Codemill AB - Growing software company valued as consulting one

Hi there,

And welcome to my new deep dive. This company has been found through, you guessed it right, A-Z in Sweden, where I am starting to know every interesting company out there.

I am sure I might have missed a lot, but that happens when you try to expand your circle of competence and study new industries and companies, therefore any feedback or additions are increasingly welcomed. Even though I always wanted to invest in easily understandable and boring companies, I always enjoy learning about the world we live in, which requires ton of technology learning along. And I like to combine a bit of VC type investing while seeking value on smaller positions.

Share Price: 14.5 SEK

Shares Oustanding: 13.62

Market Cap: 197.5m SEK

Net Cash: 24.3m SEK

Enterprise Value: 173.2m SEK

ARR: 38.24m SEK

EV/ARR: 4.5x

LTM EV/FCF: 8.6x

Silicon Valley of Europe

Codemill AB is a swedish, but with global reach micro-cap software media company that emerged from what I call “Silicon Valley of Europe”. Sweden is home one of the best innovative european countries, because of its friendly politics towards capitalism, favorable taxes, good social community and well developed healthcare and education. Codemill was founded in 2008 and formed after a spin-off from Umeå University. Since then, they invested in leading research and development in video technology, which has also resulted in its own product development. Codemill started as a consulting company that offered various technical services and built video products for some of the world's largest video and media companies. In 2015, Codemill began developing its own cloud based and modular software, Accurate Video, to simplify and streamline various workflows within video production and distribution. They originally built it for Sony. The software facilitates everything from editing, cutting, quality control of audio and subtitles and other necessary actions to get a video, series or film ready to be shown to the end consumer. In 2015 Codemill had 100% of revenues from consulting & R&D subcontracting. Based on all its learnings in serving the media’s diverse needs and use cases, Codemill launched its first dedicated customer-facing product, Accurate Player, in September 2016, a truly frame accurate HTML5 player developed with broadcast, post-production and media professionals in mind. Today the picture backed their own solutions is different, with roughly 50% of revenues come from Consulting, and 50% from software products which ARR is growing rapidly and they are closing on important deals with global blue chip companies like Amazon.

A bit of the history…

As Bill Gurley says, place of the start-up is super important.

“600km north of Stockholm in the heart of Norrland, Umeå has quietly but successfully built a reputation for success in technology and innovation – particularly around serving the needs of the media industry,” Johan Bergström explains. “Some of the companies which were either born or are based in Umeå include Ardendo (acquired by Vizrt), Codemill, Limes Audio (acquired by Google), Intinor, Toontrack and Vidispine (acquired by Arvato). “In the case of Codemill, its founders Johanna and Rickard both studied here and developed the business with the support of local business incubator Uminova. As a digital product studio, with a special focus around media and video, Codemill works with major studios, broadcasters and publishers across Europe and the US, including ITV, the Guardian and ProSiebenSat among others. “Though only Sweden’s 13th city by population, when it comes to technology, Umeå punches above its size,” Bergström adds. “Key to that is its university, with more than 30,000 students. It holds an enviable track record, particularly in Product Design, Interaction Design and Computer Science and gets consistent top ratings for this faculty. “One of the area’s most famous sons is Stieg Larsson, author of ‘The Girl with the Dragon Tattoo’ series. The city is also the birthplace of a number of world-famous death metal bands. Umeå’s ‘Guitars – the Museum’ has one of the largest private collections of famous stringed instruments in the world. The museum featured prominently when Umeå was awarded European City of Culture in 2014. “Last but not least, Kung Fury, an 80s throwback action film which raised more than $600k via Kickstarter, was conceived, edited and shot in Umeå, mostly in an office, before VFX was liberally added. The film now has more than 30m YouTube views, while its creator, David Sandberg, is now working on a full-length sequel, featuring Michael Fassbender and Arnold Schwarzenegger,” Bergström concludes. Umeå is clearly a great place to start a media technology business. But a great location and resources is of course not enough. What makes Codemill stand out from the crowd? “Codemill began as an idea in 2007 but really came together in 2008,” says Rickard Lönneborg. “The idea was to work with international clients to solve ‘interesting problems’ and the broadcast and media space was becoming an attractive place to do that. The move to the cloud was going quite slowly due to security concerns and data transfer costs, alongside competing with a lot of investment in legacy systems that needed to be amortized. “Initially we were looking wider than broadcast and media, supplying development services for all kinds of projects, but we quickly realized this was the place to achieve what we wanted. Our first customer was Vizrt –providing extra resources for R&D work, followed by Vidispine. We then moved forward from sub-contracting R&D work to working as a partner with Vidispine’s customers on custom workflows, MAM and supply chain. Our core value – then and now – is the UX, making workflows elegant and easily manageable with great user interfaces, then transforming those workflows with custom solutions either fully into the cloud or hybrid, depending on the customer’s needs. Some customers keep storage on site with applications running in the cloud.

The path to IPO..

The company IPOed in 2021 as a money losing, investing lot of in the R&D, followed by the acquition of Cantemo, which was paid for by IPO proceeds and newly issued shares. For Cantemo it made sense to merge as they were smaller company with low R&D, technical capabilities and for Codemill it was a good add to their service, which was easily integrated with their flagship product Accurate Video. Also Codemill at this time has serious working capital issues predicting it wont be sufficient to cover WC needs.

Back to the acquisition. The Codemill paid 1.3x sales and 1.7x ARR for the company in total. They both knew each other as they were cooperating for a long time together. Going public was followed by steep decline in the share price the next year as the initial targets from prospectus have not been met. This guidance should have been reached in 2024, but so far it has been missed with turnover hoovering around 100m SEK and ARR being 40% of the revenues. But given how tough the environment get for the small companies in 2022 as the liquidity disappeared, they were focused rather on getting to profitability. Since 2022, the number of employees went down from 70 to 53.

"Through a number of joint client projects, it very quickly became apparent that Cantemo Portal is a great product that is meeting an important need in the industry – to manage media in a flexible and scalable way,” noted Rickard Lönneborg, Co-Founder

Business

Codemill is a digital product development and IT-consulting company operating in media & broadcast industry supplying proffessional editors with cloud-based software with modules that span all parts of the workflow. Their primary focus and product is an HTML5 based post-production software tool called Accurate Video. Accurate Video is often used as a Quality Control (QC) and Quality Assurance (QA) tool where users can work together with video content stored in the cloud. Their main product Accurate Video let the user work with a zoomable timeline, make audio QC and subtitle verification. The product’s strength, however, lies in its modularity and customizable features. Depending on the users’ needs, Codemill will change the content of the product to fit the requested demands. Codemill's business model is divided into three parts: product offering for large companies (SaaS Large Enterprises), consulting services for large companies (Professional Services Large Enterprises) and product offering for small and medium-sized companies (SaaS SME).

Products/Services

Codemill Digital Services consist of UX research, design, full stack software development and integration for the Media & Entertainment industry. Customers select the underlying technology stack, while collaborating with Codemill on the frontend user experience, to create an integrated end-to-end workflow. From content acquisition and task management, to Quality Control (QC), asset localisation/versioning, content verification, compliance and ad-break workflows, to order fulfilment, packaging and delivery. Codemill’s Accurate Player SDK and Accurate.Video software suite add key user functionality to the overall workflow.

