Hi,

And welcome to my new article. Today I am sharing a free case study of the most illiquid (and probably cheapest) stock I have ever bought. At the time of me buying the average daily liquidity was $0.80! 80 cents! I have been able accumulate only 0.5% of my portfolio at the price disclosed lower. This idea shows the remarkable need of having very low amount of capital. Sometimes I was the only one buying the stock. Sometimes someone overbidded me. It was a net-net and most of it was cash. Today the share price is 137% higher since me researching & buying this in Autumn 2024, but the stock still trades at 3x EV/FCF while growing over 20%! I decided to share my write-up that I have prepared but could never share to my audience. Given that more interesting & liquid ideas popped up I no longer want to accumulate shares. Even if I could, I probably would not accumulate a lot.

This is draft I had prepared. Enjoy…

Going through the A-Z every day I got to know a super small singaporean company that is growing super fast and trading for around 2x earnings, while going through significant change during the last few years.

While their traditional business (masks) went bust after the covid, the company has a hidden segment that is growing very, very fast and is profitable, which is super important.

The company is not diluting and is expanding margins, while trading at negative Enterprise Value, not considering the leases.

You won’t find any twitter mentions or any deep dives about it.

Headline numbers are in SGD, but financials are in USD.

Ticker: $UUK.SI

Share Price: SGD 0.032

Shares Oustanding: 132m

Market Cap: SGD 4.22m

Net Cash: SGD 5.31m

Enterprise Value: SGD -1.09m

Why the opportunity exists

The company screens poorly because of the boom and bust of its masks segment. Masks had higher gross profits meaning the company gross margin went down a lot over the last few years. On top of that it screens as non-growth company but their wholesale segment is growing rapidly and is 99% of revenues now.

They disposed subsidiary that has been involved in minor related-party transactions for corporate governance reasons.

It is the recent “broken” IPO.

The company trades at 2x annualized cash flow and has history of paying all the profits back to owners. It is still fully controlled by the old owners.

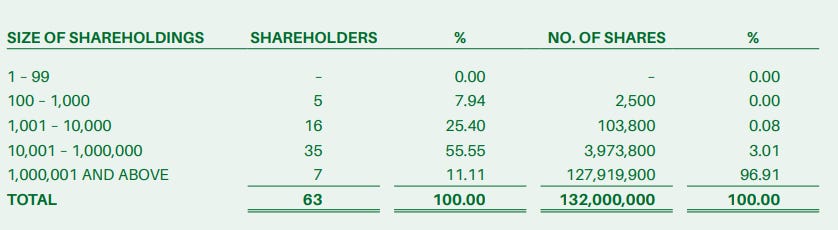

Free float is super low with only 15% for this sub $5m company.

As you can see, the company is a broken IPO from 2023. As much as I do not like to invest in IPOs, I like broken IPOs. People usually don’t touch those so it is interesting hunting ground. Combine it with singaporean company with market cap of $3.2m USD and you get really a thing no one wants to touch. Can anyone really touch it? Not really. The average volume traded is $0.8 given it is trading on SG Catalist! 80 cents! You get a good feeling that this article will be published much later than I am writing this as of 8th September of 2024. I understand this is not actionable for many readers, but I have small amount of capital. I can wait till some volume occurs. But spending so much time while I can buy such a low amount drives me crazy. But that is exactly what I love to do. The valuation was pretty steep at the placement price of 0.25, which was market cap about 33m SGD. This is the intention for use of IPO proceeds.

Overview

Pasture Holdings was incorporated in Singapore in 2017, but their activites go back to 1996 when the company was founded by current CEO. As an exclusive distributor of pharmaceutical products and vaccines developed by Byk Gulden (Altana), Genzyme SE Asia (Sanofi) and Chiron Vaccines (Novartis) for contract lenght of 3 years, they became one of the primary suppliers of influenza vaccines to the Singapore government and hospitals during the SARS (severe acute respiratory syndrome) outbreak in 2003. Following the SARS outbreak, CEO identified a gap in the market when he realised most masks were uncomfortable and posed difficulties in breathing to the user.

