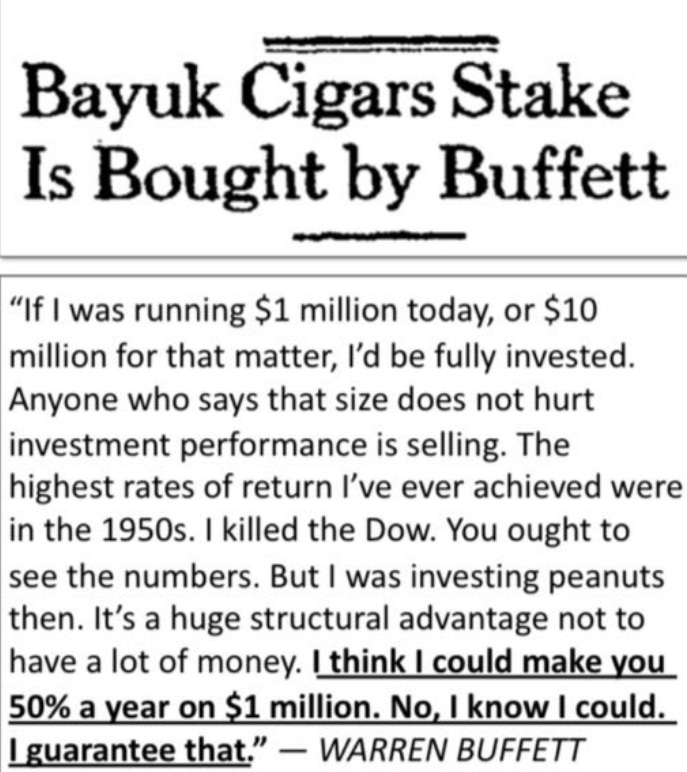

A contemporary example of young Warren Buffett's investment

Case Study article on what I think it is the real example of a stock that young Warren Buffet would put 100% of portfolio into.

Hi,

We all have the ability to study the past investments of Warren Buffett. They are somewhere hidden on the internet waiting for curious investor to find them and study them. I did one write-up translation of a Western Insurance, a company Warren Buffet profiled in article “The Security I like best”. Dirtcheapstocks gives us often the great service and re-writes them for us as case studies. All great stuff. Recently I was thinking about something. “What is the current example of Warren Buffet’s investment that he would be definitely interested in?” If I say “definitely”, I want to give a real example of strong investment case, a case where you would like to put almost whole portfolio in, meaning extreme downside protection and fabulous upside optionality. Many would argue that these no longer exist. Not true. Even though I admire that Micro-Cap space will be tougher place to fish in going forward because of the pressures from down and up, there are some real gems hiding. Let me tell you, that this article is the “only example”, I can not buy the security I mention due to being listed on low tier exchange & the volume is crazy low to even bother. But if one has access to the exchange & could negotiate private transaction or has low opportunity cost, it could definitely be worth it. This is a stock I hold on my lists with highest rank. It is the one I everytime go across and praying I could buy as much as I can. I bet Warren would like this stock.

Australian adventure Tourism Group, listed at Sydney, is the cheapest stock I know. The company makes business in tourism across the Australia. They make money through accomodation & tour sales. Accomodation is around 80% of sales. They own 6 brands through which they offer adventure services to famous places like Uluru, Great Barrier Rief, Kangaroo Island, etc. The company reports every six months and do AGMs on regular basis. The company has 33.6m of shares oustanding and its share price currently stands at $0.06, meaning Market Capitalisation of $2.01m. This is the recent H1 update by the company. It reported growth of 11% and Net Income of $368k, while also seeing strong forward bookings for a second half of the year (China is opening up & they dont need Visas to visit Australia now). The second half is typically a weaker one given a seasonality but the company is also well profitable there. I don’t think they will post less than $250k of Net Income. This will put them at $618k of total for the year, making this trade for 3.3x Price/Earnings ratio. But that is not all.

For a $2m you get this Balance Sheet. Net Equity of $9m. Almost whole borrowings are covered by the cash that is being accumulated on the Balance Sheet. But what is more, you get $9.3m of tangible assets & quite a unique very strategic asset that the company is listing for $12.5m, which sale is currently being negotiated.