Accurate Player

Communication and collaboration have and will remain essential parts of technology advancement. One of the fields that have seen a tremendous technological advancement in the last decennials, is the video post-production workflow. Video post-production has specialized software designed for each specific area of the workflow, all the way from editing the captured video, to quality control of the final product. As every step of this workflow involves large numbers of both files and system collaborators, the structure of the systems tends to be quite complicated. With such complex systems, it is vital to find ways to structure the workflow as well as letting the collaborators of the system communicating effectively with each other, as it often tends to make their performance more efficient. Now their flagship product is Accurate Video which offers these three capabilities.

Accurate Video as a whole is an HTML5, web-based video platform created for post-production, broadcast and media professionals. The product is built in Angular and can be integrated with AWS to provide cloud-based storage and a machine learning and artificial intelligence enabled platform called Baton to automate the workflow. Accurate Video can be used to both validate and ensure the quality of the Video, Audio, Metadata, subtitles. Accurate Video is modular, which means it can be configured to fit the needs of the companies.

It is only B2B for professionals who work professionally with video production, not for individuals. Easily put, it is Cloud-native product suite for content preparation. Accurate Video enables browser-based workflows that reduces the time, and need, to move and download content by bringing advanced media features to the user. Their Launch Template Architecture can make this Accurate Video product to be integrated with anything. Customers can easily add to their existing platforms or services. Can be done w/o the complexity of API. It is specifically designed for collaborative professional media workflows with time-based metadata in mind - cloud-native product suite designed specifically for broadcast, post-production, and media professionals to streamline various media workflows.

Accurate Video Validate is their flagship product focused on verification and validation of media content. Its main use case is for Content Validation and Quality Control. This tool runs in the browser, enabling remote users to easily playback and verify professional media content with frame-accurate video, multiple audio and subtitle tracks, and time-based metadata. It creates markers during the video edit. Sometimes subtitles are mispelling. You do not reach back to the video/film makers, you can now do it yourself. It is integrated with Amazon Rekognition Video Media Analysis for automated shot change detection, end credit detection, and black frame detection. Rekognition Video Media Analysis uses Machine Learning to automatically detect shot changes in pre-edited content like detection of faces, celebrities, objects, human sentiment, on-screen text, shot changes, black and colour bar detection, and end credit detection. In addition, Rekognition Video Media Analysis supports end credit detection in content, which helps technical operators determine where to add "coming next" markers, for consumer binge watching of VOD/OTT episodic content. Since 2021, the AI service Amazon Rekognition has been fully integrated into Accurate Video, which is sold via the AWS Marketplace. Customers use the AI services of Accurate Video to automate manual video production workflows for one of their streaming services. The first AI customer was ViacomCBS, which is one of the world's ten largest media groups. Viacom uses the AI services of Accurate Video to automate manual workflows in video production for one of its streaming services. Clients include major Hollywood studios including ViacomCBS, and broadcasters such as the BBC, ITV and ProSieben.Sat1, VOD/OTT services including Joyn, along with publishers and brands including The Guardian. It is very eseful for promo editors, and for technical operators setting adbreak markers, for commercial broadcasting, VOD and OTT distribution.

Other Features of Accurate Video

Audio Features: Includes tools for identifying audio layouts, re-routing audio, detecting phase issues, and visualizing audio waveforms.

Subtitles: Supports multiple simultaneous subtitles and closed caption tracks, with capabilities for importing and exporting various formats.

Ad-Breaks: Helps in defining content duration and identifying optimal spots for ad breaks using metadata-driven workflows.

Annotations and Markers: Allows for manual markers, comments, and annotations, and supports importing/exporting markers in various formats

They have been adding more solutions over time..

Accurate.Video Edit

Editing Capabilities: Enables operators to trim videos, delete segments, and combine clips. It is driven by time-based metadata, allowing for efficient editing decisions and compliance edits.

Subclipping: Uses metadata to make instant editing decisions, such as removing color bars or making compliance edits.

Export Features: Allows rendering and exporting segments as individual files or combined into a single file.

Accurate.Video Review

Beta launched of Accurate.Video Review in 2022, in an exclusive collaboration with Box, the addition of Multi-Asset Editing functionality and MP4 multi-track audio switching in Accurate.Video. It is management platform that enables organisations to accelerate business processes, manage workplace collaboration, and protect information. It allows media professionals to collaboratively share media and frame-accurately playback and comment on video content, securely stored on the Box Content Cloud. Built with Codemill’s cloud-native professional video, audio, and subtitle player framework, Accurate Player SDK, the solution allows media operators to visualise content for review and take ownership of any corrective action.

Accurate Player, which can be integrated to cloud-enable solutions, is a building block in most of their solutions,” says Lönneborg. “We’re targeting the professional media supply chain, from the studio and production to QC, QA, executive reviews and Dailies. Accurate Player has an easy interface to access highly secure material with custom workflows that have just and only the facilities customers need. We are acutely aware of the cyber threat studios face; we design with security in mind and team up with DRM watermarking partnerships. We want to stay very focused on user interfaces – we are gaining quite a reputation for our user experience expertise.”

Lönneborg continues: “We are also working on adding a second product – Adlede – using AI to deliver the best, most appropriate advertising content in the growing content-aware advertising business. We have a dedicated AI team working on Adlede and also on workflows for archiving, media tagging, compliance and finding/blurring brands. The cost of deploying AI will become less of an issue in a very short time – GPU processing will help greatly here. You will always need to be selective over how and why you want to tag content though – if you have too much metadata it can make it very hard to find the right thing quickly.”

Cantemo

The company offers their cloud product - Centemo 6 after recent upgrade. It is basically MAM software that works as digital library for videos, pictures and audio. For media companies it is an advantage because managing media in the cloud requires no hardware maintenance cost. With SaaS companies customers are always waiting to go to the next release if they can. And that's something that's just part of the business. Cantemo is Media Asset Management. It is basically cloud to store videos. “Where are all my films?” “Where is the shooting?”. Handling media is very much about storing information, where the things pop up. They launched Cantemo 6 in January. The big 2 (Media Prima, FAANG company) customers from the Q2 are now using the Cantemo 6, they have few other smaller sales (5 POC’s). Most of their older customers are on perpetual licences and for them to move to Cantemo 6, they will need to switch to subscription model, which “will be hard and painful”. On the question if they can get all the 100 customers on Cantemo 6, Maria (CEO) answered that for the small and very old customers they will try to not take them on Cantemo 6, or will in the end. Their focus is on bigger ones that have many users and that will achieve greater efficiencies if they will use the product. Small companies do not have that many users so a need of using cloud goes away. She thinks that this + next year, they can onboard 20 of them and the rest they will see. Users of Cantemo can use all the Accurate Video tools in there. The biggest proposition is that it is much more user friendly, making customers about 20-30% more effective.

Consulting

Consulting is support incrementation to create more customer value. They have their customer team that helps with that. Even being focused on products, going forward they still want to have digital services (consulting) because they see how much value it brings to customers, so it will remain part of product offering. Digital offering will be extended to help customers use their products. I had a question regarding what % of the consulting goes helping the customers to migrate to the cloud from traditional on-premise solutions. Some of the consulting agreenments are there for a longer time to help customers to create media supply chains. Then they have project which they run when customers buy the products and when they start to use them, then they migrate from their existing on-premise to new product. That is like month or two and they are done. In the bigger transformation projects, they look into how they are working and how they can improve way of working and most of the time it includes buying their products. So migration is smaller part.”