Today it has 3 segments, all 100% ownership, but initially started with one. The company is basically wholesale distributor, most known for supplying masks and medical supplies which have FDA cleareance. Those are classic masks for protection like respirators. They develop, market and sell their own Pasture Masks and to date they have supplied more than 100 million of them, which they greatly benefitted during covid, but it faded off as you would expect. Then they have pacific biosciences segment in which they focus on R&D and pet healthcare which is B2C.

The most important segment now is Pasture Pharmahub, incorporated in 2019, which is involved in pharmaceutical wholesale and dropshipment activities (B2B) in which they specialise in handling (procurement, product registration and/or licensing, warehousing and marketing) cold chain shipments such as vaccines, oncology products & medical aesthetics products. Their wholesale products portfolio includes vaccines such as influenza vaccines, human papillomavirus (HPV) vaccines (such as Gardasil®) and varicella (chickenpox) vaccines; oncology products such as Opdivo® and Keytruda®; diabetic products such as Saxenda® and Ozempic®; and nutraceutical products and dietary supplements such as ascorbic acid (Vitamin C).

Their specialise is in the cold-chain management services, which consists of a temperature-controlled supply chain network operated by them to allow for the safe and uninterrupted storage, management and delivery of temperature-sensitive pharmaceutical products, which are vaccines, oncology products and medical aesthetics products.

How cold chain works

Cold-chain management facilities are primarily located at their warehouse, which is equipped with specialised temperature-controlled refrigerators that maintain a temperature of between two (2) to eight (8) degrees Celsius for the storage of temperature-sensitive pharmaceutical products. Refrigerators are located in designated air-conditioned storage areas which are restricted to authorised personnel only. If demand is high, they also utilise third-party storage facilities which possess similar cold-chain capabilities, depending on the demand for such cold-chain management services from our customers.

Upon receipt of a cold-chain supply order, their value-add is packing the relevant cold-chain products into specialised cold boxes which are insulated, portable storage containers with validated configurations to store such products at a cold storage temperature of between two (2) to eight (8) degrees Celsius. They are also packed with ice packs or gel packs which are deep-frozen to negative 20 degrees Celsius, to maintain the desired temperatures.

The cold boxes allow for the transportation of the cold-chain products while maintaining an uninterrupted chain of low-temperature storage. Cold boxes can maintain the desired temperatures for up to 72, 96 or 120 hours, depending on the transportation and storage needs of customers. Where required, they also calibrate packing materials, such as by sweating the ice packs to adjust the temperature of the ice before packing it into the cold boxes, which allows to adapt to any specific temperature conditions or climates of the receiving country.

To validate and verify the quality of cold-chain system and ensure the safety of cold-chain products, temperature data loggers are packed into the cold boxes prior to sealing, to monitor the temperature history of the cold box from the time the cold-chain product is shipped until the time of receipt by our customers. All cold-chain management processes are supervised by a store supervisor, who ensures that the receipt, storage and sale of cold-chain products are implemented in accordance with our standard operating procedures, which are implemented in accordance with the Guidance Notes on Good Distribution Practice issued by the HSA.

It is a growing market. In 2022, approximately 35% of the pharmaceutical market comprised cold chain medicines, an increase from 26% in 2017. It is anticipated that this trend would continue, with nearly 50% of new medicines expected to require cold storage and distribution over the next five years.

They also provide drop-shipment services in this segment, which serve as back-end support of pharmaceutical wholesale supplies to international clients wholesale pharmacy businesses. They state their value-add is in providing direct shipping and delivery services to the end-customers, which include clinics, hospitals, pharmacies and other healthcare and medical institutions. Customers are being distributors of pharmaceutical products and medical supplies and devices, as well as governments and institutional customers such as hospitals, pharmacies and other healthcare institutions. They have a private label supply agreement with McKesson Medical-Surgical Inc. for the supply of medical and surgical supplies and devices from McKesson (non-exclusie), which is one of the largest medical supplier in the world. It contains of 7 distinct product categories and 300 SKUs and it grants them accessibility to a wide array of products under McKesson's ambit.

They also participate in both private and government tenders through local distributors and representatives in other countries to obtain contracts for the wholesale of certain pharmaceutical products and/or medical supplies and devices for government entities.

