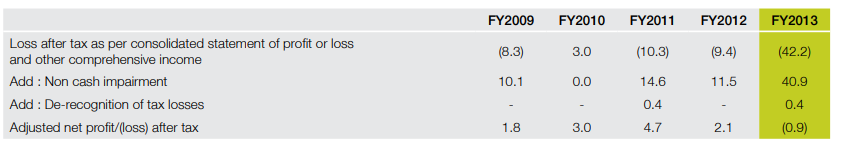

The company is around for 40 years, it was founded by Geoffrey J Moles who was director until 2022. The company has performed poorly since IPO in 2005 as shareholders basically lost 97% since. The share price went up for some time as the company was growing and profitable. The revenues peaked in 2008. Since then it was steep downhill with declining revenues and the company getting deep into the losses. The company posted a profitable year in 2013 and then nothing for 8 years. Stock price got punished. It was mainly due to poor leadership and highly competitive industry. I have access to annual reports that go back to 2013 only unfortunately. The highlight of the poor management team is when they “restructured” the company in 2013, they used $0.5m for it claiming that it will generate $3.5m of cost savings. That kind of number would make the company profitable next year again. The next year, costs went up by $1.5m, because they reinvested these savings into China division and the goodwill impairment was on the roll. The dividends were cut. And management was paid well, without having no ownership apart a small % by founder. The board got overturned in 2014 and CEO resigned as well as founder leaving after 30 years on the board. Therefore, the company had 0% of insider ownership. They desperately tried to reach profitability again, but were unsuccessful. Every year it was the same story of realising the benefits of implemented improvements in previous years. 2018 results have been impacted by the loss of two of the largest contracting customers. At that time, the company had even presence in China. Their chinese division had issues, needed to reorganize. Revenues were falling massively and it was loss making. In 2019 they divested the chinese business and incurred loss the next year of doing so and the company was without CEO again. There were little synergies and it was time consuming and all accelerated when chinese division turned to losses. During all this time the company was on the edge. They were loss making on a C-level and had net debt, which clearly limited their potential operational manouvers. During these times from 2018 and 2021, there were 3 CEO changes. In 2021 they had their best result since 2012 and they reported just slightly positive profit. But following a tender submission in February 2023, they received news in June 2023 that their largest gross margin customer contract would not be renewed. This negatively impacted the Managed Services division which has higher gross margins but it is lower % of revenue.

Management Team

Cameron Judson is the CEO of the company since beginning of 2023 after joning board in 2022. He has a rich history of working places. He held from 2005 until 2015 a variety of senior executive roles at the previously ASX-listed recruitment company, Chandler MacLeod Group Limited which had over $1b of sales in 2015. Cameron was CEO and Managing Director of Chandler MacLeod from 2012 until 2015. Then he led not the most successful campaign at McGrath where he resigned after 18 months in lead. I really like how he talks and cares about shareholders through reports and what network of people he has around himself that I know a bit from other investments. He seems like a good guy and is very responsive. Also what I like is that encouraging words have not fallen apart. He said last year that they will devlier improvement in profit and that is what they did despite decrease in revneues. After recent good results he is stating the same going forward. He took the company from losses to profits very quickly by reducing underperfoming parts of the business. One thing to point out is that the youtube is full of interviews with him on Sky News. Anyhow. He owns 4.9% of the stock which he gained through share issuance this year when he participated by a wish with his own money of $400k. Management owns 5.9% together. In total, they raised $4.45m for a recapitalization purposes before they could run to potential issues. It strenghtened the balance sheet as they repaid their debt and lowered the reliance on the credit facility with cost of capital of 10.2% for the potential working capital build up. Also their customers want to see them well capitalized if they want to do a new business with them. In the end, those are government authorities and two of their largest clients in Managed Services undertake annual balance sheet stress on Ignite. It also had other purposes as the company is trying to transform itself.

The company had no CFO since 2022, they had only financial controller. They felt that during these reorganisational times and streamlining of the operations they did not want to spend on the CFO. From the beginning of this year, they finally have a new CFO Lisa Hou. She seems to have a rich background too mostly at financial planning. Also one director resigned in 2022 and it just shows how the business with no competitive advantage should be run - operational efficiency or withdraw. They have now only 3 directors. Anyway, after talking to few shareholders, we all came to conclusion that the board is completely useless. But Cameron is doing right moves for the shareholders as the recent announcement of fully franked dividend suggests.

I really like their new Equity Incentive Scheme adopted on 20 October 2023. First 3.625m of options is very little dilution and their vesting is based on EPS targets that should be met until the releasing FY2026 results. $0.015 EPS target would make this close to 5x earnings. Exercise price was adjusted to $0.07625 after recapitalisation.