Consulting was the majority of sales when I started writing this write-up, but few months went by and ton of things can change in the world of small companies and especially intangible businesses. Optically bad news emerged.

“Codemill has had a specialized consulting group on site at one of its customers that does not belong to the Media&Entertainment segment. The value of the agreement has grown since 2018 and corresponds to SEK 18.4 million in expected consulting revenue for 2024. The customer has been very satisfied with Codemill's delivery but is now consolidating its suppliers and will not extend the contract for 2025. This will not affect Codemill's recurring product revenue.” Losing 18% of revenues might look bad especially when the company just turned profitable few quarters back, but it is not a huge issue to be worried about. It is very low margin business compared to products and it requires lots of time and resources. Maria said, that they took this consulting when they had little money and this assigment grew to the number you saw. It actually saved them during covid. They could not find the way to sell their products to this customer. In September this year, Maria had discussions with the board if they want to cut off this project. They want it to keep it for one more year to let the ARR grow, but it was not in their intention to continue working on this project (Is it really the case though?). The customer went to them first, that they do not want to continue. However it was not a core business and it was not “super high margin” business for them either. The customer was not involved with video media, but sound media. Going forward they will have only consulting related to their products. This customer loss should not have any real impact on ARR or on the future uptake. I think decrease in share price in relation to this might provide good opportunity as of the time of writing this. I asked whether there are any similar projects that are coming to the end. Maria said this was the last big one. All other are focused around video. As they are using contractors for this consulting work I wanted to understand whether they can and will reduce the workforce. Unclear, they might retain them for other projects. It is not a huge number. Number of employees stand at 54, up from 52 last year. This consulting loss, should not lead to losses, but it may lower the net income of the business. But it might not be that bad given it was low margin in nature (10-15% GM). It should streamline their operations now to focus solely on video media and growing the high margin ARR.

On the question if there are any new tools that could be possibly offered, she answered that they are focusing now on validating subtitle editing tool, blurring and blipping of content (compliace tool). These tools are being developed. Expecting Compliance to be part of solution coming out in November and subtitling is expected for January. During the conference, the 6 AI companies came to them to find if they can somehow bring their technology to their products.

Selling Strategy

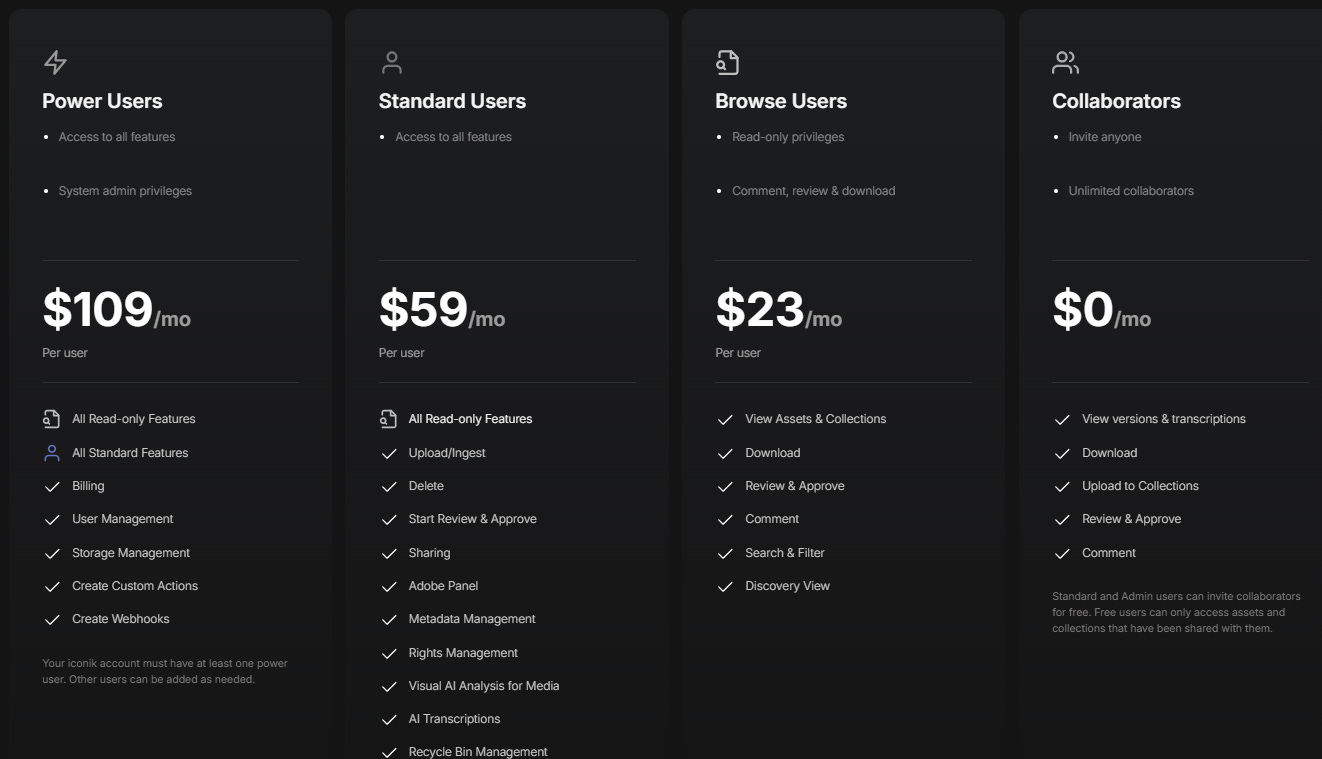

SS Consists of a combination of direct sales to, above all, the larger customers in the industry, but also partner collaborations for faster growth and easier reach to larger target groups. Codemill targets companies with over 200 users. They have about 100 customers all over the media chain, only 5 of them come from Sweden, rest of them are global. Partner strategy includes both a dealer network in the US, Europe and Asia, but also niche platforms such as SDVI's Rally and the cloud provider AWS. Codemill's product offering for larger companies consists of its own product suite that can be purchased either in a ready-packaged version (so-called off-the-shelf) with certain selected modules or as a specially adapted version where the customer himself chooses different modules that are put together and adapted to the customer's specific needs and workflows. Customers pay a subscription fee per month or year based either on number of users or usage, eg number of video files uploaded and/ or processed. Codemill's product offering for small and medium-sized companies consists of prepackaged versions that are part of the product suite that are purchased off-the-shelf from cloud-based platforms such as AWS Marketplace. Customers pay a monthly fee per number of users or based on usage. Until 2021, their product has been mainly sold through direct channels. Since then it is distributed mainly via partners like AWS Marketplace, SDVI and Box.com. I believe this is the main reason why they have been able to grow sales since then

These are Codemill’s customers. They recently made a deal with Media Prima Berhad, they have Deutchse Bank, Apple, Amazon, Paramount, Disney, and other companies from many different sectors as customers. Going forward they want to focus more on Studios and Production companies. Their product roadmap is developed with their key customers. By the words of the CEO, their strategy is not revolutionary but mainly focused on aligned directions with the customers. They are continuing to develop products based on customer inputs. They want to mainly work with “big six” media players. They have lots of different departments that they can get into. And also they want to work with tech companies that want to get into media. One focus going forward of the current CEO is to cross-sell and up-sell of the products. And hire the sales people in the US.