In respect of classic products and also cold-chain products they engage third-party contractors, such as freight forwarders, to deliver customer orders. In other jurisdictions than Singapore they rely on local distributors to distribute their products in those jurisdictions. They enter into distributorship agreements with local distributors such as those in Malaysia, Indonesia and Thailand, which are usually for an initial term of three years with the ability for parties to renew the contract. End distributors need to have approvals to distribute it as well, which in the past resulted of agreenment termination. Distributorship agreements entered into by Pasture are non-exclusive in nature, so they would be able to cease its business relations with such distributors and enter into new distributorship arrangements with other local distributors instead, if for example they breach the approval distribution terms. They also have some development activites, but it generates zero revenue currently collaborating with contract manufacturers to conduct research and development activities.

Cold Chain Generally

When ice cream melts in your hands on a hot day, it can be a bit frustrating; but if a load of vaccines can’t be used because it went bad due to improper storage or transportation conditions, the results are a lot more serious, if not fatal. So, it’s important that all supply chain parties (3PLs, carriers, storage facilities, etc.) dealing with such goods understand how to handle them correctly. Cold chain distribution is critical in many industries and require various expertise and trust. A cold chain is a supply chain that deals with perishable, temperature-sensitive goods (also called cool cargo) such as fresh produce, meat, dairy, seafood, chemicals, pharmaceuticals, flowers, wine, etc. Failure to maintain the right temperature leads to product spoilage and, ultimately, financial losses. Cold chain logistics is a set of activities aimed at handling and transporting such items securely from the manufacturer or supplier to consumer.

The longer the journey between the original supplier and end consumer and the more legs (and/or transportation modes) involved, the more difficult it is to maintain the necessary temperature. For example, in the case of international shipping, freight sometimes goes through multiple storage facilities or distribution centers and has to be reloaded several times. Unless items are permanently kept in a sealed refrigerated container, all these activities increase the risks of temperature fluctuations. Within the cold chain logistics process, the packaging, storage, and shipping stages cause the greatest complications.

Cold chain packaging

Ensuring optimal temperature starts with selecting the proper type of packaging, container, and refrigerating method. All that, in turn, depends on multiple factors, such as

type of cargo,

required temperature and humidity levels,

size of shipment,

duration of transit,

outside temperature (it’s especially important in case of climate changes for long-distance shipments), and so on.

For every type of temperature-sensitive shipment, different packaging is used. For example, vaccines are transported in small insulated boxes, while 53 foot reefers with inbuilt refrigerating units are used to haul foodstuff.

The company is subject to extensive legal, regulatory, licensing and accreditation requirements. Such laws and regulations include product registration and/or certification requirements, licensing requirements in respect of the import, wholesale and handling of regulated products such as therapeutic products and controlled drugs, as well as quality assurance and safety standards. Failing to comply with regulations can make this company lots of problems like receiving fines or shutting down the business. It is a risk worth not to underestimate. There may also be changes in applicable laws, regulations or government policies which are introduced from time to time. They need to have very high degree of internal controls of the products as they are very sensitive to time and temperature, constantly checking its quality as they are being periodically audited and exposed to inspections (typically one in every two years). Therefore defects or failures can be expected and it is a risk, because it can end at court if lives are at stake or it can get them bad reputation. There have not been any issues the last 12 months, but they got warning letter in 2019 which was for importing products that did not meet conditions of therapeutic products and the licence for import which they acquired in 2016. It ended in a good way and they have not received the penalty. All sides need to be super prudent with whom and how they do business.

They have been audited again in 2022 and no issues occured. On top of that this regulations can impact a growth if the company wants to for example expand into new jurisdictions because processes are complex and often time-consuming, as they require meticulous adherence to the regulatory requirements of various jurisdictions.