Almost all shareholders are from Australia. I have been lucky enough to talk to Graham Newman PTY. They are deeply involved with management. Furthermore, the company recently did 1:10 reverse stock split, further entrenching the possibility for acquiring shares.

Competition - Fighting for tenders

As you can see below, the competition in staffing naturally is fierce. There are currently competitors that are doing better job than Ignite, they are more profitable and having more success than Ignite in terms of government contracts awarded.

There are no barriers to entry to these contracts among existing agencies. There are some barriers for the new ones, but generally MOATs hardly exist in this business. Competition is fighting for projects which are limited in number. It is competitive bidding process. Tangible capital is not required. You need to have staff and relationships, your customers can trust. Agencies reduce pricing to sustain market shares and companies constantly negotiating pricing for the tenders. That means shrinking margins and profits. Every one can come in, look for people, set up the billing system, offer lower take rate and start stealing market shares. Reputation might mean something, but is is not a big hurdle. I believe this business needs to be run on operational efficiency otherwise there is low chance of survival. And I think current CEO is doing exactly that. HiTech has been very well managed for long time. Thanks to their lean structure and also focus more on IT/cybersecurity they have EBIT margins higher by 10% and gross margins by 8%. Why? Federal government critical IT programs require substantial technological expertise, which I believe is also the reason for higher margins. Ignite is more focused on specialist recruitment. Hitech focused also on moving away from high volume, low margin projects, which is something Ignite is currently exploring and therefore experiencing revenue decline. I think Hitech as an investment is safer given the decade of consistent profits, but I believe Ignite offers more upside if turn around will happen, which will also unlock realization of its hidden assets.

Hitech’s financials

Current supply of employees

The company benefits inflation as wages rise, but low unemployment rate is usually bad. Unemployment rate is 4.1% in Australia. That is above 4% for the first time since January 2022. From Hitech’s reports there is still significant demand and shortage for IT workers. Then for staffing agencies there is obviously a churn-rate of employees that get fully employed. I am not sure how much that exactly is for government contracts, but all these agencies are fighting for supply of workers.

Financials

The business is lineary divided. It is on-hired labour servies and permanent placement. On-hired labour is divided to specialist recruitment and managed services. While the revenues have been sliding, this business has super low operating leverage and they are able to collect lots of receivables on the way down. Recruitment revenues is mainly impacted by the number of contractors. Some of the revenue decline were attributed to the loss of the contracts, like payrolling in 2018, which continued into 2019. Permanent revenue is higher margin than contracting, but is is negligible % of total revenue. Specialist recruitment is 98% of the gross profits and it is basically sourcing and placement of temporary contractors. All revenues come from Australia.

Managed services have about 25% gross margins on average while special recrutiment has around 11%. Obviously when those went down, the overall gross margin went down. That also applies for permanent placement which is usually high margin, which collapsed after covid hit. Now their focus is to grow gross margin per contractor. 2024 results were achieved even with the loss of the largest client contract in managed services, which they already knew about that will be very poor year the 2024, therefore there is some efficient development in specialist recruitment.

With the special recruiment they want to achieve growth of active contractors which was lagging in recent years, mainly refocus on higher margin contracts. The largest customer is now 15%, 4 largest are 34% of revneues. The recent half year provides clear view that the bottom line is stabilizing and margins and profits are growing.

Costs

The company was burneded by “non-recurring & restructuring” costs for a long, long time. They were trying to turn the ship as it was sinking to bottom of the sea. In 2019, The Group relocated 3 offices in Melbourne and Sydney and closed 1 in Brisbane. The relocation and closure of these offices has significantly reduced the Group’s property footprint and resulted in a 40% reduction in ongoing occupancy costs. Majority of the staff started working from home and therefore there is further opportunity to reduce occupancy costs.

They are trying to lower the costs down even further. They engaged a Technology lead, a Data Expert and a Bullhorn Expert in Q1 FY24 to help take advantage of Bullhorn Analytics, and Bullhorn Automations to improve the costs, productivity, and performance of Specialist Recruitment business. Amortisation is mostly cash expense here, so that needs to be deducted.

Assets

Devil is in the detail. But also an angel is. The note “franking credits” is hiding in plain sight. Franking credits are a tax credit mechanism primarily used in Australia to prevent double taxation on dividends. Franking credits represent the amount of corporate tax that a company has already paid on its profits before distributing dividends to shareholders. This system allows shareholders to receive a credit for the tax already paid, effectively offsetting their own income tax liabilities on the dividends received. A company can only distribute as many franking credits as it has accrued through paying corporate taxes.

Why did it happen?

It highlights the unbelievable poor mangagement this company has had in the past. The build up of franking credits seems to date back to the years before 2008 when the company made large profits but didn't pay out all the profits as fully franked dividends. If you had placed a high value on these franking credits in 2008, you would have been wrong, because the company then went into an era of losing money, year after year after year. So it is about whether this company can continue to make a profit now! I believe it can under new leadership.