The value chain

To understand the real value proposition lets first understand the value chain of the video shooting and where the Codemill comes to play. Post-production is what occurs after the process of shooting the video. Depending on the type of content that is produced, the post-production process can differ a bit. There are, for example, differences between post-production for Hollywood movies and documentary filmmakers, but most of the workflow is still similar to each other. I am using for research here BC thesis. You can skip this part if you want to. The main stages of video production are as follow:

• Capture

• Prep

• Edit

• Conform

• Visual Effects (VFX)

• Color

• Sound

• Delivery

Capture

The first step in making a film is to have the right equipment. The general rule is to aim for the camera that has the highest-quality of codec. Codec is the meshing of two words: coder and decoder (co/dec). Shortly described, it is the technique to transform and compress video and sound and then decompressing them for editing or playback. With higher quality codec, more information will be included in the captured data, which gives greater options regarding editing. After choosing the codec, a decision has to be taken whether to record in log or not. By using a logarithmic profile, the recorded material gives a wide dynamic and tonal range, which allows more options for applying colour and style choices in the editing stage. The downside is that the resulting image appears washed out and requires colour-grading in the editing stage, but it highlights details and retains shadows that otherwise would be lost using a linear profile.

Prep

When the shooting of the video is completed, the next step in the workflow is Prep. All the data is now stored on memory cards or Solid-State Drives (SSD’s). More often than not, these files are stored in back up hard drives not to lose the material. To make sure that the files are still identical to the original, the camera operators use a checksum. A checksum is a program that puts the file through an algorithm that uses a cryptographic hash function to produce a string, consisting of numbers and letters, of a fixed length. If two files contain the same information, their checksums will match, thereby can it be used for authentication. Dailies are the term used for all of the footage that was shot during a given day. The digital imaging technician (DIT) preps these dailies and then sends them off to the producers and to the editors, which can begin to create assembly edits. With other words, dailies are raw, unedited footage shot during the day and have no cuts at all. However, before the DIT takes the dailies, some important tasks must first occur. The producing of a feature film will have many thousands of individual video and audio files, and these must be appropriately organized since the camera does not do this automatically. A folder structure system is often used with the files renamed so that it is evident in which order they belong, even if they get moved out of the correct folder. The sound must also be synced and organized in a similar matter since it often is recorded separately. Even Metadata must be organized and transferred since it can be valuable for the rest of the post-production process. The camera itself can capture metadata, and some are recorded separately. Examples of metadata are such things as lens information, shutter speed, date and timecode. The DIT’s next job may to be to transcode the footage, since the codec used may not be easy, or even impossible, to playback in an ordinary computer. After this, if the footage was log-recorded, the Director of Photography (DP) may apply a Look Up Table (LUT) to the footage so that the producers can see an image that resembles the DP’s vision as close as possible. Then the files are sent to the reviewers (director, client, producer) and the editorial team. A LUT holds a preset of numbers that are used by the software in order to change the colours of the images deliberately. Since log-recording often washes out the colours in favour of an extra detailed image, LUTs are often used to create a predetermined colour grade of the recorded footage quickly.

Edit

After the dailies arrive (either on a hard drive or through the internet) the assistant editors ingest the files and ensure that all the video, sound and metadata files are included and synced. After that, the post-production may begin. Since editorial teams often consist of more than one person, the files are often transferred to shared storage, thus enabling collaborative work and preventing two persons working on the same file simultaneously. This enables multiple persons working on the same project at the same time, but not on a particular part of it. Since the type of film can vary, so can also the number of stages and the time spend in editing. A feature film may take up to 6 months to edit while a short film may only take a couple of weeks. In larger productions, the editorial team follows the production team closely related in time to make an assembly edit that includes all the scenes in the script. By doing this, any potential issues with a shot may be detected, and the production team can do a reshoot of them before they leave the location. After the assembly process, the rough cut takes place where the director works closely with the editor to trim and tweak the assembly edit. The point with having a rough cut is to see how the story works and to see if reshoots are needed. When the rough cut is done, it is usually shown to the producers for feedback. It is also in this stage where different cuts like ”director’s cut” are created. After this, the picture is ”locked”, meaning that no more editorial changes can occur and that it is ready for the next step in post-production. Now, colour, sound and VFX teams to begin working on it to start finalizing the looks of the picture [6]. Visual effects (VFX) is the process where imagery is manipulated or created outside the context of a live-action shot, during post-production. More often than not, this includes computer-generated imagery (CGI) which uses digital effects to create environments that otherwise would be costly, dangerous or impossible to capture on camera.

The different phases of post-production happen in multiple locations. The editorial team may be placed in New York, e.g. while the colour correction occurs in Chicago and the VFX in Stockholm. With a remote workflow like this, it is vital to keep track of the files and keep them in sync to effectively collaborate between the teams (as well as in them). The internet has proved to be helpful by doing this, as editors can ”lock” the file they are working on thus preventing another user from working on the same file simultaneously. This new way of working has helped the editor with the review process as well. For a long time, the only way for an editor to receive feedback from the director was to have him/her to come directly to the editing room. With online feedback, this has changed. The standard for a long time has been to upload reviewed video to a storage site or similar, then sending emails back-and-forth among all the collaborators. This procedure enables remote collaboration, but it can be tedious for the editor to manage and process all the feedback, especially if the number of collaborators is large. More and more online services are trying to change this workflow to centralize their creators and collaborators to one platform, where creators can both share content, as well as receiving organized feedback, all in one location. This allows both distributed as well as asynchronous feedback online where the reviewers can leave their comments on different locations as well as on different times, allowing each reviewer to give feedback when it is most convenient for them.

Conform

When the edit is locked, it is time to move to the next step in post-production. Conform is the process of transforming the entire project into a format that the colour, sound and finishing team can use in their software. This stage often involves simplifying the timeline, relinking both audio and video files to the original camera files etc. However, how do they keep track of the entire project? The more common way of doing this is to export a reference video, which is used for checking that everything was transferred properly.

VFX

As previously stated, VFX stands for ”Visual Effects” and gets more and more common in motion pictures as the tools required has become cheaper and easier to use. There are many different kinds of VFX techniques, where one of the most fundamental is compositing. Compositing is the process of combining multiple images, so they appear to occur in the same shot. It can often involve having two people standing next to each other, but in reality, neither of them were in the same room at the same time. The editorial team is responsible for selecting the takes that will combine live-action with synthetic elements. These will later be supplied to the VFX team, thus enabling them to begin their work.

Colour

After the editorial and VFX teams have done their jobs, the colour correction begins. The process of colour correction involves enhancing and adjusting the visual attributes of the film, including colour balance, exposure etc. Some colour correction has already been applied in the earlier stages of the process, but the colour corrections job is to finalize the film’s appearance according to the DP’s vision. A usual way of approaching this is having the colour teams inspecting the LUTs crafted by the DP as a guideline for the finalized look.

Sound

Sound Sound, while not visible, still plays a large part in the experience of watching a film. The work done in this stage can heighten the immersion, excitement and atmosphere of the story. This stage also ensures that the project’s content meets the technical specification for the intended platform. Some examples of work done in this stage are organizing audio tracks into categories (e.g. ”dialogue” and ”music”) and editing the dialogue and music tracks to match the projects intended composition.