Market

The market growth is tied to aging of the population especially in Japan and the increased use of Ozempic drug & other vaccinnes. Pharmaceutical sales in SEA are projected to grow from US$29.2 billion in 2023 to US$38.2 billion by 2028, with countries like Singapore, Malaysia, and Thailand leading this growth. Singapore, in particular, has attracted major pharmaceutical companies, such as Pfizer, AstraZeneca, and Novartis, to establish manufacturing facilities, boosting its pharmaceutical and medical devices sectors. The country's medical devices market is expected to grow at a 6.3% compound annual growth rate, reaching US$1.2 billion by 2028,

I believe market is very big and fragmented. They face competition from large multi-national corporations who similarly conduct wholesale, manufacturing and distribution of pharmaceutical products and medical supplies and devices. In addition, some of the customers and suppliers are also pharmaceutical and medical supplies and devices companies which also possess wholesale or distribution capabilities, thereby creating vertical competition between them and some of the customers. In pharmaceutical wholesale and drop-shipment business segment, they face competition from other local wholesalers and suppliers of similar pharmaceutical and nutraceutical products, such as Hyphens Pharma International Limited.

Even though this kind of business does not have probably deep moat, they have established track record of more than 26 years in the pharmaceutical products and medical supplies and devices industry. Given the high regulation heritage on both sides, this is probably something that keeps new entrants away. Their customers are very selective with whom they conduct business. Getting licence is probably 3-6 months timeline. The next thing is that building such supply network is doable but not easy. It takes probably years to get to know the suppliers and then to persuade customers that you are legit business with high quality products. Customers won’t risk the health of their patients, so you need to have high quality supplier base. Add that the risk of these products. You need to build the infrastructure for temperature sensitive products. I am just guessing and it is my question to management. They state that due to their extensive years of operating, they are able to source niche products that may not be easily available. But competition exists from big players and also competitors can be seen among customers and suppliers. That is never a good thing.

Management - Family business

The company is being led by its founder who is also the CEO and substantial shareholder. His name is Lloyd Soong. Prior to founding Pasture, Mr. Lloyd Soong has had over 39 years of experience in the pharmaceutical products and medical supplies and devices industry and possesses extensive industry knowledge and expertise in the fields of nanotechnology and immunology. Soong graduated with a Master of Business Administration (Strategic Marketing) from the University of Hull, England in 1993.

Their CFO seems to have also lots of experience from Dun & Bradstreet Singapore where he took on several roles in business development and management as well as Reuters Singapore and KPMG. He was also the regional director for Hewlett Packard Asia-Pacific Pte Ltd where he led several functions such as consulting services, sales and marketing, resource management, financial management, client relations and partner and alliance management. Thereafter, he was the senior vice president at Singapore Medical Group Ltd from December 2011 to June 2012, a specialist medical and healthcare provider listed on the Catalist of the SGX-ST, where he assisted in the sale of the founder-owner’s stake to a consortium and another medical group. He obtained a Bachelor of Commerce from the University of Toronto in 1989.

Shareholder base is super concentrated further limiting the liquidity of the shares. PMI Holdings Pte. Ltd. and Plutus Star Holding Pte. Ltd. hold approximately 84.8% of the outstanding shares, of which is deemed interest of 56% by the CEO as he owns 100% of PMI Holdings. Plutus Star Holdings is divided between 3 people of Palepu family. Each of them had lock-up period 12 months to not sell the shares. I have not noticed any changes to date. The float of the company is minimum and it has only few shareholders.

Mr. Prashanth Palepu is a Non-Executive Director and was appointed to Board in 2017. He was appointed as a non-executive director of Pasture PharmaHub in September 2019. He is a director appointed by Plutus Star Holding Pte. Ltd. to oversee the investment of Plutus Star Holding Pte. Ltd. in Group. He started his career at British American Tobacco Singapore Pte. Ltd., where he was a material planner and data analyst from April 2015 to October 2016.

In regards to the capital allocation, the company was paying out good dividends pre-IPO to its biggest shareholders. There is a likelihood that this will continue in the future as they would basically pay themselves and they mentioned on prospectus, that they want to pay out all of the profit to shareholders. The company is well capitalized and recently went through business transformation and returned to profitability. Capital structure is clean with only 1 class of shares. The company has not been retaining most of its earnings in the past, but were paying out as dividends pre-IPO. If they wouldnt, they would have been able to nicely grow cash balance. They have not paid out dividends given masks segment declined by 99%, because of high stock piles of masks in 2023 & they incurred significant IPO expenses. My guess is, if they would be profitable, they will be paying nice dividends in the future. They are profitable this year but are looking to expand meanwhile.