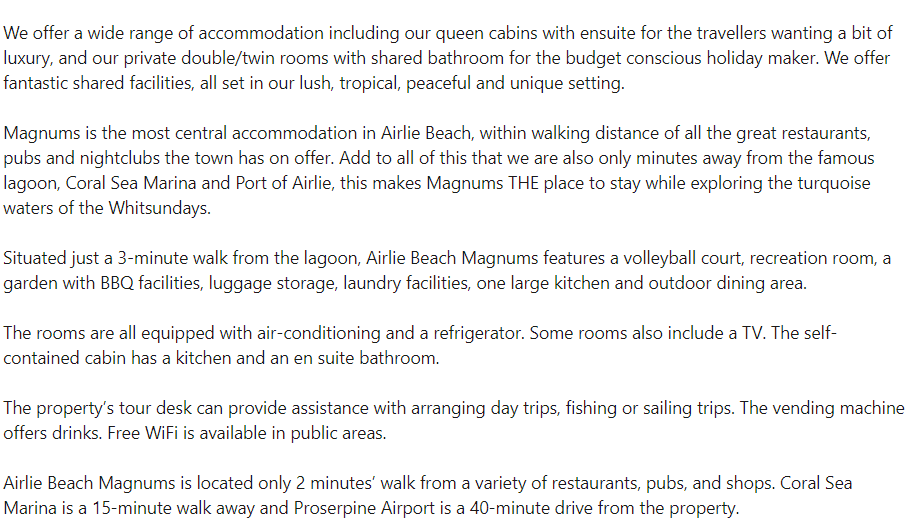

So for $2m of equity, you are getting this unique property of 1.73 hectares (17.000 square meters) that the company wants to sell for $12.5 + other assets they carry. + The company may not lose all its cash flows if they can negotiate the sales-lease back transaction. $12.5m would mean $735 per sqm. for relatively high-cost-of-living location compared to other parts of Australia. This is largely due to its popularity as a tourist destination and the demand for housing and services in the area due to the offering of easy access to the ocean and various outdoor activities. Median house price here is $1.2m. The Group also owns land at Airlie Beach adjoining the Magnums Accommodation property, which is currently used for vehicle parking and access. You can have a look at the photos of the asset, services & reviews the company offers here.

Other Assets

Going forward the company is focused on Whitsunday Skyway Project. During the last 2-3 years, the company been actively pursuing regulatory approval for the Whitsunday Skyway Project. This is the prospective development of a gondola cableway from the central Airlie Beach to the top of the nearby 430metre high un-named peak overlooking Airlie Beach and the Airlie Town Centre with panoramic vistas of the Whitsundays waterways and to adjacent islands. In October 2020 the Queensland Premier Hon Annastacia Palaszczuk MP publicly announced her Government's strong support for the Whitsunday Skyway Project and advised the Project's Engagement with the Queensland Government under its Exclusive transactions Framework. The Premier was quoted in a Queensland Government press release at the time that: "Australian Adventure Tourism Group's Whitsundays Skyway cableway and ecotourism adventure proposal had the potential to support hundreds of jobs and create a brand-new tourism experience for the Whitsundays". The cost of the land for this project was $1.5m, almost the whole value of the company now.

I am sure this wouldn’t make any difference whether Warren Buffet would invest. The stock is extremely cheap today. For $2m you are likely getting over $10m of net assets, which will be cash and still the company would have the operating business with some value (Tours). Warren Buffet would have extremely high margin of safety here and probably would not have lost any money on this trade. If he would go activist here he would probably liquidated the whole company or paid some juicy dividends to shareholders while also having the optionality of this Skyway Project on. If the property would’t be sold, you are still getting the company at 3.3x P/E, growing 11% YoY. And that is it. I am sure there would be much more to say about the company, but the case is obivous, simple & undiscovered.

The Opportunity Cost

Even though it is extremely illiquid stock, trades occasionaly happen. One needs to be super patient or negotiate a private transactions of people who are stuck or got bored. These private transactions would probably resulted in higher stock price transaction, but anyway, still could be good value even if higher by 100%, that is the margin you can undergo when dealing with such cheap asset. I am not sure what exactly is going to happen but I am sure that this is a gem for private buyer. Even though I can’t buy this one, I am sure there are plenty of others hiding.

The presentation is not an investment recommendation. It is for educational purposes only.

Thank you for your criticism, feedback or discussion,

Jacob

This post is free for everyone, but if you value my work and would like to support me, you can do it here:

Interesting idea but it appears only $22.2K AUD of stock has traded since 2022… and only $1,760 since April 2022. Warren Buffett would have to be very, very young to put 100% of his assets into this! As there is no volume on offer at all, and the recent trades have been so small, it seems highly unlikely that anyone could buy shares at the last traded price yet alone a meaningful amount.

Thanks, Jakub. I love the no-brainer investments Buffett made. This was a great read. I love illuiqidity but this one is dead in the water. Imagine you find someone up for a private transaction, I bet that person would ask for a lot more than the currently listed price. But one might get lucky. Still, a great analysis! Thanks for the write-up!