Delivery

In this final step of the process, the media is packaged and optimized for its intended medium: broadcast, web, theatrical etc. Since file-based delivery has become an industry-standard during the last years, the files specification must meet the intended format. If a failure occurs in this stage, the delivered files may produce picture artefacts, sound hiccups and more during playback.

Quality Control

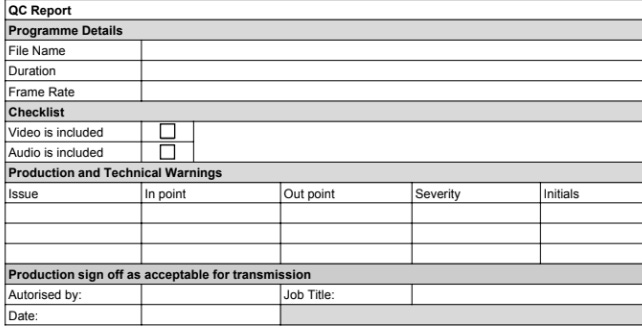

Quality Control, or ”QC” as it is often referred to, is a method of controlling that the deliverables meet the sought after requirements. QC is not only applied to the visual aspect of the film, but it also includes checking the for technical issues in audio- and video levels, file metadata, a proper timecode et cetera. In many types of projects, QC is done using an automated process, where specialized software does Quality Control over the media and generate QC-report with issues and cohering timecodes. It is also essential to notice that visual QC can be very subjective and may need a human to confirm the issues before sending the QC-report.

One example of this kind of specialized software for QC uses machine learning and Artificial Intelligence that supports a combination of automated and manual QC checks. Some parts of the automated procedures include a quality check of subtitles, license verification, loudness detection, identification of audio language etc. The software also has the option of exporting the results in multiple formats, including PDF and Excel. In large productions, quality control can envelop hundred of potential issues. Failing a QC can, therefore, be both expensive as time-consuming, since this means time and money spent on correcting the failure. To prevent failure from happening, the media files should be reviewed thoroughly in previous stages. Some example of common QC flags include: Visible production equipment, Dead/bad pixels, Incorrect timecode and frame rates, Shifts in luminance, Errors in compositing, Artifacts due to compression of the files, ideo out of focus (blurry images), Aliasing errors, Poor colour or grading, Low level audio, Unintended humming or buzzing sounds, Video dropout, Freeze frames, Photosensitive Epilepsy Testing (PSE), A/V sync (Lip Sync), Video signal level, Maximum true peak (audio) level (dBTP). All checkpoints be included in the QC-report with coherent timelines to the issues. When the quality control is done, there are often many markers placed in the timeline, which is used to report issues one step back in the video post-production chain. To do the report, a specified QC-report is often used that is mailed to the concerned part.

.

I think about Codemill as an assembly line. The content goes through the line and Codemill checks whether the products are in the right condition.

AI and ML can be integrated into Accurate Video to further increase the automation in quality control. Baton is one of these products that use AI to check the files automatically and places markers where the program is deemed that it is needed. It can, for example, place markers on every black frame or when the audio is over the set threshold value, depending on the company’s preferences. It can also be used to automate the QC-report to some degree. A workflow scenario for a QC-worker that uses an AI integrated system in Accurate Video can exist of:1. Ingesting the files slated for QC. 2. Let the AI integrated system process the files. 3. Manually check the results and correct unnecessary markers and add markers where deemed needed. 4. Generate a QC-report and send it to the concerned part. In larger companies, an AI-integrated software often does the initial QC control, and then QC workers often check the validity of the markers and remove or adds additional markers. As many QC workers fill the QC report manually, there probably exists a desire to make this process more automatic to ease the workload and to increase effectiveness, then QC reports are often sent through the mail to the desired person. The QC process can be quite extensive, thus generating many marker-rows in Accurate Video.

”Nice to not have to do the report manually. Prefers a system that keep track of the user, time codes and everything”.

”Nice to have a sorted list”

”The autogenerated QC report feels much smoother. To write a QC report manually feels tedious and can be subject to human errors”

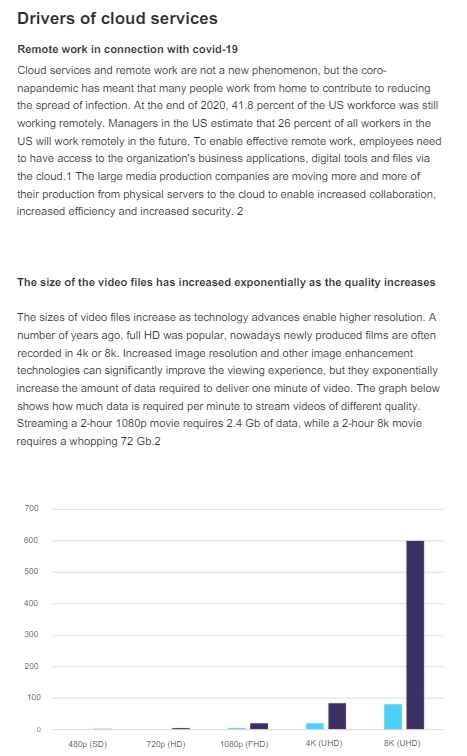

What is driving demand - Media companies are behind with adopting cloud

Media Prima Berhad, the largest media and entertainment conglomerate with the highest audience reach in Malaysia, will pay (consulting) Codemill to help them migrate from traditional on-premise services to a new hybrid cloud for unifying their their broadcast and digital media workflows. This is a what is driving business for Codemill and it is real opportunity. Media started to move to cloud very late in 2015, when Codemill started to offer products. The second thing is the size of video files that goes in hand in high quality content with increased image resolution. All in all size of data and increased quality content is among the most important driver of the industry demand towards Codemill products as it takes with the cybersecurity needs (Cloud storage security combines a number of measures to protect data stored online from unauthorized access, breaches and loss), remote and more sophisticated projects. All of this makes a cloud valuable proposition.

Disruption Demand

Studios and video streamers face the reality of their own market disruption, trying to find profits in a less profitable business. They compete with not only each other for attention, time, and revenues, but also with social media, user-generated content, and video games. The latter have evolved more quickly, staying close to younger demographics. While streaming video-on-demand services spend billions on content to tempt fickle subscribers, social media services have more free video content than they can manage. Indeed, top social media services are leaning into user-generated video content (UGC), emphasizing users’ interests more than their connections—and looking more like a new kind of personalized TV. While the creator economy has supported social media and brought independent creators closer to their audiences, creator incomes are still lean and unreliable. Leading UGC services seem unsure how best to support their content creators and brand ambassadors while keeping their own costs down.

Traditional on-premise providers might be hesitant to switch their business model, because they would cannibalize themselves. On top of that this is not a full disruption, people will still use their services and complement them with Codemill products. Similar to Vanguard’s invention of passive investing in 70s, eliminating expensive management fees, but active funds were reluctant to switch, because they did not want to cannibalize themselves even though they knew they will eventually be disrupted - call it innovators dilemma. The next thing that supports a cloud is creation of exclusive content (VOD & OTT) and customize videos is all possible sectors. It is not only one sector thing. And most importantly, it is gaining global traction off interestingly low point of cloud adoption for today’s world. So I see as a win-win for big companies like Amazon to collaborate with players like Codemill that may not get so big to fully disrupt traditional on-premise & have small revenue base to even invest in new services. They eventually may even buy Codemill out.