The employees are very critical in this business. In total they have 16. They do not employ any part-time staff and all are working in Singapore. They must be trained and are supervised. The company must conduct the internal audits of quality of the products annually or when neccessary. The internal audit is conducted by Chief Pharmacist or such other manager assigned by Executive Chairman and Chief Executive Officer. In total it is about $100k SGD per employee in salary which is a bit higher than the average salary in Singapore but I guess it could be related to this kind of business which requires higher expertise.

They have Pasture Performance Share Plan as a share incentive scheme for employees who help with the development and success of the business. For them the incentives are quantifiable. For non-executives are not and are being rewarded individually.

Remuneration

They have very good incentive structure for building the business. Their incentive bonus is tied to Profit before tax. The more they can grow it the more CEO and CFO can make through annual bonus. It also creates a pressure on keeping the costs very lean.

While the daughter of the CEO is involved and it raises related-party question, here remuneration is low. Also the CEO sold his entire share in Pasture Marketing to unrelated third party to streamline his ownership interests. The new japanase owner still conducts business with Pasture but it was only $0.1m in 2022. No related parties now.

Financials

Distributors operate with low margins and high operating leverage. They are usually volume takers and the scale is one of the important things to get them from being a small company to bigger one. The company needs to grow otherwise I think there is low probability of being it good investment (not trade) - but that is true for many micro-caps. There is significant risk of investing in micro-caps that dont grow. I guess the company has not much pricing power and bigger competitors may be able to secure much larger volumes for lower prices, therefore eliminating the space for price increases. Their goal is to further establish new partnerships with local distributors to set up distribution channels in new jurisdictions. This obviously can take time, but as I mentioned before, the valuation seems to be very cheap so currently no growth is being accounted for. As most of the sales and sales growth has come from Japan I spotted an interesting thing. There are regulatory restrictions in Japan on importing unregistered pharmaceutical products into Japan by Japanese-incorporated entities. This means that Japanese customers engage Pasture to supply such unregistered pharmaceutical products directly to their clients, who comprise doctors and other medical practitioners situated in Japan. Japanese segment is therefore wholesale mainly and benefitting these regulations. It is their biggest % of sales.

You can see the business change over the time. Obviously they benefited selling respirators during the pandemic, when they sold over 150m respirators, and then the segment went bust. Malaysian sales were impacted by one-time contract for supplying masks for 2 years. Singapore, Canada and Hong Kong were also growing because of significant orders for masks. The UK was one-time, which included the sale of masks to McKesson Corporation. Then the orders stopped coming as pandemic was easing and company obviously printed losses, but on the other hand they created their reputation and created important sales channels and relationships, which should now help them with their wholesale segment.

Lower Margins

One can quickly see the margin difference between Masks and Wholesale as a whole. The next thing is that they probably have low bargaining power given how small the business is and customer concentration. So they are volume taker. They will take the volume even resulting lower GMs, therefore one can expect that unit economics will be hard to predict and GMs will possibly decrease further. Company stated that they supply pharmaceutical products to Bluesky (largest customer - Japan) at a lower gross margin, in exchange for constant and large volume of orders.

The best question to ask when researching low-margin business is “Is there any possible way to decrease non-material costs and if so by how much?”

The previous years were impacted by R&D of Futr Life, the mobile pet app aplication. It did not have huge impact, but every margin point is important for low margin distributor. They were receving R&D grants for this development which is interesting. It is booked as other income, which one needs to deduct to get the underlying earnings power. They have not received it this year yet, but core business is doing well enough to offset.

Customer concentration

The company has significant customer concentration with BlueSky which is a customer from Japan. Were the regulations in Japan change, there would be significant risk. This customer concentration also increased thanks to decreasing of mask supplies. Usually they work on a few year contracts. For example Adventa was on 2 year contract. Now it is a 0. Quantity and pricing is usually fixed. Some orders like for Skypro are one time. This is significant risk for the company. Receivable terms are matching payables in 30-60 days. So far only $0.2m was past due.