These $15.6m can be teoretically given to shareholders, but there are few constraints. The franking credits are basically worthless to foreign buyers, because they cant utilize its value of the tax benefit. To be eligible for the franking credits, shareholders must hold their shares for a minimum period (typically 45 days) around the ex-dividend date. The company also needs to be profitable which in this case happened just recently. And we, non-australian residents are not eligible to receive them. So why bother? Well, they have value for another buyer and that is the only thing that matters to us.

So what is the face value for acquiring company?

There are numerous benefits for acquring company. By utilizing franking credits, the acquiring company can offer fully franked dividends, which are attractive to investors. This can lead to increased demand for its shares and potentially higher share price, benefiting existing shareholders. The ability to distribute franking credits allows the acquiring company to manage its tax obligations more effectively. By declaring dividends that utilize franking credits, it can optimize its cash flow and tax position. Is there any problem with ownership change? I have not found out. The acquiring company needs to be in the similar business and are limited to fractioning rules.

Investors/companies value franking credits less than their face value. With the help of my highly knowledge friend Tristan, the franking credits should have higher value if most of the shareholders are domestic which seems the case to be here. Tristan forwarded me some cases on franking credits. One such case was Centrepoint Alliance which had 12c of franking credits. In the first 18 nonths they distributed 6c of its 8c of cash. Fully franked it became 8.6c.

Other assets

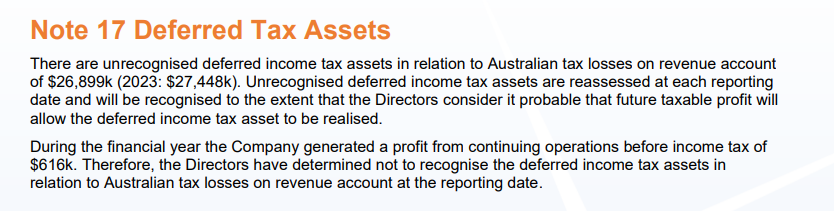

By my understanding cash is fully or most of it excess as receivables are being billed in 30 days and they are more than exceeding the liabilities. The company has done stellar job collecting more receivables than decline in payables was which resulted in much higher cash flows than reported net income. They have $26.9m of deffered tax assets against which the profits can be shielded. This should prevent the company paying a tax for quite some time.

Valuation

So the company just announced $570k of fully franked dividend. That means that the shareholder will receive $570k + $244k of franking credits (570/1-0.3=244k). So australian shareholders will have 30% tax on that $814k which means their dividends will not be taxed. And this obviously is an asset which should lead to higher share price, because shareholders will keep more than they otherwise would. I believe the company can pay out now whole EBITDA as a dividend as they have a cash buffer and significant NOLs. That would mean 11% dividend yield on my buying price of 80 cents if I were australian. They still anticipate improvements in margins so it could grow bigger over time. I think the downside is heavily protected by continued profits and deep asset base. Mind that, NOLs and Franking Credits have only value if the company is profitable. Net assets are $8.3m, which I consider to be good downside protection to enjoy. Thinking simply about upside, the company made about $750k of EBITDA for H1. That translates to $1.5m EBITDA per annum. The company does not have debt, so no interest expenses and it also does not need to pay taxes because of significant NOLs. It does not have any CAPEX either. They updated frontend a while back.

Valuation when I bought

Valuation now

Risks

Getting to losses/margin deteoriation again. I believe that is unlikely under the new leadership, but I am just not sure. This is not a great business and things can change quickly.

It might prove to be cyclical as staffing agencies usually are. But given low operating leverage and ability to collect receivables during the downturn I think downside is well protected.

The IT projects might get disrupted by AI. I think government agencies are usually slow with implementation, but eventually it can happen once the benefit is clearly cost effective.

I am not a lawyer. I might have understood the term and implication of “Franking Credits” wrong.

Review

Ignite is not wonderful company, but it is an average business that has hidden assets that are valuable, call it cigar butt. I am not expecting this to triple or whatsoever. I expect revaluation based on continued improvements in profits and announcing dividends (in hindsight, this has already happened). I bought at 80 cents expecting not holding for long. If I get further 20-30% upside based on further improvements I might sell. I wont enjoy fully franked dividends and when the stock will be treated as a bond, I will be out. This is not an investment to hold for long. Remaining profitable and slowing down revenue decline is key. Once again I apologize for not sharing earlier.

The presentation is not an investment recommendation. It is for educational purposes only.

Thank you for your criticism, feedback or discussion,

Jacob

This post is free for everyone, but if you value my work and would like to buy me a coffee, you can do it here:

Thanks for posting this during hard times. Useful case study. I liked your line in the franking credits section about buying things that have value to another buyer. It’s the job we do.