“Amazon Studios is building a next generation Media Supply Chain using Codemill’s Digital Services with their unique Media & Entertainment and UX capabilities and as previously announced Accurate Player SDK. With this order Amazon Studios confirms the intention to continue to build their future state Media Supply Chain together with Codemill.“

"Whether it’s an original production or the latest acquisition, delivering quality content is an expensive and time-consuming business. As the demand for entertainment diversifies, media organisations need to keep pace with competition – in all its forms. VOD providers and broadcasters are no longer just competing with each other, but also with newer types of UGC and experiential online content. The boundaries between how we consume media are blurring. This means the complexity and definition of entertainment will rapidly evolve in the coming years – especially as the adoption of extended reality becomes more prevalent and the creator economy matures. We are, once again, on the cusp of an entertainment revolution."

Nevertheles it will put pressure on traditional on-premise. Until recently, the on-premise vs cloud debate wasn’t on many creatives’ radar. Back when teams worked under one roof, on-premise storage largely did the job for media asset management and collaboration. But things have changed. As creatives spend more time outside the office, the cloud vs on-prem question can shape the way people in media work. On-premise also seems to be expensive than Cloud, because company maintains complete control over the maintenance and security of software, hardware and systems, whereas in the cloud provider manages the infrastructure, offering automatic updates and maintenance. Cloud storage is also consistently faster, regardless of the amount of data stored — whether you’re using terabytes (TB) or petabytes (PB) — while on-premises storage requires a more extensive infrastructure to maintain high speeds. On-premise involves significant upfront investments in hardware and software, with ongoing costs for maintenance and upgrades. With Cloud largely uses a pay-as-you-go model, shifting expenses from capital investments (cap-ex) to operating expenses (op-ex). This model provides cost efficiency and flexibility to scale resources based on demand. 94% of companies already use cloud software for a reason. The technology can give teams all the features of on-prem technology, but in a more convenient, flexible and reliable package.

Organic Demand

As the media industry continues to navigate new consumer trends and monetise increasing volumes of content, there is a growing desire for platforms that provide complete asset management and operational efficiency. As organisations weigh up their options in moving towards a cloud-based future, MAM solutions need to evolve to meet the demand for more remote and hybrid workflows. A combination of MAM, content processing tools, and supply chain systems, should work together to streamline complex media workflows. By embracing an integrated approach, entertainment providers can successfully manage content at scale. In traditional on-prem media workflows, MAM systems lack agility, and they often face over-provisioning. Legacy MAM design centres on providing extra capacity for editing and content processing, but this is constrained by the parameters of physical storage. This approach contradicts the flexible usage model embedded in the cloud, where resources are available dynamically and on-demand.

“As Malaysia’s leading fully integrated media company, Media Prima Berhad has a long history of creating captivating content and iconic brand names that Malaysians identify with and grow up with. We are constantly adopting new technologies to improve our efficiencies and delivery of content to our audience. Cantemo Cloud Hybrid MAM has enabled us to centralize our extensive assets and streamline our processes through one user interface. With this, we aim to continue delivering high-quality content, preserving our brand's essence while embracing tomorrow's technology advancements.”

Mardhiah Nasir, Executive Director of IPSB Technology, expressed her enthusiasm: “IPSB Technology has been a trusted partner of Media Prima for many years, providing innovative solutions for managing petabytes of storage data and broadcast network infrastructure. We have chosen Codemill to deliver Cantemo for Media Prima, as we believe Codemill can empower media teams through its bespoke digital services and Media Asset Management workflows”. Now petabytes are really a ton of data.

Maria Hellström, CEO of Codemill, commented “This is an exciting next step for Codemill in the South East Asian market. We are proud to support Media Prima in their digital transformation to the cloud. Our local partner IPSB Technology will support and maintain the complete solution for Media Prima."

So after all this work of analysing demand I think we are at the beginning of the great demand cycle or at least all points to that, which should benefit Codemill a lot. The question is what do we pay for that? We will get to it soon.

So what is the TAM? Is it the legacy On-Premise market? I think so. The market has changed after Covid hit. The demand for remote post production work increased massively.

Market

During our conversation with the CEO, we asked about the market size, because it was not clear from our findings. But Maria told us that they do not fit into any bucket for Accurate Video and Player. They fit into different pieces. They are in QC part but also in marketing, delivery part. There is no one bucket. They are not 100% in post production, because post production means you take videos that have been recored and you edit them into one movie. They are in like post-post production part. She tried herself to estimate the total adressable market for them but she was not able to come to any conclusion. One thing I have learned that most of the time the TAM is usually bigger than what one thinks for a new products/industries. But at this point of time I have no idea how the next growth phase will look like. They will try for the next year to do the research of how much products are the customers for the products in this industry and how much share they can take. They tried to find some reports on the industry size, etc., but they have not succeed. Maria told us that with the product of Cantemo, there is not expected growth in the industry. What they see is that people are moving from on-prem to the cloud, therefore they are growing from the replacement to the cloud, not from general market growth.

Competition

The difference between on-premise and Codemill is that traditional suppliers of software for video production on-premise solutions software is installed and run in its own server rooms, on the computers of the individual or organization using the software, rather than via cloud technology. On-premise computing involves hosting everything in-house. This includes backup, security, communication, software, hardware and other infrastructure maintained at an organization’s physical location. Cloud computing refers to remotely hosting data, software, applications and hardware hosted at data centers ‘in the cloud’. Cloud tools can pull data from multiple servers across the world, offering the flexibility of accessing and managing resources through a web browser. This essentially empowers teams to work and collaborate from anywhere with an internet connection. With the help of Codemill's products, the work instead takes place in a low-resolution copy of the video file directly in a browser, while the original file is stored in the cloud. This means that work is not tied to a specific computer or location and users do not have to download and send large video files between different people and departments. The competition consists of players like Adobe, Avid, Virtz & Dalet. The last three are traditional on-premise providers and offer more pure video tools, while Adobe has broader product offering for both individuals and companies. Virtz is also a customer of Codemill. Adobe Premiere Pro is one of the most used video editing programs among creators and media companies. But it is more suitable for advanced editing, animation and effects, which means Codemill’s products are rather complement to Adobe than a competitor. Their product can be even integrated with Adobe, which means user can easily alternated between the different programs. 72% of surveyed media companies preffer best-of-breed tools over end-to-end solutions. For some users, Codemill’s products can replace all other products in all parts of the process but in some cases the workflow may need to be supplemented with programs such as Adobe Premiere Pro. By Codemill’s words it is still traditional premise that dominates the market. One thing to consider is that management sees current competition as rather low than high which consists mainly of new players and could increase in the future. No doubt. This industry migration looks promising for having good return on capital. Therefore it is very important for them to get to scale quickly with partnerships and customers.

CEO on Adobe: Adobe is rather in post production (editing movies), Codemill comes afterwards to validate stuff before distribution.