Suppliers

Given that the company does not manufacture or distribute any of its own products and the risk the company stakes with its suppliers, it is important to get understanding about the suppliers and the concentration of them as securing products is main asset for them.

At some point the company may experience shortages of products if they can’t secure them, which could result in customer loss, so distribution can cut both ways. The distribution chain looks a bit concentrated towards three main suppliers. They secure new products by employing a multi-faceted approach, which includes actively participating in industry-specific events and fairs. They also prioritize visitations to reputable pharmaceutical and healthcare companies to explore collaboration opportunities.

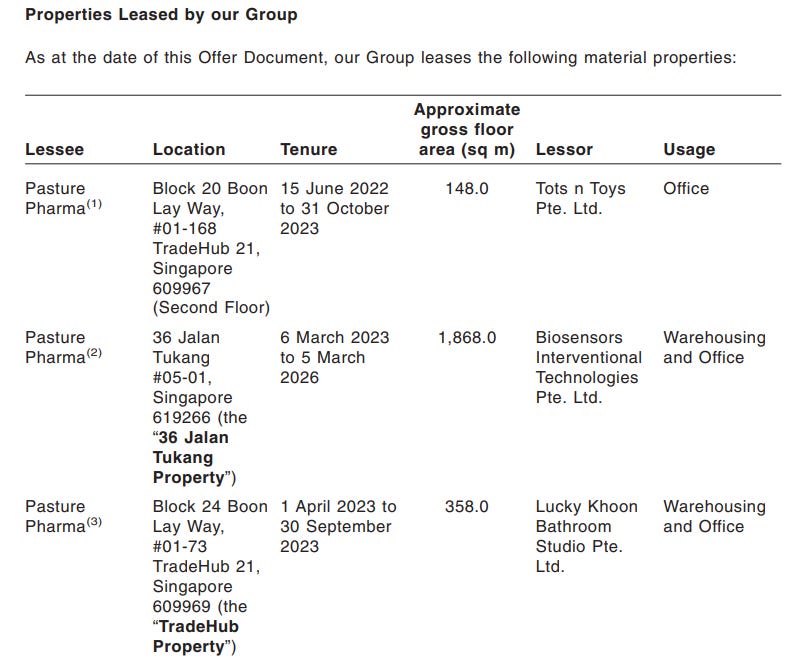

On the asset side, they mostly lease office and warehouses. They sold their property and retired debt in 2022. The property was personally guaranteed by CEO at most of its value. In 2023 they sold their property for S$2.1m, only showing slight $0.2m of gain in P&L, but it further lowered the D&A expenses. They immediately leased it back. In 2023 they leased a new office and in 2024 they relocated to a facility twice the size, supporting future growth and increased capacity.

In regards to inventories, pharmaceutical products have limited shelf lives, generally ranging between three 3 to 18 months for certain vaccines and oncology products, and between one 1 to three 3 years for other pharmaceutical products, and certain products may also be temperature-sensitive, which increases the risk of inventory obsolescence. The company has not experienced write-downs so far. But it is important to follow other losses going forward. Also inventory turnover is probably the most important thing to watch for distributors. Anomalies should be watched closely as it comprises solely from finished goods and goods for resale. Most of the inventories are secured based on the orders. Once the order is confirmed Pasture requires a deposit or full advanced payment from the customer. Apart from these orders they maintain 1-2 months of inventory levels for products which are high in demand. Regarding the temperature-sensitive products, they are stored in controlled warehouses or freezers depending on temperature requirements.

Capex

The company does not need any CAPEX for their operations. If something it is very minor.

Valuation

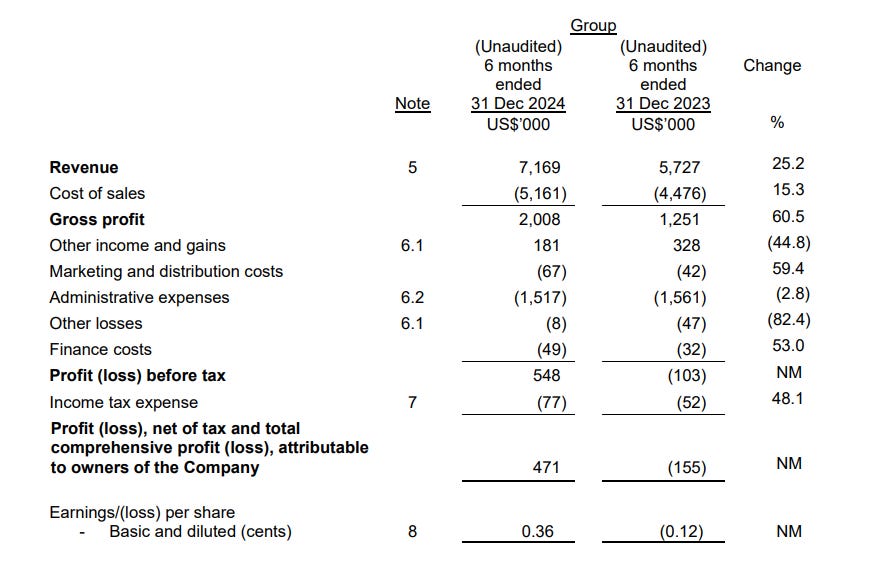

Back to today and good results are continuing. The company made $471k of profit, or roughly $1m per year while growing the revenue 25% YoY. Keep in mind these are US dollars and the company trades in SGD. The market cap today is $7.8m USD and net cash is $4.67m, not considering the leases, making the EV of $3.1m. But OCF is higher than Net Income given the higher D&A and low capital needs. Part of it is probably for working capital, but to make it easy this makes it about 3x EV/FCF with 25% sales growth and good capital allocation in the past. Also it has significant risks though mainly with customer concentration which is not disappearing. At the time of me buying I was basically buying negative EV and growing profits. It seemed very off. Today it still looks very cheap.

Risks

I think I mentioned the risks throughout the write-up. Obviously they do not manufacture or distribute their own products. On top of that is highly regulated business with many approvals on all fronts, especially from other distributors, customers, manufacturers. Losing the approval, breaching it or defect of the critical product can have serious consenquences. And given the company distribute its products globally, everywhere the regulation is different which further complicates the things.

Customer concentration combined with revenue recognition is a risk. The sales are recognized when shipped to the customer, not when they are given to the end consumer. That might make this very lumpy and the growth trajectory could be misleading.

Competition is very high

The company focuses a lot on their Futrlife app for pets. This might tie their focus and resources. It does not generate any revenues at this point.

Uncertainties

The company, being a distributor, has significant fixed costs. If they were to experience loss of volumes, which have mostly variable costs tied to them, they can easily get to losses. Administration costs are fixed. But they might grow and operating leverage works both ways.

Customers will go direct. The question where I lack the answer still is (common with distributors), why customers do not eliminate the middle man and rather go direct. While with Haypp, it is clear given the strenght of network effects, I am not quite sure, why here is the case. Is there some legislative that requires the distributors? Some packaging know-how? Partnerships? Not sure yet. But these are non-exclusive agreenments. They can be terminated. One thing on my mind is that Singapore is international trade hub and customers might seek partners here.

I am also not fully sure on one thing. Most of their licences were expiring last year. I am not aware if there is any risk of renewing them. However it is essential for them to continue operating. They mentioned that they acquired all the neccesarry approvals to continue operating.

Review

I hope you enjoyed this case study, of what you can find if you dont have lots of money. Probably this stock is just for younger than me already. I have small position due to illiquidity but I wouldnt make this bigger anyway if I had more money. It would be always a cheap bet for me. But it is a good reminder that profitable, growing companies at negative enterprise value exist.

The presentation is not an investment recommendation. It is for educational purposes only.

Thank you for your criticism, feedback or discussion,

Jacob

I looked at this briefly a month ago when the last trade was 0.05 but bid/ask 0.062 / 0.113 (!) I wrote, "if it keeps growing, this could be a home run - if you can get shares." kudos for finding it early and getting some shares! SGX has a few of these super duper cheap co's