Blackbird

There is direct listed competitor Blackbird Plc. It has similar market cap to Codemill and 5x less the revenues and they are constantly loss making, far away from any profits. Revenues are declining very fast, mainly given customer loss. Mainly focusing on individual customers. However, they seem to have launched a product this March which by September had over 800 users and by now over 1800. I wonder why financials do not show such a progress? They are also building the platform on the AWS cloud, similarly to Codemill. However they seemed to be quite off. They moving towards launching payment gateaway. Good luck! For the MUMs they focus mainly on sport industry and they landed the deals with CBS19 and South Korean broadcaster. And they also partner with Arsenal football team. Codemill does not target this industry. This does not seem to be worthwile competitor to spend time with. This should tell why:

However there is some confirming stuff. The demand for these type solutions is there and it seems to be increasing. Blackbird announced deal with chess.com, my favourite website!

Dalet

Dalet is probably the closest peer to the company I could find. It was a public company but the company went private with financial backing from Long Path Partners, allowing for more focused innovation without the constraints of being publicly traded. Dalet had €56m of revenues in 2020, €22m was support/consulting, €14.6m services, and the company was in period of transitioning from licences to subscriptions, so I will use ARR instead of split. The ARR was €15.7m (180m SEK compared to current ~40m for Codemill). Dalet therefore seems to be a Gorilla in this market. Dalet has been around much longer than Codemill, for about 30 years. Dalet serves a wide range of clients, including major broadcasters like the BBC and Fox Sports Australia, highlighting its established presence in high-profile media organizations. They seem to be focusing on similar markets with Codemill. But there seems to be one difference. Dalet has a more extensive history and a larger client base within the traditional broadcasting sector, while Codemill is carving out a niche with innovative cloud solutions tailored to modern media workflows. They too collaborate with AWS. Maria told us that Dalet does not have a good cloud solution (they are just hosting) and their UX is terrible. They see Codemill’s products currently replacing theirs. At this point I am not sure how likely is that.

Dalet announced a new CEO, which has much more experience than the CEO of Codemill. I have a good feeling about him, but as I said, Dalet is a private company.

Dalet recently posted workflows industry report, which seems to be very good at describing what is currently happening in post production media industry.

News organisations have undergone years of change and disruption – driven by shifting media consumption patterns and the rise in multi-platform production, pressures on funding, the Covid pandemic, and the emergence of new technologies including AI.

Most newsrooms are having to do more with less: delivering an increasing volume of content to digital and social media platforms, while facing budget cuts and often struggling to hire enough of the right people

Newsrooms have been slower to embrace cloud technology than some other parts of the broadcast and media industry – reflecting concerns about resilience, and the large install base of legacy tech.

One third of newsrooms are full on-prem for their technology deployments, while only 12% are full cloud/SaaS

Switching cost

I am always on the look out for competitive advantage a fast growing company has. Capitalism works perfectly in most of the cases and small companies rarely have moat. But the more I think about it, I think there might be some switching cost. Codemill helps media companies to put out content better & faster, which creates for the media company more money, especially on the time-saving measures. Then they can spend more on new content, which requires new editors. The new editors will work with Codemill software. The whole post production takes few months to complete. The big projects contain more people who work in the same cloud. All of the times, Codemill customize the product for the end customer and does consulting with them. On top of that, there are relatively long-term and highly valued partnerships already, which can ultimately lead the customers choosing them immediately, eventually it can become a moat. The overal post production structure is very complex and people are being trained to use it correctly as QC-workers can be specialized in certain areas. Once a customer has added Codemill's software to their workflow, it is unusual for them to cancel the contract, because Codemill's solutions have become part of their daily work.

I am not exactly sure about the Moat yet. But I am sure something must the company be doing right. Otherwise Amazon Studios, Deutsche Bank, Media Prima Berhad wouldn’t be the customers. Now check this: "The new agreement, as well as the fact that twelve people from Amazon have visited Codemill in Umeå, shows that they are satisfied with Codemill's services. That the follow-up agreement is more extensive is another sign that Amazon values the collaboration and wants to deepen it." Don’t take my word wrong. I like moats that are identifiable easier (PharmX). I do not think there is some deep moat. I am just trying to put things together. One of the hardest thing to do here is understanding the product differentiation and the quality of the product.

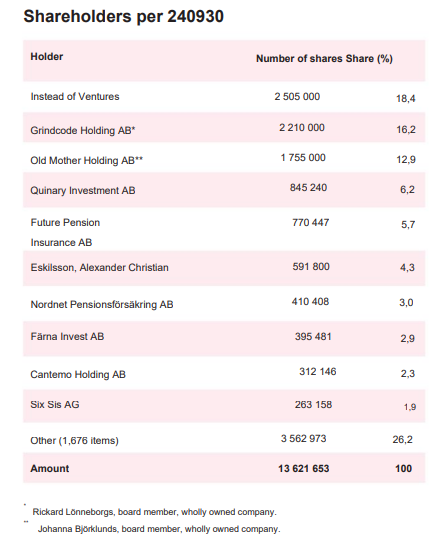

Management

Johanna Bjorklund Ph.D, Rickard Lönneborg, and Emanuel Dohi are the founders of Codemill. Management has 29.1% total ownership in the company. 16.2% is owned by Co-Founder Rickard indirectly indirectly through the company Grindcode Holding AB, where is a board member. He was CEO until recently but stepped down. CFO took over the position of the CEO for interim period. Now the CEO is Maria Hellstrom. She is nice woman with background in consulting but decided to leave mainly for money reasons and joined another swedish company Net Insight, doing media switches. She moved to the US and lived in Florida for 2 years and managed product integration and then the division was sold so she came back to Sweden and started to work as a CEO for another consulting company for 2 years. She wanted to be part of something bigger and joined Codemill, which had already its own products. She said to us. “Consultants are fun people to work with but the products bring customers more value.” And that is what is their goal. They want to be mainly product oriented, not a consulting company. She lives in Stockholm but travels to Umea twice a week. 12.9% is owned by CTO Johanna Björklunds, again indirectly through another company, where she is board member. They have been selling their stake a bit in recent time but they still hold a big ownership. By the words of Maria, founder do not want to have all the eggs in one basket. Maria said that they are not interested in selling a lot further. And she was right. Since the first call, Rickard sold “only” 100.000 shares, but this resulted in significant selling pressure for such an illiquid stock. Their salaries are super low compared to the stakes, which should leave them to be aligned along other investors. Profit taking is definitely alright given the low salaries. Their main office is in Sweden but they have two sales offices in the UK and the US. Maria told us that they want to focus now on other things in their lives, and they are no longer in opertaional charge. Their main goal directon for the company remains the same. 1. is profitability. 2. is organic growth. She also said that they are developing their roadmap of where they want to be in 5 years, so they were not clear on that or still are not. Main question she asks herself is “How do we want to grow.” (This is important, always need to look into “How”, if they will change the “How”, it is a red flag). Who they want to work with is clear. What they want with their products to do with them is also clear. Developing with the key customers is their key challenge.

Capital structure is very clear. There are only few thousands of options, which would result in maximum dilution of 0.2%. The most important thing, the company is not diluting. Its share count is very stable since the IPO, where they offered only 2.5m of shares to investors and 375k to issuing Penser Bank . Previously they had 10.5m, so call it “only” 27% dilution after the IPO. Most importnatly, management has retained a big stake in the company.

Founders talk about Codemill:

“What drives us is doing international business and all the ways we can simplify work for people, making it more fun and less tedious – meeting new people, taking on new challenges and learning new things,” Lönneborg enthuses. “We’re working with some big names including major Hollywood studios, and in London, New York, Los Angeles, Germany – sometimes we pinch ourselves!

“We have 60 people now at Codemill. It’s a private company with three main partners. I look after the technical side, building relationships and business development, Johanna keeps our university links live, recruiting new talent and interfacing with research projects (particularly AI); and Niklas Jansson, who founded one of the fastest growing companies in Sweden, left it to join us to bring onboard his expertise in how to grow a company while maintaining its unique culture and values – the things that made it great in the first place,” Lönneborg adds.

“We want to continue to grow but I don’t see us becoming an extremely large company – maybe we can double our size without breaking the culture that drives our success,” Lönneborg explains. “Our staff care for each other and we all work together in a friendly atmosphere – we call it ‘Codemillism’ – and this includes popcorn on Fridays! Also, we are built on talking to our customers – digging deep into what they want and delivering it. We can’t afford to lose that connection. While we will continue to develop custom workflows for our customers, we also see our product offerings being a greater part of our revenues over time.”

You can see passionate team with interest in building a great culture. However sometimes it is very tough to see, what the future holds for you. The things of you have not even imagined can happed. The good or the bad. So I will do everything I can to understand whether this is just 1) Not understanding the TAM or 2) Lack of courage by management.

Last year, Grindcore was paid 2 million SEK for consulting. What was that for? When Maria joined, they were using him for some things, as they were moving to cloud themselves, he helped them with servers.

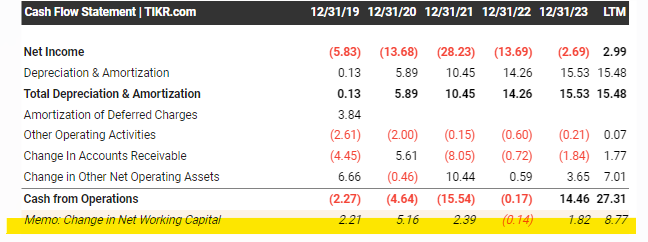

Financials

During the Q2 they started to work Media Berhad, which chose Codemill products to migrate from on-premise. What Maria thinks is super exciting is that they are going to their Cantemo 6, which they invested a lot during 2023. When they launched it customers were like: “It is shame you just did updates and you have not done any new features development. Then they tried it and were like: “we are now super efficient as we can reduce like 30% of the time utilized. One of the big customers is already in the Cantemo 6. Last year Q they dealt with Deutsche Bank and most of the revenues were one-time hardware. If excluding hardware they had growth of 55%. ARR continues to grow and it really picked up Q4 last year. Q2 was 10% QoQ and 38% YoY, but the most recent quarter showed QoQ decline, but still showed 28% YoY growth. However all of this does not include the deal they did with Cantemo 6 and what they should start seeing in the next quarters. We asked: “What is the percentage of customers on the old model and what are the pricing differences between these 2 models. (to understand the potential just from this migration). Maria Answered that they still have majority of the customers on the old version. Maria said that they will not jump because of the price change, but for the efficiences they will get. 2023 was a strong year, which included hardware sales of about 8m SEK. These have not occured this year.

ARR can be easily manipulated, so we wanted to understand how exactly they book it. ARR in Accurate Video and Cantemo is based on number of users while Accurate Player is impression-based and those are more fluctuating. Unfortunately, Maria did not tell me the impression based ARR as a total % of sales. And that is good too! Nobody should receive any sensitive information that would get them the edge. She will talk to the CFO and we will see whether they will disclose that in the future. They will start to measure that internally first and then they will decide. Back. Everyone using Accurate Player and Cantemo needs to pay the subscription. Part of the growth is from impressions model and part of it is subscriptions. Their Gross Margin should be around 80-90%, as they have some partners that take their share + infra costs.

Currently, Codemill trades at 9-10x EV/FCF (my estimate of FCF). They constantly capitalize less intangibles than they amortize, focusing more on profitability (better R&D structure, done the needed major investments). This does not account for negative working capital company enjoys if it grows. Question remains the impact on economics with losing 18m SEK low margin revenue. But Anyhow, 9-10x FCF does not sound bad for a software company growing long term this fast. Another question remains the direction of Recurring revenue over the next few years. Drop in ARR does not mean bad thing straight away. Could be seasonality or whatsover, most of the ARR is impression based.

Looks like sales growth is driven by big media companies. Therefore the question comes: “Do they have still space to grow"?” I am not sure but I think so. There is some delay of ARR occuring. Usually consulting should result in more products acquired. Also ARR is impacted too by bigger deals, which may be lumpy.

On the cost side one can see last Q being related to one time event. As they do not break up R&D and S&M, we proposed changing a bit the P&L to more SaaS-wise. They mentioned that they invest in products now at slower rate, which is part of cost control (more structure, they know where they want invest now).

Relative Valuation

Today Codemill is fast growing software company valued like IT Consulting company with much higher growth and future potential operating leverage off its 90% Gross Margin. These are all the relative IT consulting companies I have on my lists (have not included the smallest ones).

And if you want to have more direct comparison to Codemill it is a company called Blackbird Plc. But Blackbird is mostly B2C focusing on companies with 1-200 employees rather to 200 or more. Blackbird is also much smaller scale yet it trades at 9x EV/Sales.

Risks

One of the near term risk is that the company hired more people in H1 and now they lost their low-margin consulting part of the business. This could mean the company could feel profitability impact in the near term before ARR growth catches up.

Guidance was not met in the past. When the old management was in charge, they set up the goal of having 200m SEK in sales by 2025, which is not going to happen. Currently the CEO is Maria and I am still waiting how she will handle the first setback of losing part of the consulting revenues. But one thing is clear, the guidance which I hate, was not met. Maria obviously said that reaching this guidance will be super hard as they are not doubling their revenues in a year.

They do not know what is their addresable market. That means that it might not be that big (could it be niche?), and therefore the growth might not continue going forward which would be an issue, given the thesis is solely based on the future growth. As Maria said, they are growing rather from replacing traditional on-prem than from general market growth. And I am not sure what run-way is left for replacement. That would be the next question for future call.

Companies can make their own player, Maria said. This is big risk that I am counting on. Their customers are big and it could definitely happen in the future. She said that customers have already done that.

What would need to happen for this thesis to be impaired?

Continuation of declining ARR (new products failing and customers churning)

Seeing customers developing their own products

Founders selling all their stakes (they have still influence over the company)

What needs to happen for this to be successfull investment?

Obviously ARR growth - persuading customers to switch from prem.

Finding new features to up-sell. (They have all big customers already).

Growing within the teams of these customers (deepening relationships).

Getting integrated with other products in media industry.

Review

I know, super long. I bet you have not read it whole and it makes sense. The longevity gives you two hints and you would be right: 1) It is not an easy business/industry to understand, 2) The case is not risk-free and risk/reward is still not clear to me at this point. But I decided to initiate a smallish position and I will definitely follow the company long-term. There are still many questions to ask. My understanding is not perfect at this point, but on my list of all swedish companies I follow, Codemill appeared to be at the top. Sweden is a great country and I got a real satisfaction fishing far away from Wall Street. If you do too, feel free to subscribe. Lots of stuff is coming.

Shows that will Codemill participate in:

https://cloud.e.nabshow.com/2025/

he presentation is not an investment recommendation. It is for educational purposes only.

Thank you for your criticism, feedback or discussion,

Jacob

This post is free for everyone, but if you value my work and would like to buy me coffee, you can do it here: